]

Kiwi dollar traded slightly lower today in line with other risk correlated trades which have been depressed the get go today following weaker Chinese economic figures over the weekend exacerbated by the Japanese GDP figures were revised down today. Given all these factors bear it rather astonishing that NZD / USD shed only 20 pips while most other risk assets have fallen 1% or more. Certainly, the strongest figures Manufacturing Q4 to New Zealand released at 5:45 am SGT (5:45 p.m. EDT) helped to buffer against extreme downward pressure on the market, but the credit must still be given to the bullish underlying strength that the initial reaction the manufacturing numbers were muted, suggesting that the bullish impact of the news is rather limited.

timetable

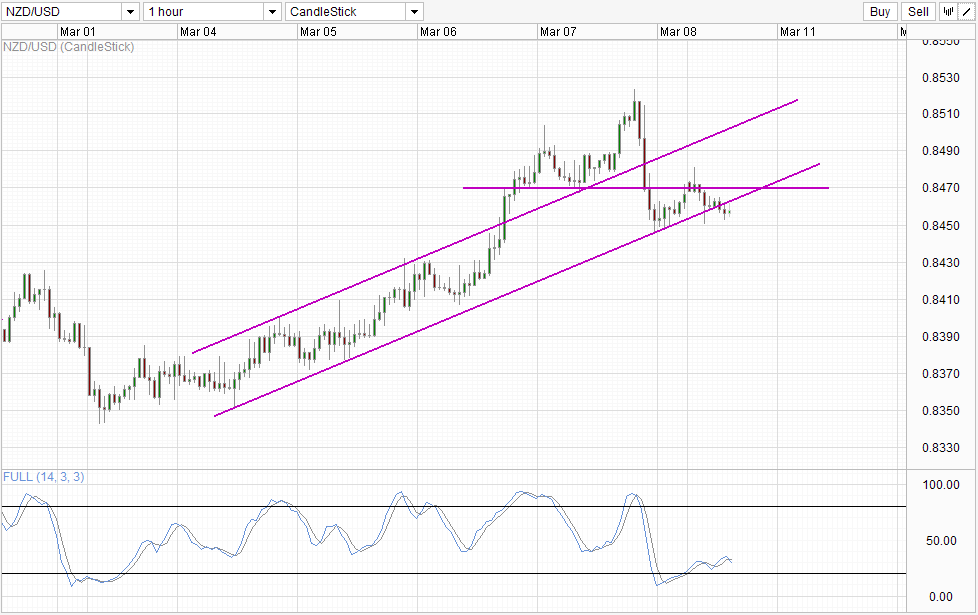

However, it should also be noted that the strong upside resistance inherent failed to prevent prices to break down the rising channel, which exhibits 0.845. If the price breaks 0.845, the probability of a new bearish momentum is increasing and we could see bullish momentum completely unravel. Stochastic indicator has given a bullish cycle signal this morning, but this signal is under threat as Stoch curve is now less advanced and crossed the signal line. Therefore, possibility of downward extension here can not be ignored. Moreover, even if 0.845 support holds, the price will rise above the bottom of the channel and preferably above 0.847 to restore bull back. Do not do it and the downside risk remains as low sense of risk can lead to lower prices again.

Table Daily

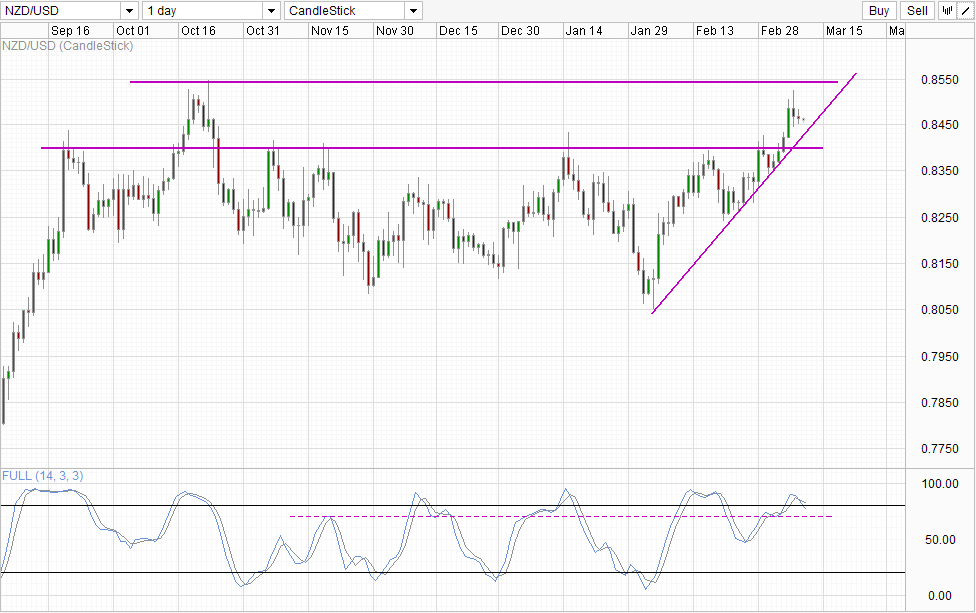

downward pressure is even greater on the daily chart where prices seem to be leading to the resistance 0.855 . That said, there is no immediate downside risk that the price will break the growing trend of online trade and preferably less than 0.84 round number before strong bearish conviction can take root. stochastic indicator is in agreement - although Stoch curve is below 80.0 level and the signal line not far behind the curve Stoch should ideally grow below 70.0 "support" to demonstrate a strong bearish momentum

with the rate decision of the RBNZ next Thursday (. 4 p.m. Wednesday night EDT), it is unlikely that aggressive traders to short here and now that most of the market expects an increase RBNZ rates this time - a notion that is supported even by New Zealand Prime Minister himself this morning. However, this does not mean that there is a higher risk of falling should actually go ahead RBNZ fail to raise rates. Even if RBNZ push rates greater the chance that bullish follow through will be limited as the market has already taken into account a large piece of this possibility, which results in greater opportunity to "buy the rumor , sell the news "play. out

Links:

AUD / USD - Facilitates far from resistance level at 0.91

EUR / USD - shockwaves two-year high above 1.39

GBP / USD - Resistance Level at 1.68 wide bundles

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : NZD/USD Technicals – RBNZ Rate Hike Expectation Increases Future Downside Risk

Tidak ada komentar:

Posting Komentar