]

Time Table

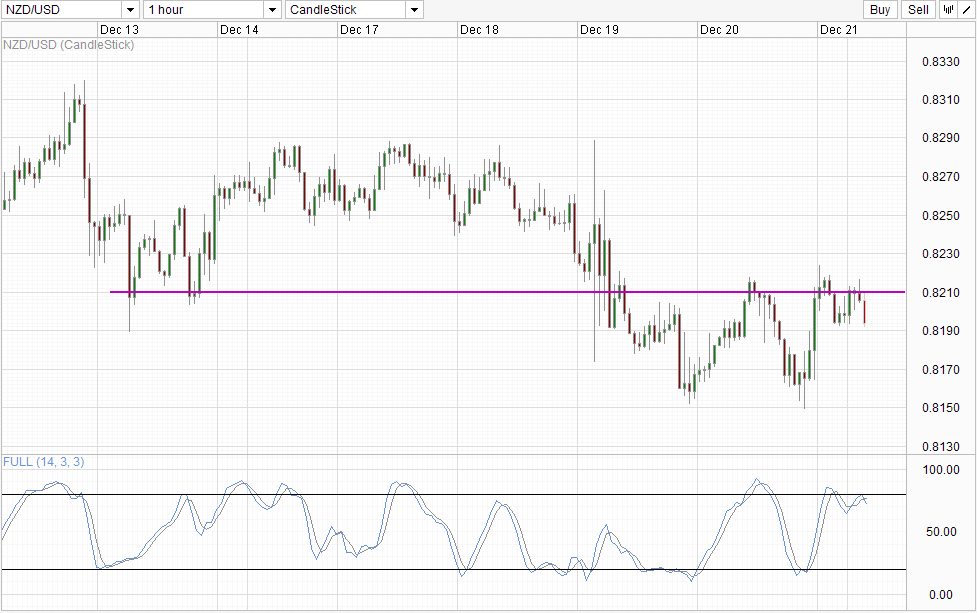

Kiwi dollar collected in the first hour after the starting market trading this week, led by declines in USD that affected all pairs of USD across the board. However, prices were unable to sustain the pressure above the .820 to .822 resistance band which has been in the game since last Thursday and has since returned lower. Currently we are trading below the open this week and the below 0.819 flexible support point of negotiation which could potentially open up a move towards 0,815 support

There are additional bearish signs as well -. The thrust of this morning is the lowest bullish 3 attempts to break the resistance band mentioned above, with prices that can not match the peaks of the swing Thursday and Friday. In addition, the immediate bearish reaction followed the failure seems to be the strongest among the same few attempts to increase, suggesting that the downward pressure is greatest and a push beyond 0815 should not be excluded. In addition, stochastic readings are suitable, with the stochastic crossing curve signal line and promoting a down cycle going forward. However, it should be noted that the curve Stoch should ideally grow below 65.0 to 68.0 show the strongest conviction decline. This reinforcement of the notion that prices will clear the level of 0.819 before stronger bearish momentum may follow. Not doing so does not invalidate necessary current bearish bias, but certainly can allow bulls to hold for a little while longer.

Table Daily

daily chart is similar bearish, but the two studies on indicators and the stochastic lines suggest that the price may not be able to hit a low maximum of 0.81 in the near future - because of the level of multi-month media seen in conjunction with stochastic curve tell us that the greatest current down cycle part is already over . This perspective is also in line with fundamentals that promotes NZD higher in 2014 and 2015 because of rising prospects rate RBNZ, with the first round of rate hike should come in March 2014, and much more to come from 2.25% in total. Although RBNZ explicitly stated that they prefer to see NZD lower, it is unlikely they will be able to see it happen for their own term rates rise. In addition, it is unlikely that they will be too unhappy with NZD higher as this would contribute to the fight against inflation at the same time prevent hot money too to enter New Zealand as foreigners seeking higher transportation. Therefore, expect NZD remains well supported against the dollar, while the greenback should get higher against all major currencies with QE Tapering becoming a real thing

Links :.

week FX Americas - Bernanke Tapers on his final FOMC

week FX Asia - abenomics First year The end of deflation

week FX in Europe - European Union on the naughty list S & P downgraded to AA +

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : NZD/USD Technicals – Bearish Below 0.82 But Don’t Expect Landslide

Tidak ada komentar:

Posting Komentar