AUD / USD saw bearish similar factors as EUR / USD last week - two currency pairs had influences Central Bank (RBA Declaration and lower ECB rates) Lowest shipping prices, and were driven lower if a stronger than expected non-farm US payroll was released which led USD higher and pulled the two pairs of lower currencies. However, the bearish reaction in AUD / USD was actually much more bearish on both absolute and relative terms; AUD / USD pushed 110 pips (1.16%) lower, while the EUR / USD was slightly cut to 99 pips (0.78%).

This suggests that AUD / USD is more bearish than the EUR / USD for now although the ECB has proved to be much more accommodating than RBA last week. There is also the chance that EUR / USD bears are simply lethargic after the huge slide 0 pips following the rate cut by the ECB, while Bear AUD / USD itched to follow the downward temptation Monetary Policy Statement RBA, but that does not change the fact that EUR / USD seems to be much stronger compared to AUD / USD, a point that should not be missed by traders EUR / AUD.

timetable

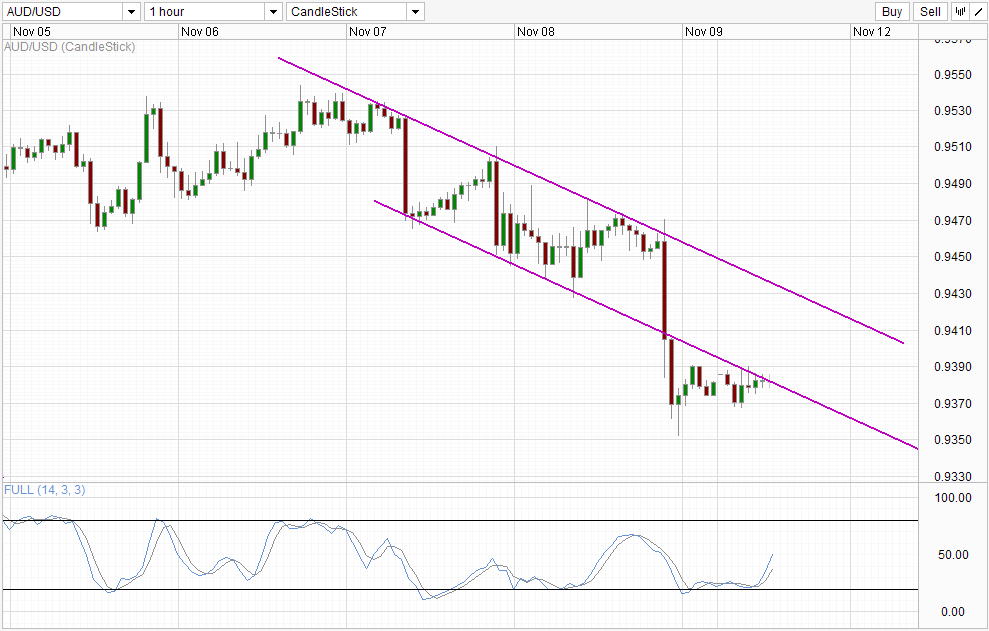

This bearishness in AUD / USD is self without even compare to other major currency pairs. Prices have managed to break the descending channel that was in play, suggesting that prices are getting into a faster pace of bearish momentum. Prices are negotiated flat between 0.937 to 0.939 from the mild pullback Friday - appears to be the extension to Monday morning too, but remain bearish bias as long as price stay below Bottom Channel. Currently, we are testing Bottom Channel, with stochastic readings push higher. If the breaks prices the channel once more, Channel Top become immediate upside target. However, it should be noted that there is every chance Bottom Canal held view that the AUD / USD is known to be the most bearish among all major currencies today. Stochastic with curved face "resistance" around the level of 50.0, do not automatically assume that a break will occur. In addition, it should be noted that the channel bottom is not exactly drawn to the precision and is open to the interpretation that the various points of contact are not "clean", a break in the English Channel, it would further bullish confirmation before we can verify a push towards Top channel is possible.

Weekly Chart

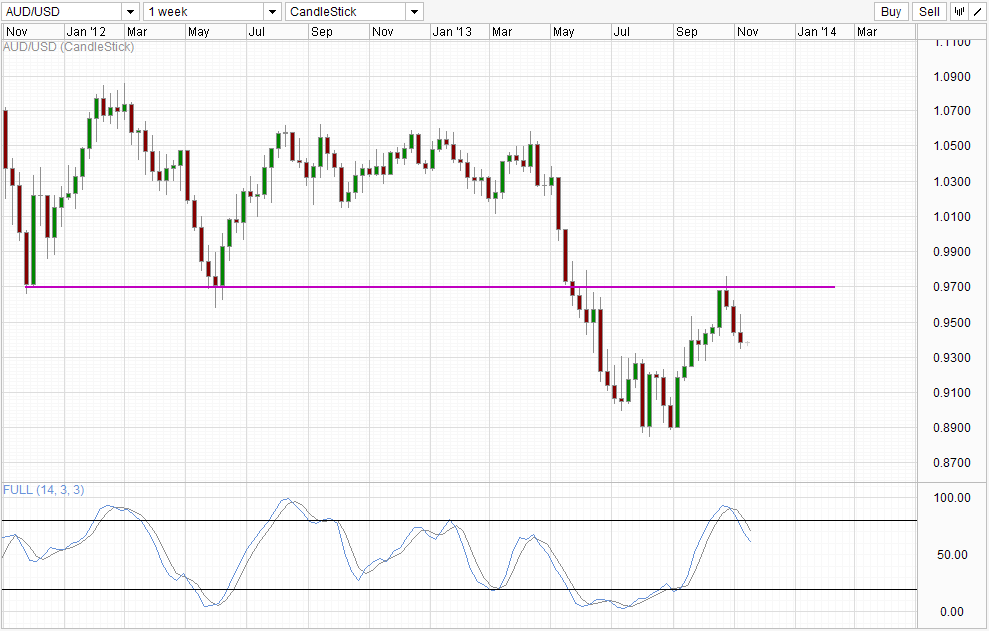

weekly chart supports the short-term bearish outlook, with a bearish momentum continues after bearish rejection 0 97. Stochastic reading as appropriate, with a bear market signal that emerged in conjunction with the release 0.97. As the bear market is in its relatively early stages, the probability of a push towards 0.89 is high because there is ample allowance before current momentum reached oversold. 0.93 round number is still expected to provide significant support, but the whole is expected bearish momentum to prevail unless something significant changes to fundamental AUD (eg announcement RBA rate cut will occur not in the next 6 months, or Fed announcing that the current QE will continue well into 2014)

links :.

EUR / USD Technicals - Slight bearish potential but mainly supported post NFP

Or Techniques - 1,300 broken, but most bearish suspect acceleration

FX week Asia - Commodities focus is expected Plenum of the Chinese reforms

This article is for information only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : AUD/USD Technicals – Post NFP Pullback Seen, Downside Bias Remain

Tidak ada komentar:

Posting Komentar