Despite the weakness seen in USD of the persistent threat of US default, USD / INR remains supported, with prices pushing higher on the left, reaching a high of 60.95. This slight recovery in USD / INR is even more inexplicable when one considers the strong bearish signal TECHNICAL Friday.

Basically, nothing has changed for India at the weekend, so it is unlikely that the weak rupee today is due to the economy of India. A plausible explanation is that the speculators who have already believed in new RBI governor Rajan decided to close some of their short positions USD / INR tired after no action after so long. However, this statement does not fly because there is nothing that could have triggered this change of position. In addition, it is likely that these speculators would actually look bearish technical signals and therefore more likely to hold their positions and perhaps even add to them.

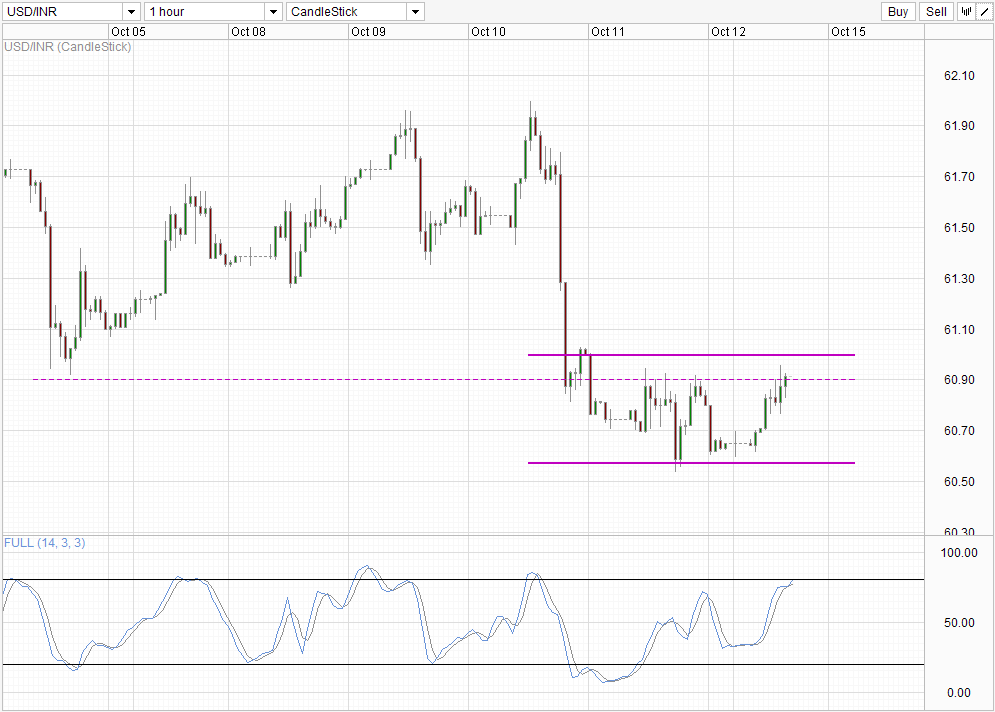

Time Table

perhaps technicals may be able to give us some clues. 60.6 acts as a tremendous level of support, with the share price this morning briefly tested level and was forced high after prices failed to break it. It seems that after 60.6, the prices directly to the resistance band of 60.9 to 61.0, which put a lid on current rebound; a good sign that it is indeed technical influences that have pushed prices higher this morning

With stochastic readings close to the overbought region, the probability of 60.9 -. 61.0 Detention increases, and we could easily see USD / INR position lower again that short-term fundamentals remain similar to what we have the previous week -. favoring a weak and stronger USD INR

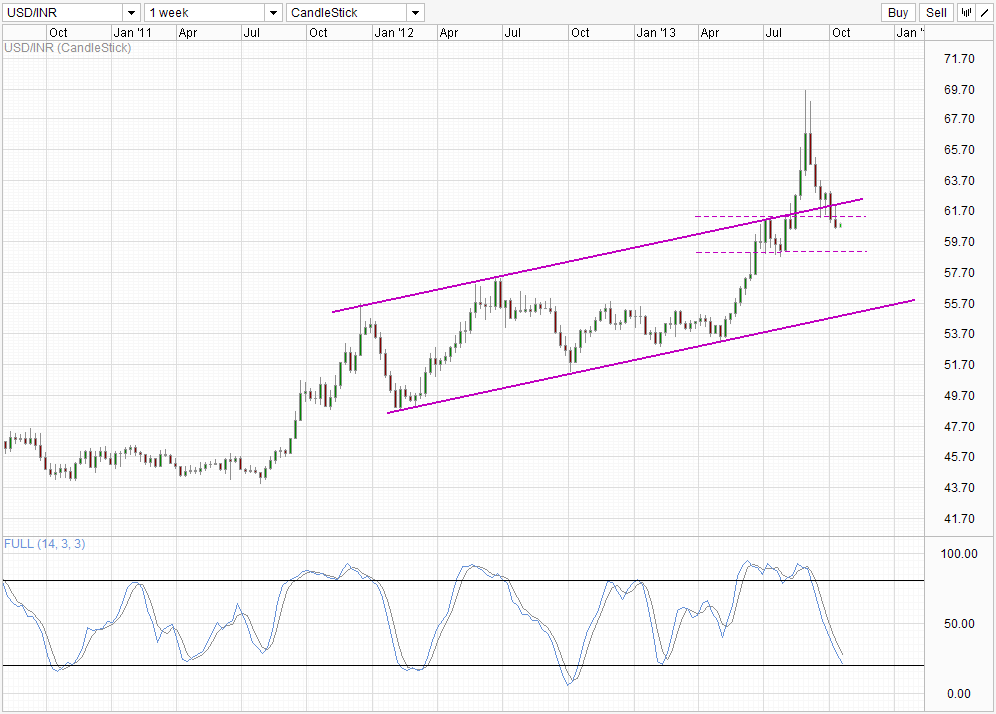

Weekly Chart

weekly chart is bearish with prices not only breaking in rising channel, but also included in the July consolidation zone between 59.0 and 61.0 (up to 61.3 if you are generous). Therefore, you have 2 drawing support levels lower prices, and we should reasonably expect at least a test of 59.0 eventually. stochastic indicator is in agreement with the lower score readings and suggest that the current bearish momentum should continue a little more. However, the readings are close to oversold territory, and so it may be a little difficult for prices to push beyond 59.0 and hit the bottom of the channel based on this single down cycle.

This is consistent with the fundamental long-term outlook where USD is expected to strengthen when the politicians finally resolve the debt limit and government budget issues. This will likely result in the expected bullish fallback USD / INR. However, if India fail to recover, the rate differential between the INR and USD will certainly promote a stronger rupee and a move back towards the channel bottom will be realistically possible.

This article is for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : USD/INR Technicals – Bearish Pressure Remain With 61.0 Resistance Holding

Tidak ada komentar:

Posting Komentar