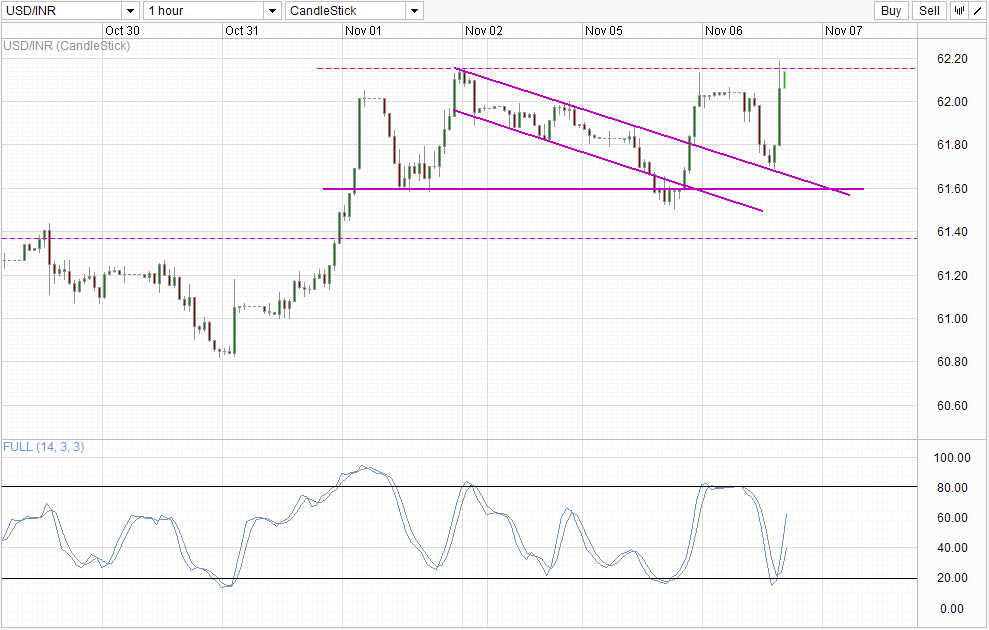

Indian Rupee has not moved as expected yesterday, with prices quickly recovered above the 61.6 instead of pushing the level of support 61.35. With USD trading flat during the same period, due to the reversal of yesterday seems to be based on the weakness of the INR. However, there was no release of fundamental news during the period might have changed sense, and the only reasonable explanation would be INR bullish traders realizing that they themselves overwhelmed by shorting USD / INR following numbers PMI when the prices of stocks and risk appetite do not support such a bullish reaction.

This would mean that the next rally can be interpreted as a one-off revaluation and does not necessarily mean that the overall feeling of USD / INR. This could also explain why USD / INR dipped down again during the Asian session today, even if new basic badly needed again.

Technicals play an important role as well. It is likely that short-circuited swing traders USD / INR above the ceiling of 62.0, adding downward pressure on the top of the gentle downward bias of origin was seen Monday. This statement is strengthened when we see that prices were supported by the original descending channel that was set last Friday's decline. The bullish response resulting is huge, but we are again facing resistance once again in the form of high-swing last Friday.

Time Table

Considering that this decision is purely technical, it is hard to imagine price gain much traction above 62.2. However, stochastic readings remain optimistic for now, with the current reading level suggests that prices may even reach up to 62.4 ~ using the previous upward cycle as a reference. However, there is every chance that stochastic readings will be able to reverse from here, because there are priority with many inflection points around current levels over the last 5 trading days, which opens 61 6 as bearish target.

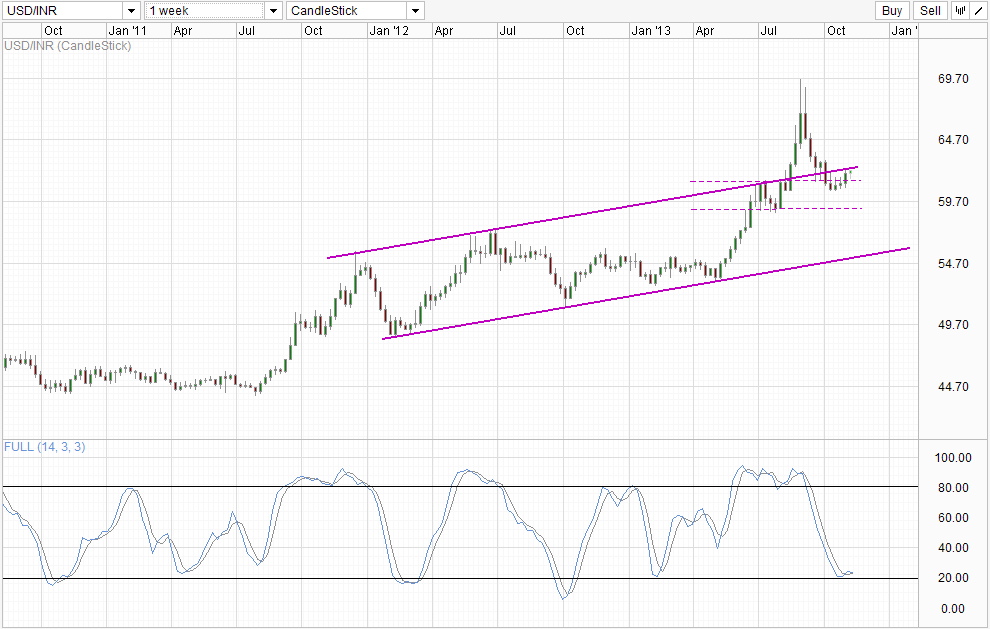

Weekly Chart

Weekly Chart agrees with a possible bearish decline and because prices are now testing Top channel right now. Interestingly, Top Channel is currently around 62.4 as well, adding credence to the above analysis that short-term bullish momentum may run out of steam around there. This increases the strength of the resistance of the Top channel and opens a passage to 61.35 again

Links:

USD / JPY Technicals - slightly bearish Among Still . water

NZD / USD - Post Rally employment data Lacking punch

GBP / USD - strongly support surges 1.59

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : USD/INR – Bullish But 62.4 Resistance Hangs Overhead

Tidak ada komentar:

Posting Komentar