Yesterday (EURUSD - Break Lower increasingly likely) I noted that despite trading in a range for much of the last month, the EURUSD continues to have a slight bearish bias as

- remained in the downlink channel;

- had formed a pennant in the last month (mild lower highs and higher lows);

- is still trading below the 50 day SMA.

Well, one of these conditions is under the threat that the euro rally today has pushed the pair above the descending trend line that has traded below since the middle of December.

it is important to note that there were no close above the trend line on 4-hour chart and would like to see at least that before I consider it a legitimate break if not on a daily basis. less time frames could also offer useful insights if we see a new test successfully.

The fact that 1.08 high was broken yesterday is certainly another red flag well and can suggest a move towards 1.0850 Friday high is on the cards . A break of this level suggests to me that we could see another test of SMA 50 days that proved to be a strong resistance level in the past.

should it be broken, it would raise serious questions about whether the upper end of the month long trading range may contain. It would certainly suggested to me that a more optimistic bias appeared on the market

The upper end of the trading range around 1.1030 -. 1.1050 would be seriously threatened in my opinion and a break of this would suggest the long expected correction has arrived.

If, on the other hand, it proves to be a false breakout, which would not be unusual, ADM-50 period on the 4 hour chart and the previous 1.0660 support could come in the severe pressure and quickly.

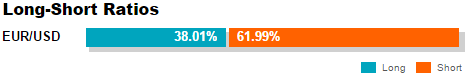

OANDA clients have become increasingly net short in the last 24 hours, with 61.99% now taking a short position. History suggests that is not necessarily a bearish sign if, in fact, it might even be seen as bullish.

Especially when paired with the COT report which not net trade positions shows (those held by large speculators, mainly hedge funds and commercial banks currency futures for purposes of speculation) for the euro are becoming less short.

Especially when paired with the COT report which not net trade positions shows (those held by large speculators, mainly hedge funds and commercial banks currency futures for purposes of speculation) for the euro are becoming less short.

[ad_2]

Read More : EURUSD – Euro Rally Breaks Key Resistance

Tidak ada komentar:

Posting Komentar