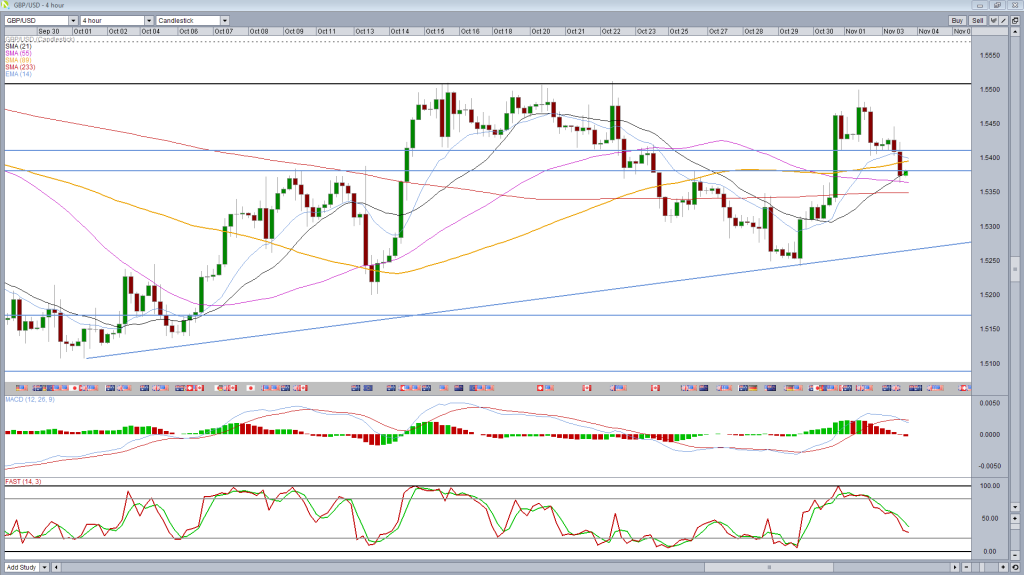

Yesterday, I suggest that, after running into resistance around 1.55, an inverting configuration can form in the cable on the 4 hour chart, which could point to a consolidation, correction or reversal of the pair (GBPUSD - bearish Setup potential Resistance).

Not only that the star formation of the full evening, the pair has since sold and a bearish pattern might now forming on the daily chart which could point to advance back losses.

finished candle ofYesterday was a shooting star, a bearish reversal candle, especially when found in a known resistance level. On this occasion, they are previous highs and 89-day simple moving average, which provided support and resistance several times this year.

That the pair manages to trade above the high of the shooting star, the next day can often provide insight into whether we are witnessing a reversal or not . On this occasion, the pair initially rallied today but failed to make new highs, suggesting that we are. Since then, the pair has been on the decline.

Now we have a situation where we could see a star formation in the evening on the daily chart, which would still suggest that more losses are coming. For this, a close below 1.5350 should occur -. Two-thirds of the way into the candle on Friday

This seems very possible at this stage, since, on the 4 hour chart we see. no loss of low momentum is the MACD and stochastic

Here below, the pair may find support around 1.5270 from the rising trend line - October 1 low - and 1.5250 on 28 and 28th October low. A break of these suggest that we will see a return to the lower end of the trading range of 6 months from the pair around 1.5080 to 1.5170.

[ad_2]

Read More : GBPUSD – Bearish Case Builds as Reversal Forms

Tidak ada komentar:

Posting Komentar