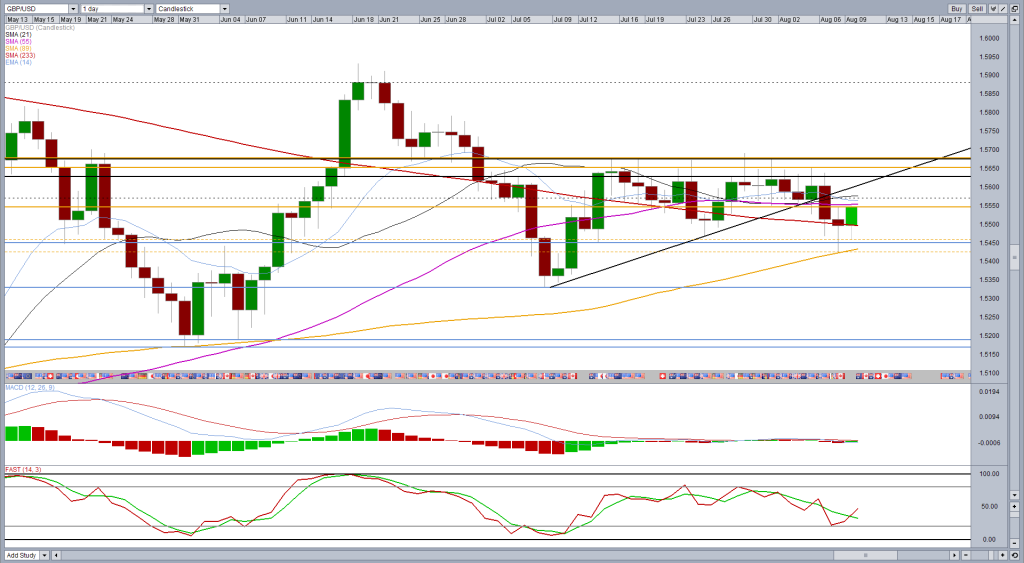

new Cable bounced off its 89 days simple moving average on Friday and has since rallied and got the week off to a good start ? Despite some weakness early in the European session

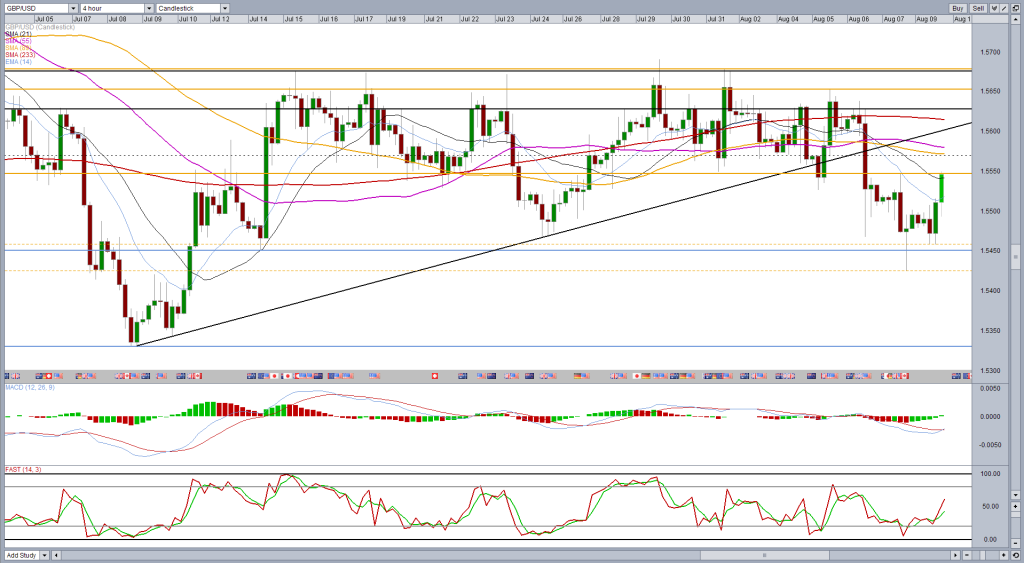

failure to break below Friday's low this morning, could be considered a bullish signal, especially if it is accompanied by a close above 1.5572 -. two thirds of the way into Thursday's candle - that would complement a morning star formation. Some consider this to be the case if we see a close more than half in it, so above 1.5557.

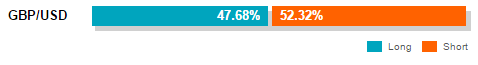

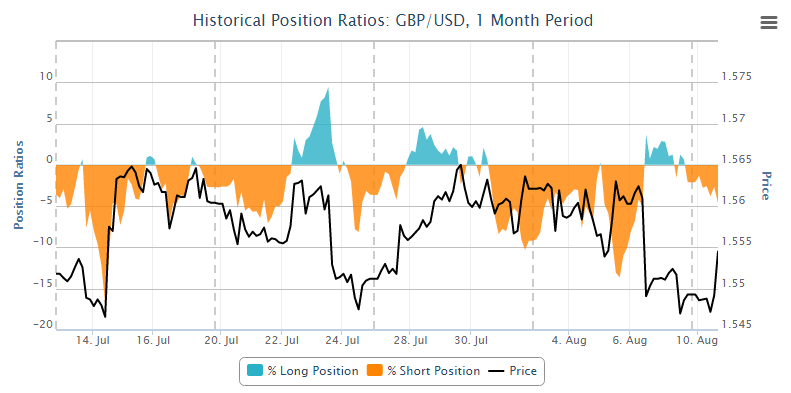

Even then, I find it hard to get too carried away. The pair is clearly some form of consolidation phase that is supported by the fundamental picture of currencies. Two countries, each experience with decent recoveries central banks intend to raise rates, but being held back by persistent low inflation.

Technically, there is much resistance around 1.5625 to 1.5675 with the pair failed to break through here many times in recent weeks.

short term, 1.5550 could offer some resistance with it after a key level on a number of occasions in the past. A break above here would also represent a break above support and the most recent resistance levels, which is significant.

It could also be argued that 1.5550 marks the neckline of an imperfect inverse head and shoulders with 1.5458 shoulders and head to 1.5425. If this is the case, then according to the distance thereof from the neck, it could give a conservative price projection approximately 1.5642 and 1.5675 of an aggressive, which coincides with the high mentioned earlier.

The tools above and others can be found in OANDA Forex Labs.

[ad_2]

Read More : GBPUSD – Inverse Head and Shoulders?

Tidak ada komentar:

Posting Komentar