The euro is very bullish on research in the short term against the dollar after clearing 1.11, level resistance during the last month and the downward trend line dating back to July 1 of last year.

The move came after the People's Bank of China's decision to devalue the yuan, currently down nearly 3% against the dollar in two days which could apply other deflationary pressures in the United States. This could encourage the Fed to hold off on raising interest rates this year, which is bearish for the dollar.

At present, there is nothing to suggest that this is anything more than a relief rally, especially as the Fed is still likely to raise rates soon just maybe not as soon as was a price.

key test of this rally is going to come between 1.1392 and 1.1534, where the pair faces a number of previous support and resistance. It could also deal with the resistance of the descending trend line dating back to May 8 last year, which cuts the region above.

Failure to break above this level may suggest that the pair has found a new trading range that negotiated between 1.08 and 1.11 for most the last month.

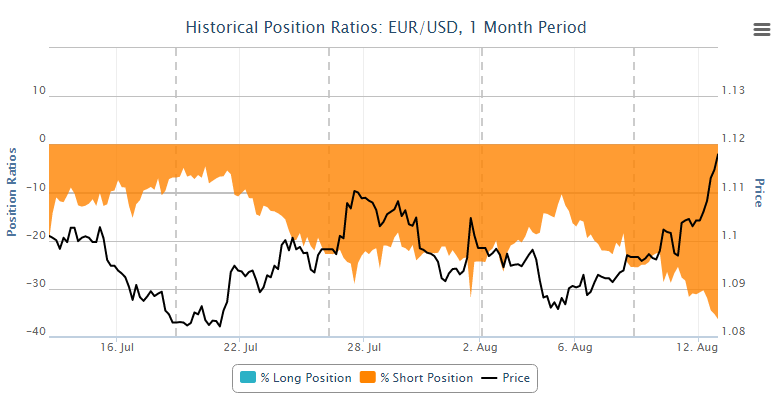

As you can see below, the net positions OANDA clients were on the wrong side of the market quite consistent over the last month. During the rally last week, net shorts were growing. Given that net shorts seem to continue to grow, this itself could be considered a bullish indicator.

The tools above and others can be found in OANDA Forex Labs.

[ad_2]

Read More : EURUSD – Bullish Breakout on Fed Rate Hike Doubts

Tidak ada komentar:

Posting Komentar