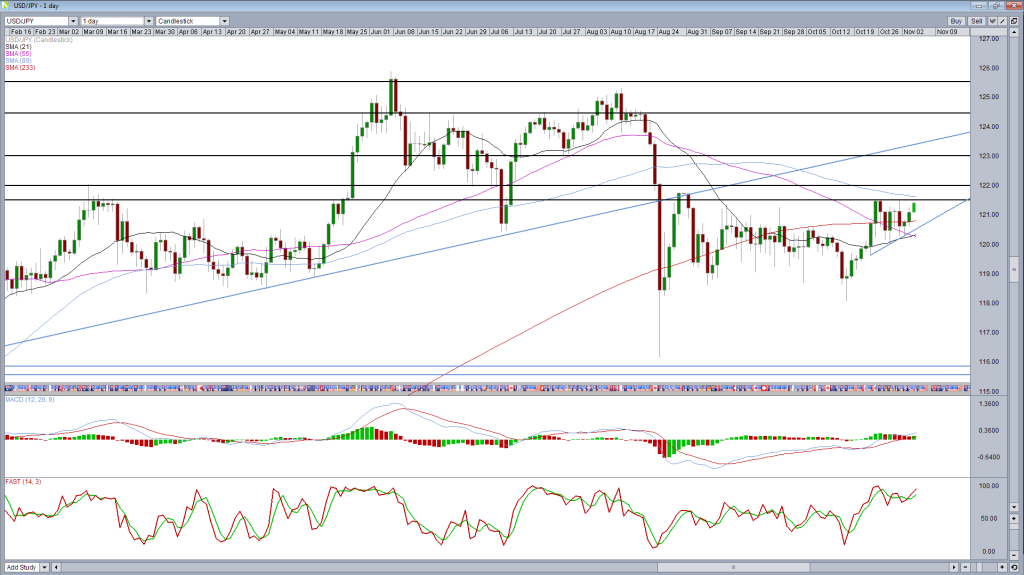

The dollar was looking increasingly bullish against the yen over the past two weeks, but continues to face difficulties when it comes to breaking 121.50.

what is interesting is that while we have seen many unsuccessful attempts to break this level, every time he failed, the pair made new more higher low, which suggests the bulls are shaken.

The ascending triangle that formed as a result is generally considered bullish, is in a bullish or bearish trend.

again today, we find ourselves at recent summits and try to break this resistance level well protected. Given the growing enthusiasm each time we see the pair pull back from these levels, I wonder if this level will continue to be so well protected.

This does not mean it is necessarily going to be broken on this occasion, but clearly the bulls are more confident. If we see a break if this level, the move could be quite aggressive given the way it has been protected until now.

If the pair fails to break that level again, the triangle support could be a key level, with a break of which suggests that there has been a dynamic change of the pair and the trend bullish is easing.

for now, I continue to focus on the 121.50 resistance level, with both the stochastic and MACD suggesting dynamic remains with the bulls.

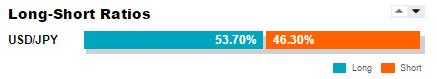

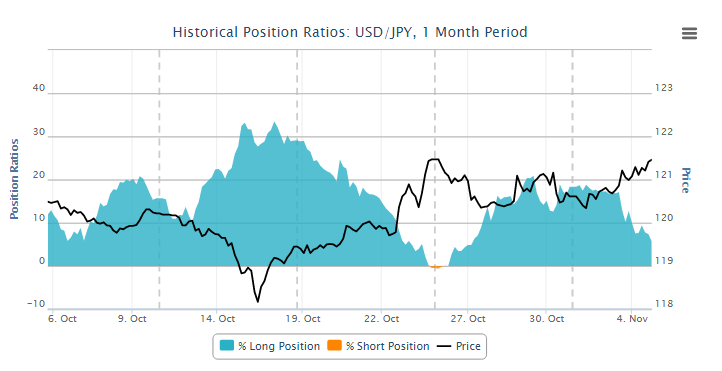

Although OANDA net customer position is slightly long, it was more and less in recent days, which could actually be a bullish signal given the trend over much of the last month, according to the table below.

To access OANDA open Ratios Ratios tools and historical position, among many others, visit OANDA Forex Labs.

To access OANDA open Ratios Ratios tools and historical position, among many others, visit OANDA Forex Labs.

[ad_2]

Read More : USDJPY – Looks Increasingly Bullish at Resistance

Tidak ada komentar:

Posting Komentar