Time Table

Australian Dollar follows the trend of all major currencies that find themselves losing ground against a marauding USD on the day of boxing. However, the rest of its counterparts, the decline in the AUD / USD is the strongest, highlighting the immense downward pressure that AUD is currently underway. Prices have fallen from a high of 0.8928 to a low of 0.8884 during the first 5 hours since the free market, without any significant bullish response and heads for the flexible support line just above 0.888. Despite the strong downward pressure at the moment, the possibility of a small rebound from the support mentioned above remains with Stochasic currently oversold readings with lines Stoch / Signal converging -. Involving a possible bottoming of the curve Stoch

should support the level indeed hold to the obvious short-term upside target would be the previous flexible support turned resistance at 0.808, but given the strong downtrend in time, traders should not be surprised if prices fail to break 0.89 round number and push the lower back, once more.

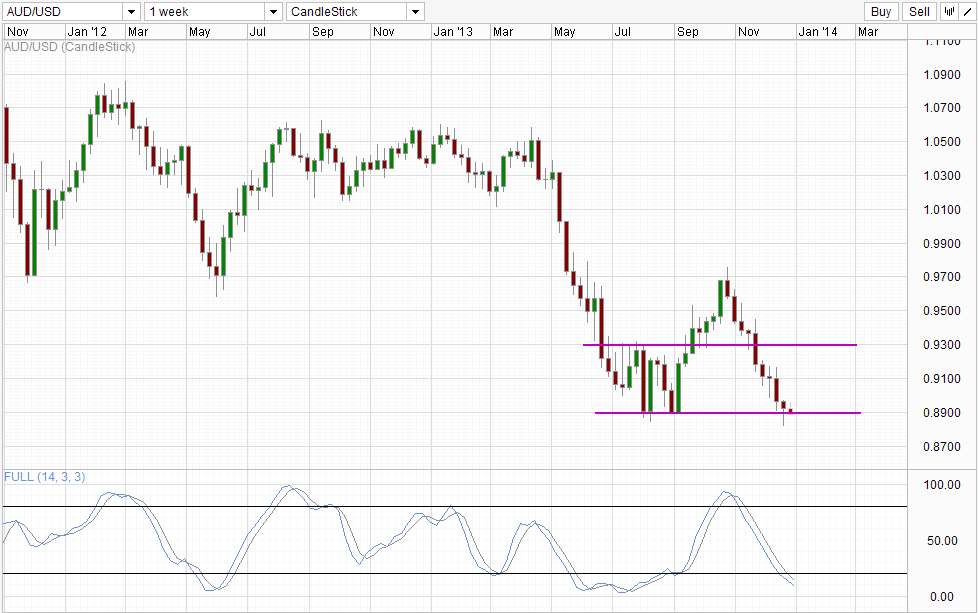

Weekly Chart

weekly chart is very bearish, and we could see a bearish continuation should support is 0.89 broken. Unfortunately, even if we trade just under 0.89 right now, this is not enough to see that the 0.89 support is broken FX as support / resistance lines tend to be "bands" rather than a singular line. Therefore, more confirmation is needed especially as Stochastic readings are already in the oversold area which favors are bullish push towards 0.93.

As for short-term chart analysis, it should be noted that it is quite possible that the price may not even be able to violate 0.91 round number given the bearish bias extreme is at stake right now. In addition, the fundamentals continue to support a weaker AUD move forward after the rate cut by the RBA outlook compared with a strong narrative USD in 2014 due to the sharp Fed. Therefore, do not be surprised if a rebound off 0.89 support fail to produce a significant upward push and may instead result in a stronger bearish response in the future that the bears certainly find higher prices a bargain sell into.

Links:

GBP / USD - Pound disdain Sharp US data

USD / CAD - Loonie Holds Firm Despite Sharp numbers US

USD / JPY - Steady Ahead of key figures of the United States

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : AUD/USD Technicals – Mild Support Seen Versus Strong Bearish Backdrop

Tidak ada komentar:

Posting Komentar