Time Table

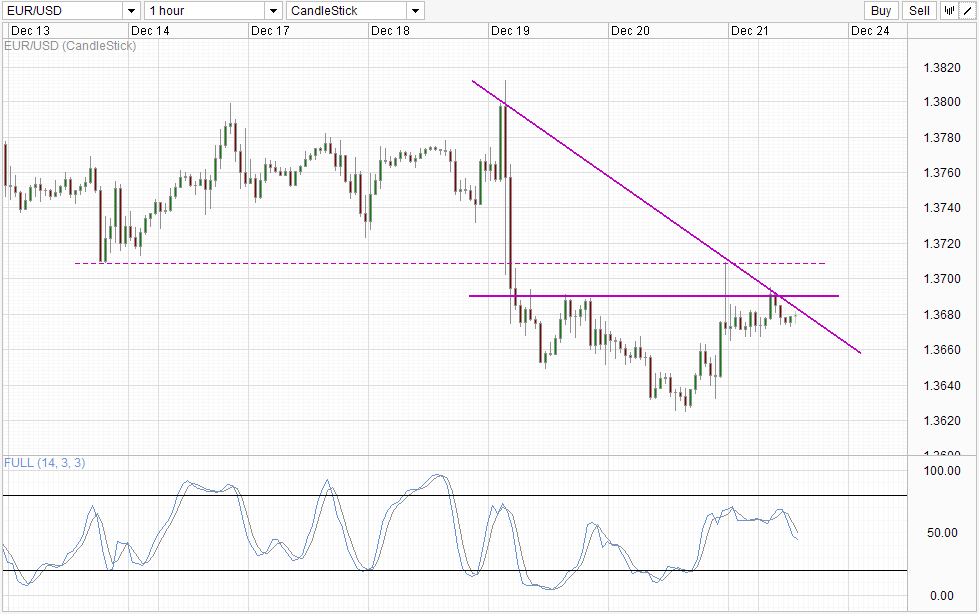

downside pressure remains intact for EUR / USD despite Friday's rally managed to push above 1.37 momentarily. However, not only the price unable to break the round figure number, prices fell quickly under the 1369 ceiling and soft, highlighting the strong downward pressure that EUR / USD is under. This morning was brief respite for the bulls once again, but the bullish venture start was stopped by the combined resistance of 1.369 gentle resistance and the downward trend line which is in post FOMC Wednesday game (Thursday Asian hours). This still open Friday's background as possible bearish target once, and we could see a downward acceleration should push prices below 1,367 flexible support.

Table Daily

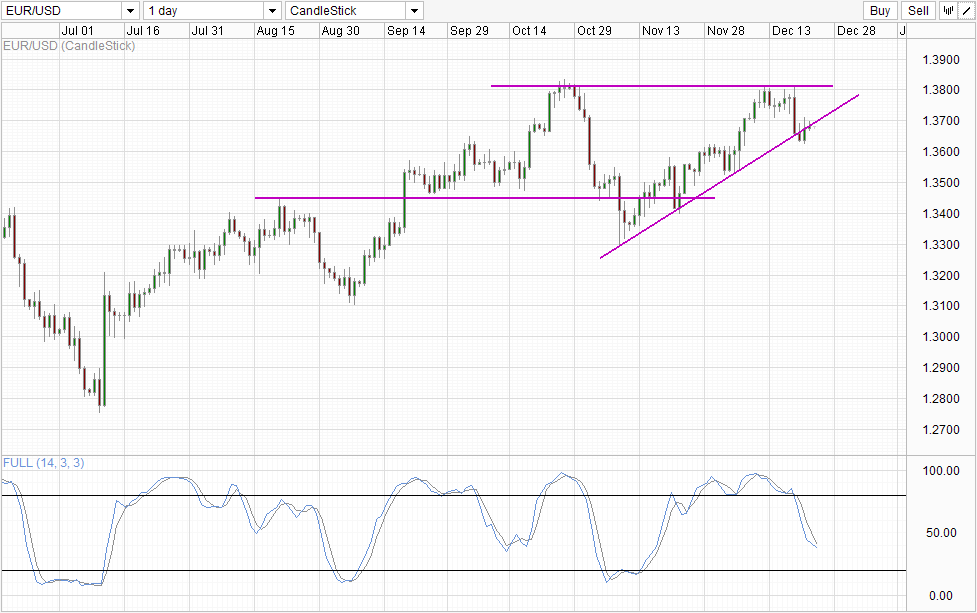

Daily chart is bearish with bullish effort Friday unable to break above the rising trend line , piling pressure even more bearish on prices. A silver lining for the bulls, however, remain as Stochastic on the daily chart is less steep than ever and can even lower the current level - where previous low was seen in mid October. Therefore, it may be premature to assume that the test rising trendline ended, even if prices do not grow below the rising trend line, we could always find significant support near 1.36 readings as stochastic will most likely be in the region oversold when it happens.

Basically, we have to wonder if EUR must be so high at the moment. The problems of Greece and other peripheral euro zone countries remain, and can raise their ugly heads in Q1 2014 similar to recent years. In addition, USD is expected to strengthen in 2014 with the Fed should start rolling tapered ball after making the first cut last Wednesday. Therefore, we need to see a strong fundamental developments for EUR / USD to foster greater heights going forward, and now it is hard to imagine that happening in the next few months. ECB may yet pull another rabbit out of his hat to solve the problems of the eurozone once and for all, but possible solutions that have been thrown around the relevant liquidity measures (another round of LTRO) and / or the introduction negative rate - the two that lead weaker EUR, not harder, making the long-term probability of EUR / USD rally even lower.

that said, it should be noted that bulls EUR / USD remains strong, prices have managed to stay afloat despite S & P downgrading EU debt to AA +. Therefore, traders should not simply any short EUR / USD at the moment and hope for the best. Again, this bullish sentiment will only work in the long term if speculators are rewarded with upbeat news finally coming through, without which bearish retaliation may end up even bigger than the rally and we can have a quick sell-off on our hands in the future. Bottomline? Stay bear patients

Links :.

Gold Technicals - Bullish Pullback Seen But Bears Firmly In Play

NZD / USD Technical - bearish below 0.82 but do not expect Landslide

FX week Europe - European Union on the naughty list S & P downgraded to AA +

This article is only for general information purposes . It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : EUR/USD Technicals – Bearish Bias But Strong Bullish Support Expected

Tidak ada komentar:

Posting Komentar