Australian dollar traded higher this morning, in line with most major currency pairs on the continuing bullish momentum that started last 13 February the total funding of record published by the People's Bank of China over the weekend also helped fueled risk appetite, driving risk correlated currencies like AUD higher, in line with a broad improvement in Asian stocks. However, it should be mentioned that the rally in the AUD / USD is the strongest, with the currency pair lost in EUR / USD and GBP / USD just by a glance. This is interesting because Australia's economy is much more dependent on China than either Eurozone or the UK, and in the last 5 years, AUD / USD has benefited from a stronger correlation with the risk appetite compared to EUR / USD and GBP / USD, so the less spectacular rally seen, we can say that the current bullish sentiment AUD / USD is not as strong as we think.

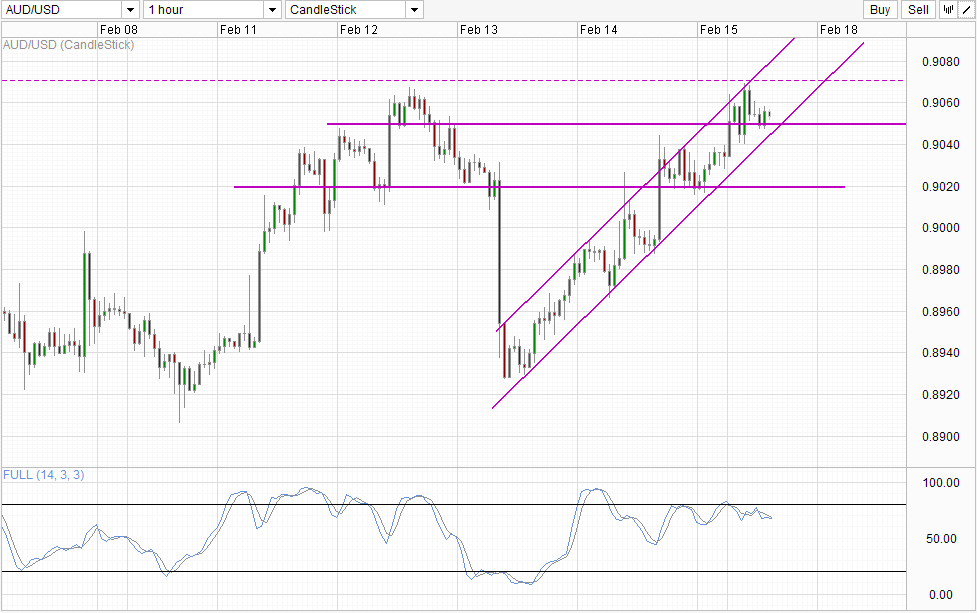

timetable

However, this does not mean that AUD / USD will move lower here, the momentum is definitely now. In fact, add compliance gave Aussie bulls as prices have managed to ignore the decline after a weaker than expected employment change was announced last Thursday. This can actually explain why the rally in AUD / USD today was less dramatic, since operators can not be convinced that AUD / USD will be able to maintain long-term gains and thus more reluctant to enter.

This implies that S / T bullish momentum may be impaired, and there is less chance to break the 0,07 resistance. The probability of a bearish downturn becomes higher as well, because prices are likely to move sharply lower expected risk appetite disappears. That said, short of eager traders may want to wait for further confirmation, as the break of 0.05 support and / or the channel floor mounted in conjunction with Stoch curve below moving 62.5 "Consolidation floor" . This is important because a broad sentiment remains bullish for now and keep AUD / USD lifted.

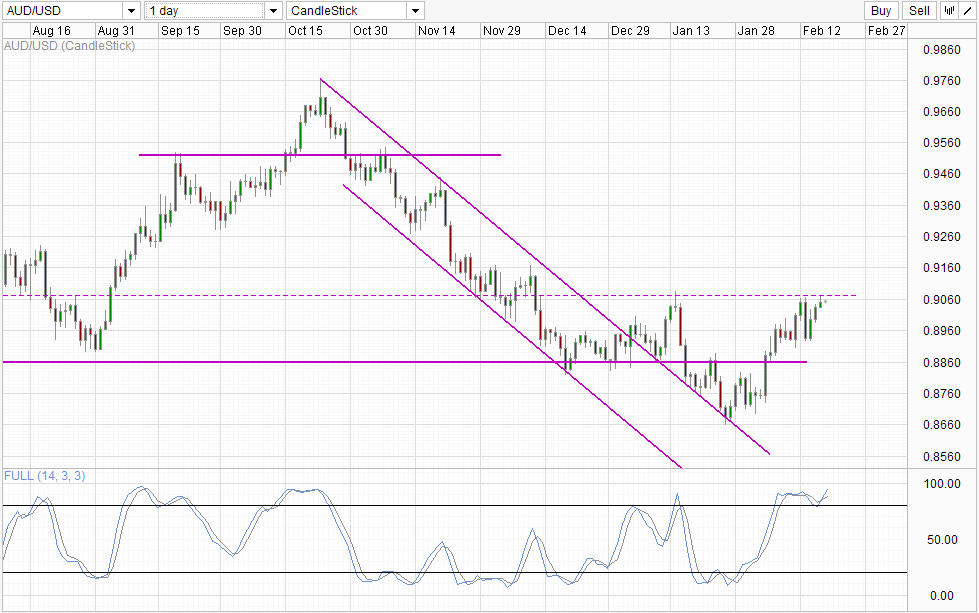

Table Daily

Table also encourages daily bearish sell-off that stochastic readings are very overbought, favoring a bearish reversal move forward. However, confirmation is still needed because even curve Stoch remains bullish for now, so patience is certainly . advisable as there are still any chance that prices may violate 0.07 and hit 0.916 resistance before retreating

links:

EUR / USD Technical - trading above 1, 37 on S / T upward pressure

week in FX Asia - Chinese Fortunes Tough to Pin Down

week in FX Americas - Look beyond the Clouds storm

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : AUD/USD Technicals – Trading Higher But Bullish Impetus Weak

Tidak ada komentar:

Posting Komentar