AUD/USD – Drops to Six Year Low Below 0.75 AUD / USD - Monday, July 6, 2015

The Australian dollar has not had his best week down sharply above the key 0.77 level to a new six-year low below 0.75. The AUD / USD was trading now around the level of 0.75 try to consolidate and hold. Some time last week the AUD / USD tested the key support level at 0.76 and enjoyed a solid support before it failed. Throughout last week, the Australian dollar began to feel some selling pressure from the level of 0.77, and his eyes were firmly focused on the long term support level at 0.76. There are a few weeks, the AUD / USD fell sharply lower below 0.77 but found strong support for long-term support level at 0.76. This level has provided strong support throughout most of this year, so it is quite significant that it was strongly broken.

there

A few weeks ago, he made a greater leap of below 0.77 until the last three weeks, but he ran straight into the key 0.7850 resistance level, which played this role more time this year. All this time, he also spent most of his time fairly stable operations around the 0.7750 level while enjoying a strong support 0.77. In the last month, the 0.7850 resistance level has played a major role and continues to exert downward pressure on selling the AUD / USD. During this same period, it received strong support from the rock the long term support level at 0.76 which allowed him to bounce back strongly to more than 0.78 to more than one occasion. Throughout the second half of May, the Australian dollar fell sharply four-month high above 0.8150 to the level of key support at 0.76. This level was a significant level for a couple of months and has supported the Australian dollar on multiple occasions. This recent price action has been a significant reversal, because there is not so long, the AUD / USD was in a solid medium term trend upward after crossing the 0.7850 key level and reaches four month high above 0.8150.

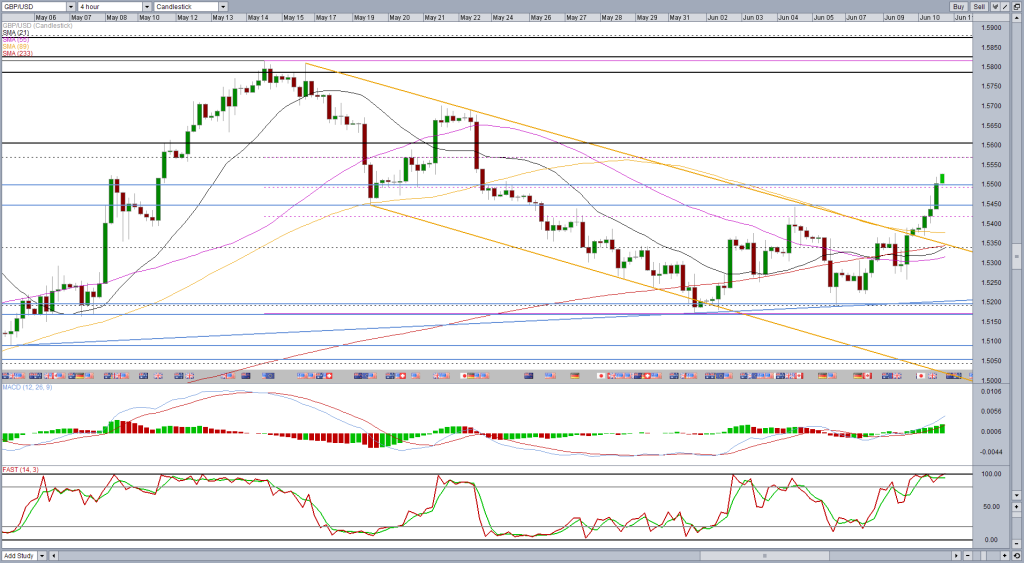

For most of this year, the Australian dollar has traded in a wide trading range between support at 0.76 and resistance around 0.7850. Earlier this year in February this range was narrower with the highest level of support 0.77. Throughout this period he has had reasonable swings back and forth between the two key levels with very few excursions beyond the levels. The key level remains now 0.76 and it will be interesting to see how the support at this level can contain and stop the trend of sharp decline in the AUD / USD has experienced in recent weeks. The 4 hour chart below shows how constant the recent decline was, but also how significant the level of 0.76 to be able to temporarily halt the decline.

