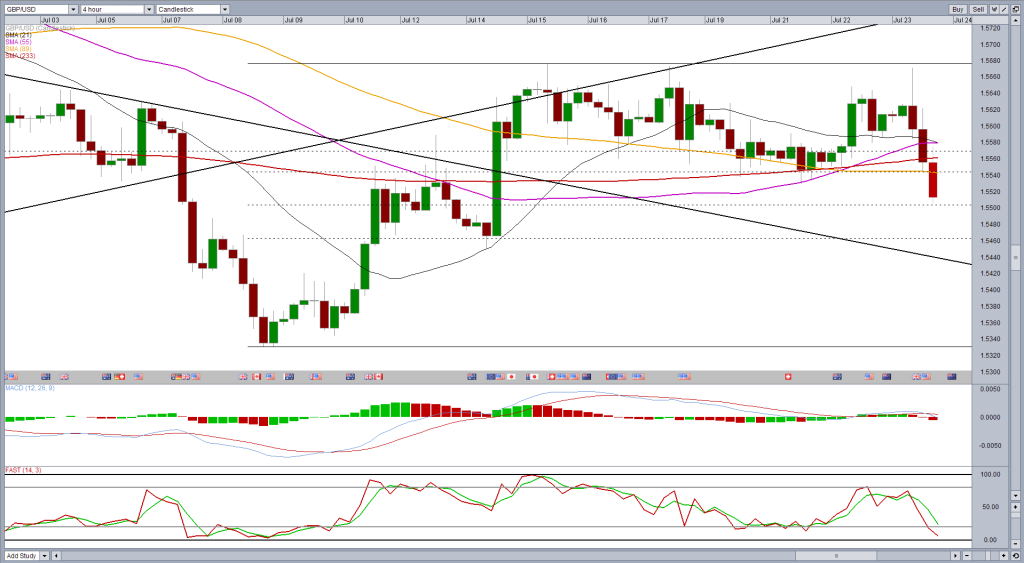

As pointed out yesterday (GBPUSD - Possible Morning Star on key support), the cable is starting to look more optimistic again after a week or so of consolidation and despite threatening not sometimes the morning star formation has been completed.

This was followed by a brilliant start to the trading session today, with the pair rallying to the heights of 15 and 17 July and looking like threatening a break above.

With UK retail sales data was released this morning, it was not surprising to see the pair consolidate ahead of the number and even then it has formed a flag, a continuation bullish pattern.

Unfortunately, the number was worse than expected and given the importance that the consumer is to the UK economy and the maintenance expenses of the inflation outlook, it was not surprising lead book on the number.

It must be remembered that the book has performed well recently that the Bank of England has suddenly become much more hawkish with Governor Mark Carney recently suggesting that an increase could come by the end of this year. This is well before the middle of next year, which had been previously suggested. Obviously, anything that threatens to push it back again is bearish for the pound.

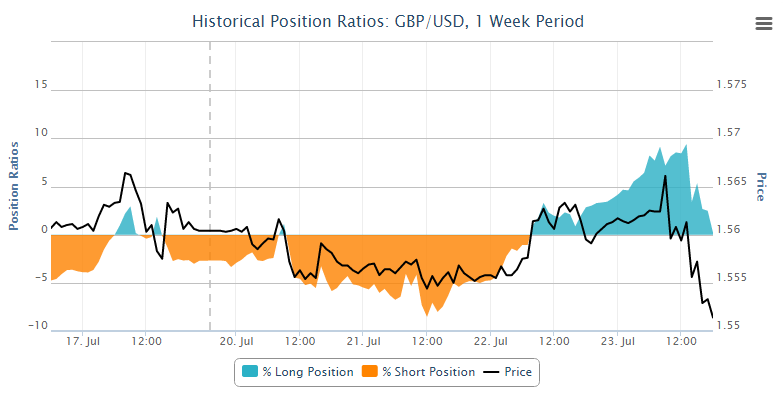

From a technical perspective, the picture is looking much more bearish now and if the pair ends the day below the opening yesterday, it will create a model bearish engulfing on the daily chart.

At present, the pair is finding support around 1.55, a record level of support and resistance and 50% retracement of the move down from July 8 to 15 highs in July. If it is broken, further support could be found around 1.5450 to 1.5460 - 14 July and down 61.8 fib level - although given the movement today, this may not be as strong that support as it would without it

[

If it is broken, it will be interesting to see how the pair reacts to the 89 simple moving average days for a some time now has been a key indicator of bullish and bearish bias.

[ad_2]

Read More : GBPUSD – Bearish Reversal on Poor Retail Sales

Tidak ada komentar:

Posting Komentar