Time Table

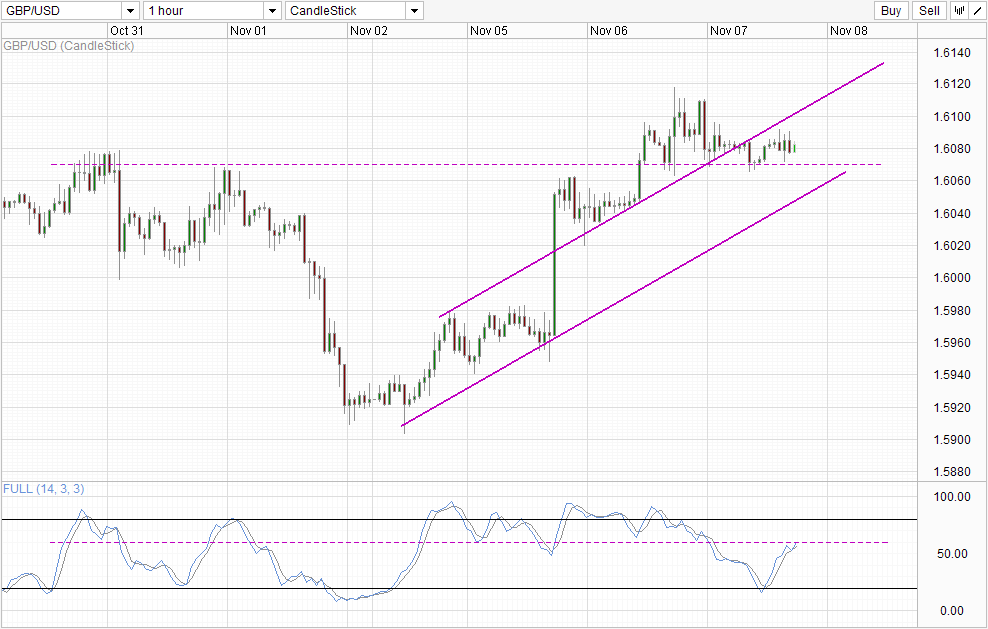

Cable has recovered significantly since Monday, when prices almost labeled key support 1.59. By trading near 1.61, the immediate risks of a Double Top pattern on daily chart views is reduced, and opens a potential move to 1,625 for a Triple Top pattern or even a potential bullish scenario extension.

However, short-term bias is mixed. Prices remain above 07 support, but we are also trading below the rise Top Channel, suggesting that the pace of the upward momentum was taking a lower notch. Stochastic readings is unclear as well, with the highest score of readings, but the face of "resistance" around the level of 60.0. Therefore, it is an understatement when we say that the direction of prices is uncertain, and it is the game everyone to take.

Bank of England rate decision coming in 2 hours time can be the game changer, however. The Monetary Policy Committee voting unanimously to keep interest rates and the asset purchase program as it is the last time round, it is highly unlikely that five voting members to the MPC swing opposite side and form a favorable outcome to the status quo today. As such, it is likely that the GBP / USD may enjoy a small pop after the event decision on rates. In general, the probability of an immediate withdrawal would be higher than the market price would be fully in the results sooner. However, with prices that need directional signals at this time, the small upward movement may actually cause further bullish waterfall, and the outbreak of the next upside momentum if we stay above 1.612 after the event.

If prices do not grow until 1612 but trading lower back again, the immediate short term bias is bearish, but that does not necessarily mean that a new downtrend will emerge especially if prices remain above 1.607. This can be interpreted as prices returning to the "neutral" position again, and traders may need to wait for other indications (eg NFP Friday) for steering

Links :.

EUR / USD Technicals - Bearish Bias Minor Before Bullish ECB Event

WTI Crude - slightly higher but S / T downward pressure remains now

USD / INR Technicals - bullish Breakout on short and long term charts

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : GBP/USD Technicals – BOE Event May Spark Next Bullish Run

Tidak ada komentar:

Posting Komentar