US futures were little changed as we approach the open on Friday, as investors adopted a more cautious approach ahead of the penultimate work much anticipated report before the meeting of the December FOMC. The Federal Reserve has consistently stated its intention to raise interest rates this year as long as the economy continues to recover in line with its expectations, which was clearly the case until its October meeting when it again reaffirmed its position despite a weakening in the data and the headwinds increasingly abroad.

Moreover, recent comments from Fed officials were unusually on the message. President Janet Yellen on Wednesday, according to a rate hike in December is a "live possibility," Vice Chairman Stanley Fischer said the 2% target can be quickly reached once the temporary deflationary pressures and spend more politicians made comments to the same support. given that the Fed seems content with the data despite the growth of the third quarter poorest and most soft jobs reports in the last two months, it seems that we will see a significant deterioration in the data in the next six weeks for the Fed to reconsider.

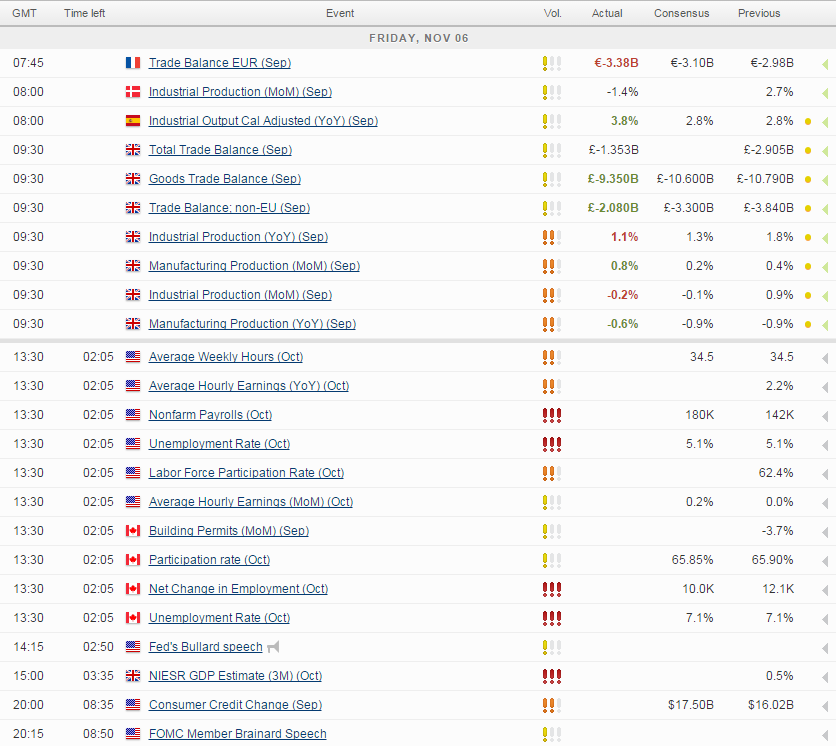

jobs report today is one of only two to come before the December meeting, and if the numbers are line with market expectations - 180,000 jobs created, unemployment at 5.1% and hourly earnings rose 0.2% - I think this will more than satisfy the Fed rate hike requirements. It will also be some pressure on the November report if October may reach or exceed expectations. Fed Funds futures are now anticipating a chance to increase the Fed from 58% in December and if we get a good jobs report today, this number will only increase. This is quite a difference of 35%, we were seeing before the October meeting

Source -. CME Group FedWatch tool

EURUSD

We have seen a substantial decline in this pair as markets price in monetary policies increasingly divergent from the Fed and the ECB. The pair found some stability just above 1.08 yesterday which was a key support level since it erupted over here in April. We are witnessing the consolidation of the pair again today, with traders adopt a cautious before the meeting. If we see a good jobs report today, we could see this support under significant pressure, with a break opening of a movement back to the lowest this year around 1.0450. Under this scenario parity at year end would be a very real possibility, especially if we also see additional stimulus from the ECB. It has been suggested that higher US rates may not be a great driver in the pair move forward, but I strongly disagree. At only 58%, this increase is far from being fully priced and as long as that's the case, there is much potential for the dollar to appreciate more.

Or

gold was one of the victims of the sudden reappraisal of higher rates Fed in the markets. Having traded at nearly $ 1,0 there less than a month, it is now trading back close to $ 1 100 and other losses can follow today. The increased odds of a rate hike is usually bearish for gold and if we see a good employment report today, $ 1,100 could break which would bring down July $ 1071.80 in the home short term, but beyond that $ 1,000 could come under serious pressure late in the year, the first time he will be negotiated here since October 09.

S & P is expected to open 2 points higher, the Dow 28 points lower and the Nasdaq 1 points less.

For a look at all the economic events of today, see our economic calendar.

[ad_2]

Read More : Caution Seen Ahead of Crucial Jobs Report

Tidak ada komentar:

Posting Komentar