AUD / USD pushed lower this morning, led by lower than expected sales Australian retail that grew 0.2% versus an expected 0.3%. China's economic data compounded the misery, with a non-manufacturing employee arrives to 54.5 vs. 55.0 prior. The survey carried out by private HSBC / Markit actually increased from 51 to 51.9, but which provided comfort like index compiled Composite PMI came in at 49.3, suggesting a much faster rate of decline in the overall Chinese economy vs. the previous month to 49.8 (50 is the nominal value). Similarly, the Trade Balance figures are much stronger than expected, but the figures of February is still less than 1.4 billion AUD in January, and as such it is not surprising that few bullish impact from thereof.

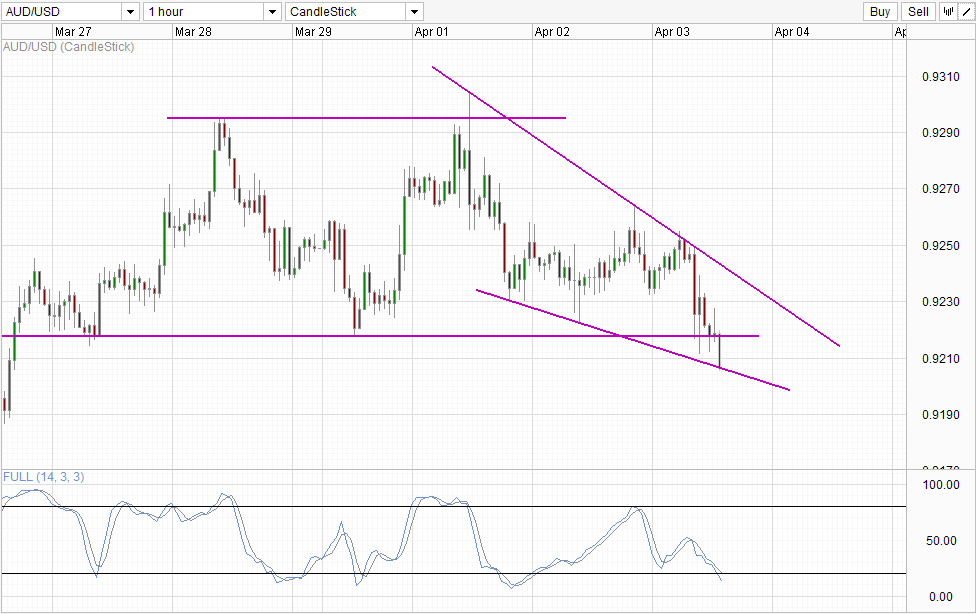

hourly chart

There is perhaps a little luck that the retail disappointment was announced when the price tested the down corner and the confluence with the 0.9255 resistance level. However, as the price managed to erase 0.922 relatively easy support, it is clear that the downward momentum is strong. As such, although the stochastic readings are currently in the oversold region, it is still possible that prices continue riding lower corner to push further down instead of bouncing from here. Nevertheless, the possibility of a temporary withdrawal bullish short term remains in the cards, but a significant push toward upper unlikely if 0.922 support turned resistance waiting.

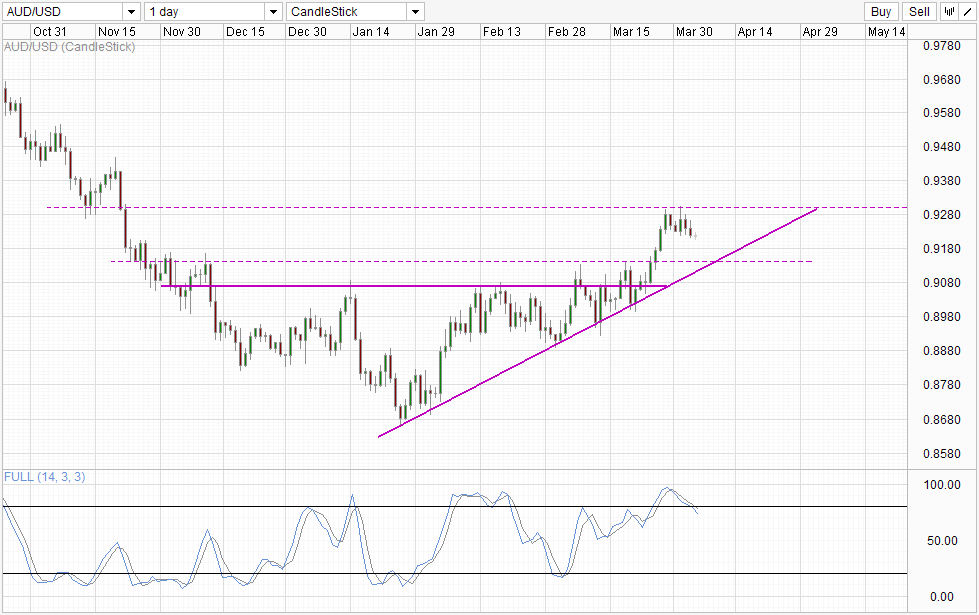

Table Daily

Daily chart is bearish with 0,914 as immediate bearish target. Based on the current downtrend pace, it is likely that we can hit the point of intersection between 0.914 and the rising trend line. Therefore, if 0914 is broken, the bullish momentum is strongly altered and we may potentially see acceleration towards 0.888 support.

Basically, the case of an Australian economy improvement has been altered by failed Retail sale today. There is also talk of increasing the sales tax in Australia to collect more tax revenue for the government to balance the books that will be a short-term negative impact. If next week of employment data and consumer confidence data disappoint, the account recovery must be discarded and the fundamental outlook for AUD will be bearish. Couple that possibility with USD should strengthen again, the outlook for AUD / USD will strongly bearish

Links:

WTI Crude - Bulls Seen Around 99.5 Keeping Afloat Price

S & P 500 - first signs of break, but 1,80 Still holding for Now

USD / CAD - Steady After strong ADP employment numbers

This is for the general for information only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : AUD/USD Technicals – Slight Bullish Rebound Possible In S/T But Outlook Bearish

Tidak ada komentar:

Posting Komentar