(daily chart / 4 hourly chart below)

AUD / 5 USD July at 23:40 GMT 0.7488 H: 0, 7518 L: 0.7463

AUD / USD technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.7500 | - | - | 0.7850 | 0.8150 | - |

During the first hours of the Asian session Monday, the Australian dollar tent to remain above the level of 0.75 after having fallen sharply to a low of six years below 0.75. Current range :. right trading around 0.75

Other levels in both directions

• The following :. 0.7500

• Above :. 0.7850 and 0.8150

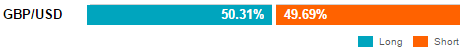

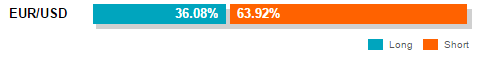

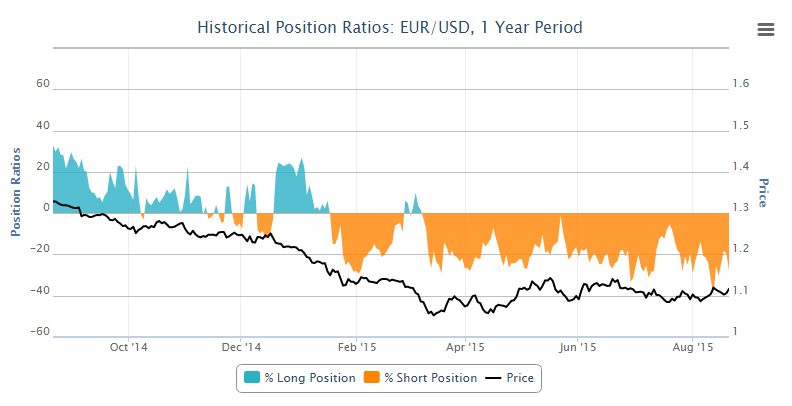

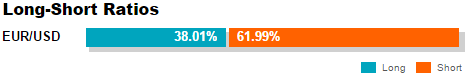

Open Ratios position OANDA

(shows the ratio of long short positions vs held AUD / USD between all OANDA clients. the left percentage (blue) shows long positions, the percentage right (orange) shows short positions)

the long position report AUD / USD fell over 65 % as the AUD / USD fell to six-year low. below 0.75. The trader sentiment is in favor of long positions.

Economic Releases

- 23:30 (Sun) AU AIG Construction PMI (June)

- 0:30 IN TD-MI gauge inflation (June)

- 1:30 AU ANZ job advertisements (June)

- 2:00 NZ Treasury publishes monthly economic indicators

- 5:00 JP leading indicator (prelim.) (May)

- 7:00 UK Halifax House price Index (sixth to tenth) (June)

- 8:30 EU Sentix indicator (July)

- 2:00 p.m. CA Ivey PMI (June)

- 2:00 p.m. US ISM non-manufacturing (June)

* All times are GMT release of

This Article is solely for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : AUD/USD – Drops to Six Year Low Below 0.75

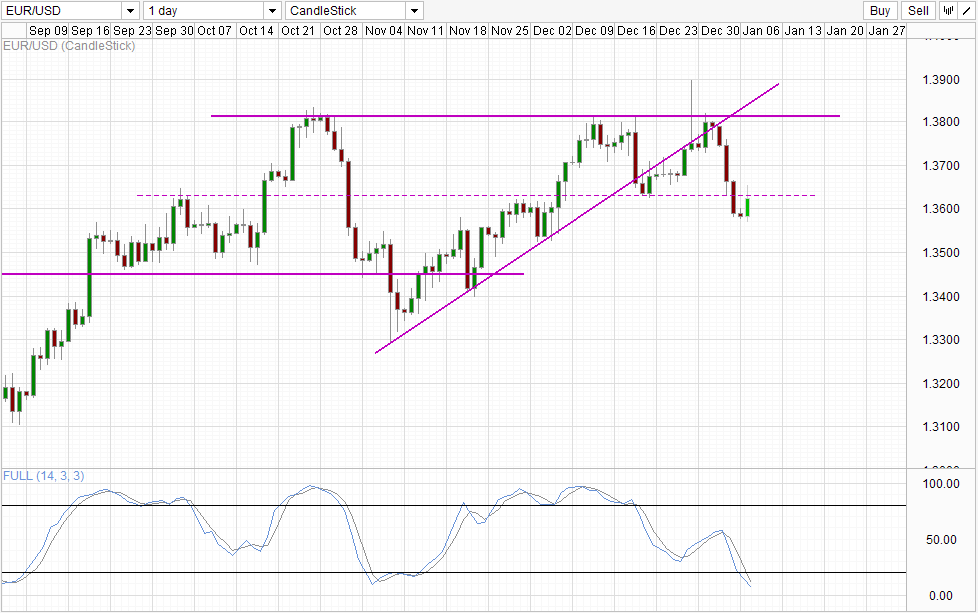

Especially when paired with the COT report which not net trade positions shows (those held by large speculators, mainly hedge funds and commercial banks currency futures for purposes of speculation) for the euro are becoming less short.

Especially when paired with the COT report which not net trade positions shows (those held by large speculators, mainly hedge funds and commercial banks currency futures for purposes of speculation) for the euro are becoming less short.