The election of the UK seems to be the closest fought for decades that Labour is trying to fight back the power of a Conservative government led by the coalition that fought to conquer the electorate despite being in power for five years. The Conservative-Liberal Democrat coalition government has implemented an austerity program and reforms aimed at reducing the deficit, reducing the size of government, and motivate the creation of private sector jobs and growth.

From this perspective, his efforts were rewarded. The deficit fell more than 10% of GDP in 2010 to 5% today, 2.3 million private sector jobs have been created, easily dwarfing the 500,000 lost in the public sector. In addition, the UK can bask in the glow of being developed economy the strongest growth in 2014.

However, preservatives reputation for being ruthless and uncompassionate while promoting the rich increased during this period that real incomes have fallen, services have been cut, and the top tax rate reduced from 50% to 45%. Inequality has been a key issue throughout the last few years on the British Isles that the gap between rich and poor has widened.

That said, the coalition government can claim that the top 1% now contributes almost one third of all income taxes, far more than under the previous government, while the lower employees now pay less due to the lower tax threshold being lifted.

controversial policy decisions such as the so-called "bedroom tax" and increases in tuition fees - not to mention the number of people now on the insecurity of zero hours contracts - will help Conservatives win popularity contests. And although the commitment of Prime Minister David Cameron to hold a referendum on joining the European Union by the end of 2017 if his government is re-elected has generated positive sentiment among voters, he also created many uncertainty among many companies that generate a significant share of trade in the wake of EU accession countries.

The result of all this is that despite the high performing economy, and unemployment is low at 5.6% while the number of persons employed is at a record level, the Conservatives can not even win the election, much less get an absolute majority.

What likely outcome of the election?

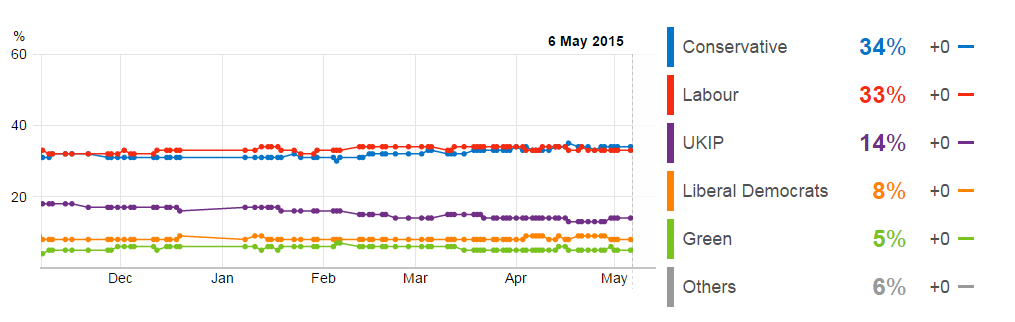

the surveys throughout the campaign have barely changed, with the Conservatives and Labour occupying about a third of the vote each, and the remaining portions of the third final.

* This was taken in relation to the monitoring survey BBC.

This means that no party is likely to get enough votes to rule the majority, resulting in a hung parliament. This will leave three options on the table :. Another coalition government agreement in confidence and supply between two or more parties, or a minority government

A coalition would probably provide the most stable government, although Labour leader Ed Miliband explicitly stated that it would not go into coalition with any rival because it would mean giving up parts of the manifesto of work. Chances are this is just a ploy to get some votes in Scotland the Scottish National Party (SNP) that people vote tactically to prevent another Conservative-led coalition.

The latest polls suggest the Conservatives will win the most seats, but will struggle to form a majority government, although a conservative UK Independence Party and the Lib-Dem coalition could be enough to form a majority. If the Conservatives feel desperate enough to prevent the work to return to power, they may have to consider this issue.

The consensus is that the "anti-conservative" feeling is so great in Westminster, a minority Labour government led by Miliband as prime minister is most likely. Minority rule would prove extremely difficult during the period of five years, and in these circumstances, we may see a change of heart and Miliband agreed confidence and supply with the SNP.

What about the market reaction?

