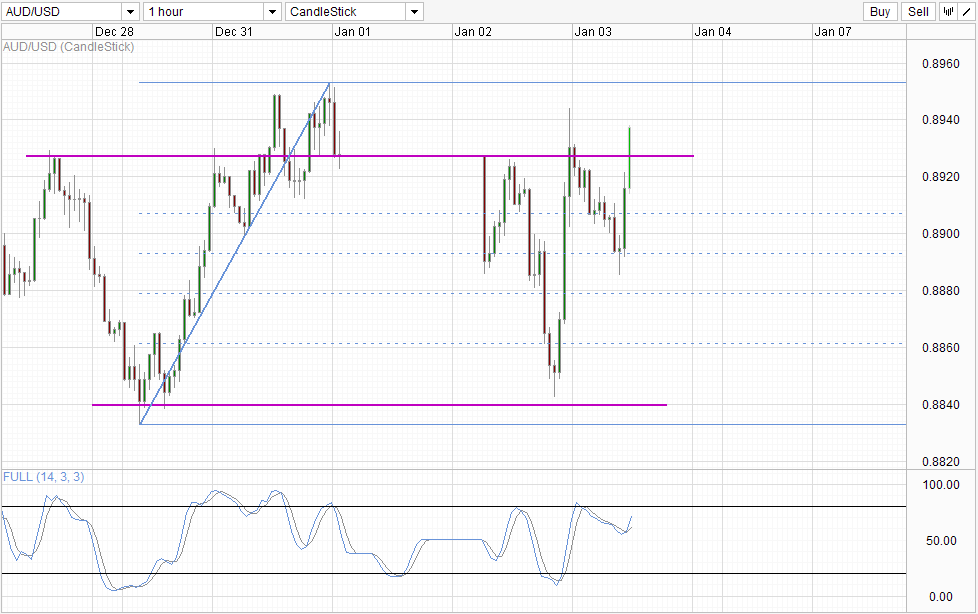

If someone told you that normal trading resumed, simply point to him / her AUD / USD hourly chart. Prices have traded at a low of around 0.884 yesterday, before pushing all the way up to more than 0.894 for a total of 0 pips return within 12 hours. It should also be noted that the extraordinary gathering, held at the beginning of the US session has not been seen in EUR / USD or GBP / USD, suggesting that AUD / USD can move on its own right now.

hourly chart

The above observation suggests that AUD / USD is in a state of flux and high volatility should continue to be expected. In this regard, the current break 0.8926 / 27 can not be a strong indication of bullish trend, but a mere reflection of high volatility. Certainly a push towards recent high of just swing above 0,895 is possible, but do not expect strong bullish bias followed by beyond. Similarly, do not assume that bearish sentiment is strong, even if the prices fail to hold its ground above resistance turned support. Looking at recent historical action, it is likely that the price could find support on either the 38.2% or 50.0% Fib retracement and more whipsaw between 0.884 -. 0.895 can wait until the return of normality

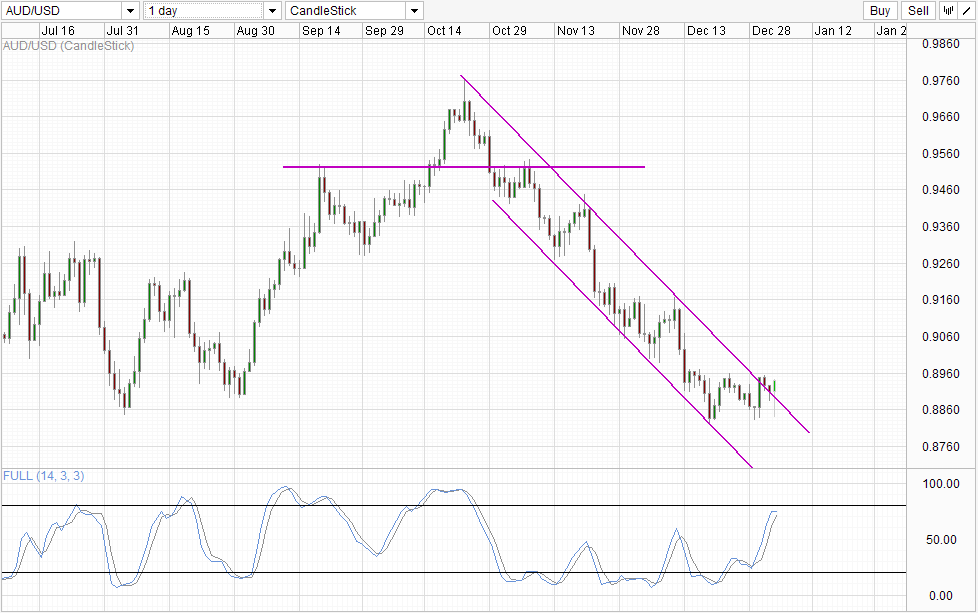

Table Daily

Daily chart suggests that a bullish breakout Channel is game, but the bulls will break above 0.89 to confirm the breakout. Interestingly, current upward venture can not tilt the stoch curve the highest point, and the current bullish momentum that started after QE Tapering December 18 remains at risk of spilling. Even if the price breaks 0.895 resolutely and managed to push the curve Stoch higher once again, we are too close to overbought levels for current bullish momentum to have any kind of meaningful follow. 0.03 a test is possible, but it is just as likely, if not more, that prices may weaken the round number of 0.0

Links :.

EUR / USD Technical - Either can Direction After Stabilize

GBP / USD - Steady As UK Manufacturing PMI Dips

S & P 500 - Hangover New Year that decline Price On Profit Taking

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : AUD/USD Technicals – Do Not Mistake Volatility As True Bullish Sentiment

Tidak ada komentar:

Posting Komentar