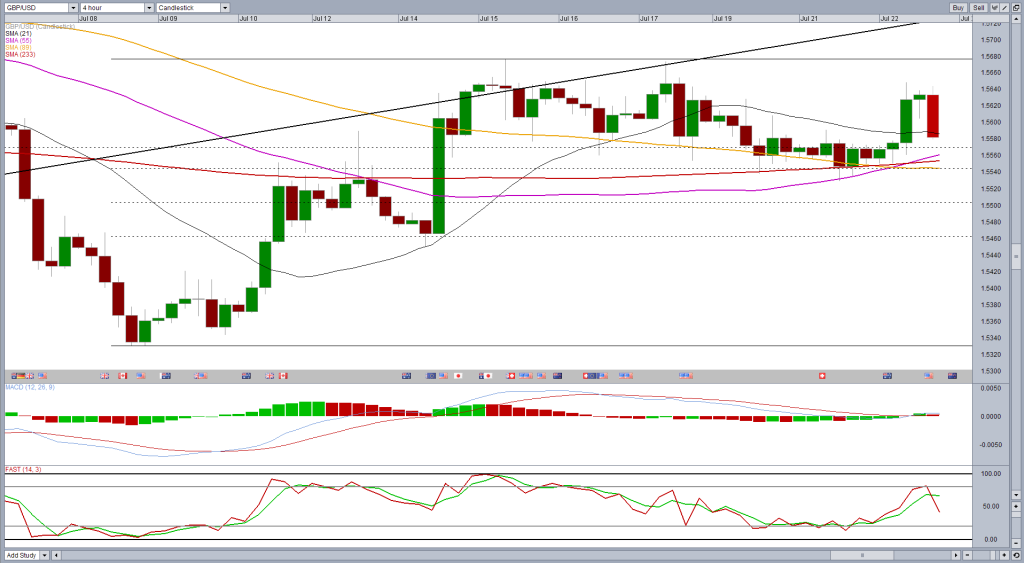

The cable is potentially very bullish to search again after the consolidation last week. The pair found support around 1.5530 from the average of 55 days and 233 single, moving and level of 38.2 fib - down 8 July to 15 July peaks - and now seems to grow again

If the candle today close above 1.5589 or around this level, it would create a star formation in the morning - very optimistic configuration - a key support level. Of course, it should be noted that these formations are always stronger when the first and the last candles are larger.

While moving averages have been no major levels of support and resistance recently, they generally tend to be less effective during periods of consolidation, we've seen lately.

That said, the 55 day SMA has now crossed the 233 days SMA which is a bullish signal and could trigger the next higher step. . In addition, in recent sessions, both offered strong support for the pair

If the pair fails to hold above this support, additional support is below about 1 , 55 -. The 50% retracement of the move above

A signal that this support may give way could come from the failure and the morning star form on the daily while shaped evening star on the 4-hour. And another more convincing than the first and last candle being larger.

[ad_2]

Read More : GBPUSD – Possible Morning Star on Key Support

Tidak ada komentar:

Posting Komentar