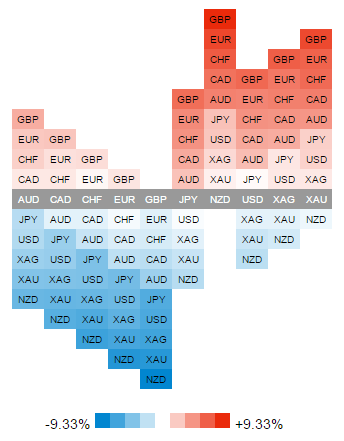

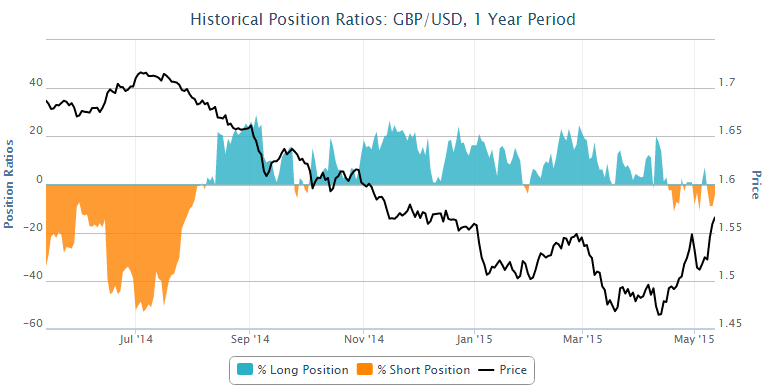

So far, the market reaction has been cut enough. The pound was lower against the US dollar since the middle of last year, but at the same time, he performed well against a basket of global currencies.

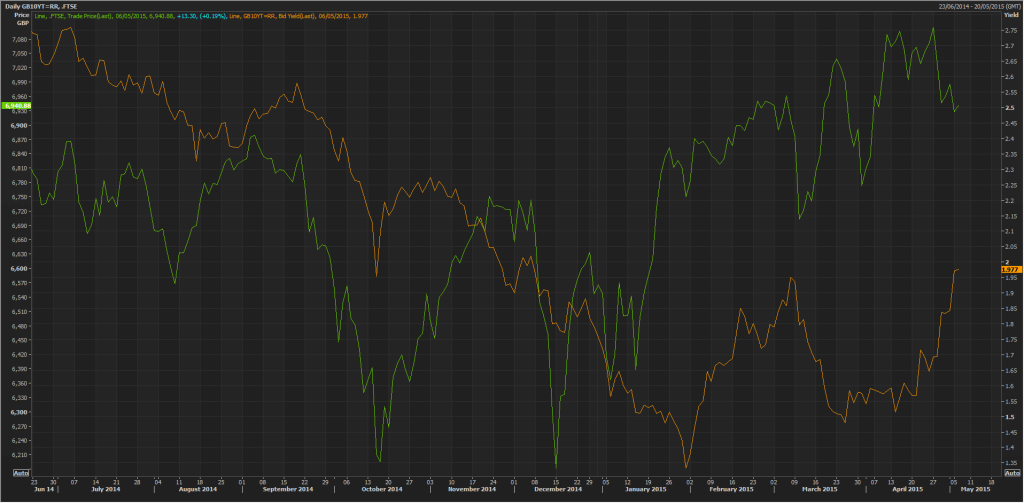

This, along with the dollar rallying suggests that the weakness in the cable is not driven by electoral uncertainty. If we need further proof of this, just compare the yield spread between the United States and in 10-year Treasury and 10 years U.K. golden cable in the last nine months. This shows that the changes in interest rate expectations is what is driving cable, not the election.

* This table comes from the terminal Reuters Eikon.

This does' t mean we will not see the electoral uncertainty about the book in recent days, however.

once the election results are out, waiting to see more of a reaction because the outcome will have a direct impact on the economic outlook, and therefore interest rates. For example, a conservative majority or coalition headed by the Conservatives is considered good for the economy because it will mean a continued strong recovery that has prompted talk of interest rate hikes from the Bank of England. In theory, this should be positive sterling.

The Labour Party, on the other hand, is considered to be less business and bring higher taxes on the wealthy, more spending, potentially higher interest rates. This scenario is considered negative for the economy and investment, and this could weigh on growth this year, pushing the interest rate expectations and weigh on the pound.

As you can see from the chart below, the correlation between the FTSE and the golden 10-year yield is not very strong. Indeed, despite being a U.K. index and benefiting from low interest rates, it is composed of large multinational companies with greater exposure to other countries like China. It is unlikely to be affected by uncertainty as before the election or its outcome.

* This table comes from the terminal Reuters Eikon.

What the charts tell us?

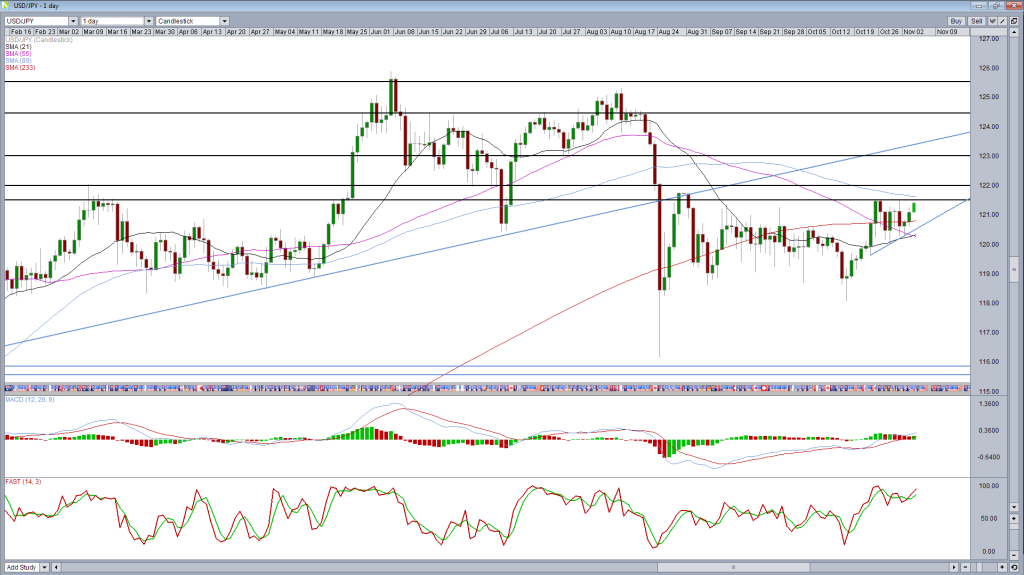

GBP / USD

cable table is to search quite optimistic at the moment, having rallied strongly in the last month. The pair broke above the simple moving average 89 days and has since provided support on the back which is a very optimistic signal. The 89-DMA is not a moving average too common to use, but it is a Fibonacci number and has been a reliable support and resistance level in the past.

With the pair looking upward, the next resistance is evident April 29 highs around 1.55. If it can be broken, 1.5550 to 1.5570 comes into play because the TSZ February 26 peaks, 14 November to 21 December support, and 38.2% the Fibonacci retracement level -July 15, 2014 peaks April 13, 2015 low

[While this may mark the end of the correction and maintaining the strength of the dollar, he could see it move further towards 1.5875. This is October 15th low and the 50% retracement of the move above. The 233-DMA (another Fibonacci number that has been proven on this graph) could also act to crown another upmove.

EUR / GBP

pair is facing strong resistance following a strong recovery during the last week. The downward trend line that had already offered support before the pair break below January 22 now provides a strong resistance. Combined with the 20 weeks SMA and 100 day SMA, it can be a level hard to break. It should be stressed that although they have provided support and resistance on many occasions, they have not been reliable at the end.

There is no guarantee of that level will, especially as the pair recently broke above the neckline of an inverse head and shoulders that formed between the middle of January and the end of April. A break of this kind offers two possible price projections, taking the size of the shoulder and head and projecting above the breakpoint. This gives us two levels around 0.75 and 0.7750, the latter which acted as a support between October and the end of the year.

If the current resistance level holds, it could lead to the formation of a double top with low neckline was yesterday. A break of this would be a bearish signal with a possible price projection, depending on the size of the training of around 0.7215.

[ad_2]

Read More : UK Election Preview and Analysis

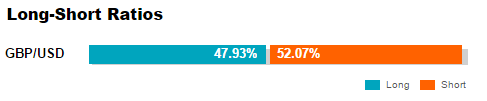

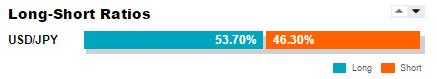

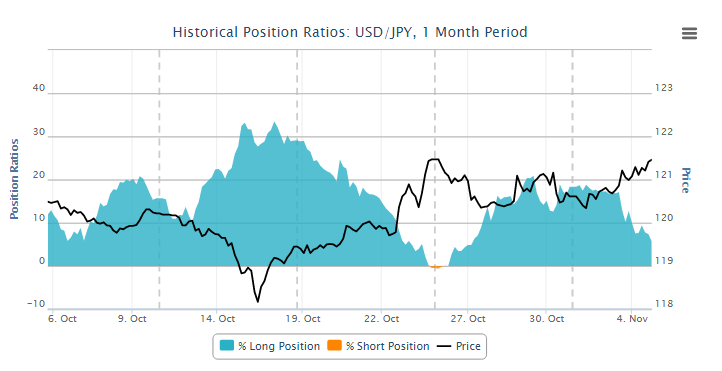

To access OANDA open Ratios Ratios tools and historical position, among many others, visit OANDA Forex Labs.

To access OANDA open Ratios Ratios tools and historical position, among many others, visit OANDA Forex Labs.