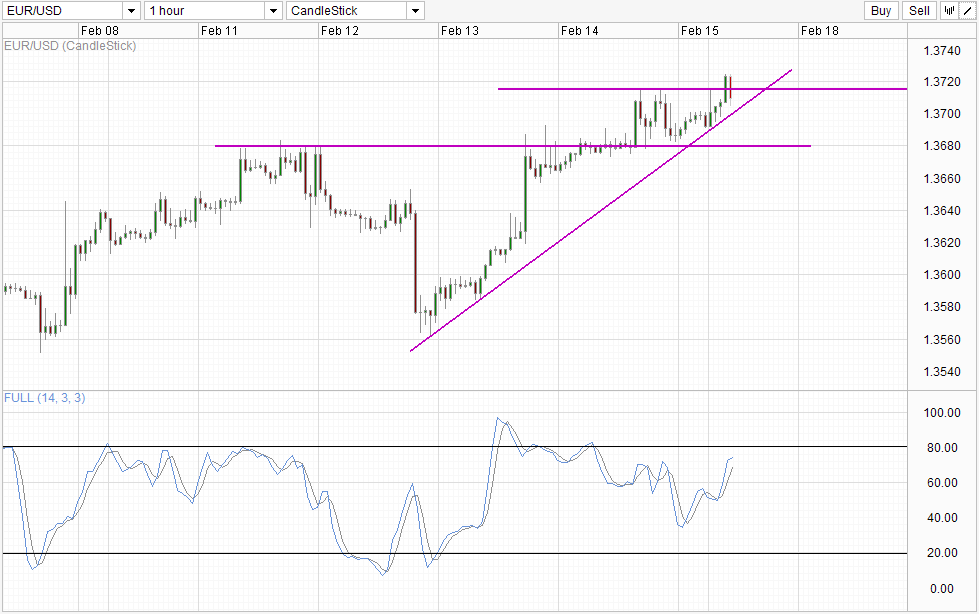

Early trading on Monday continued the bullish uptrend that has been in the game since February 13 while prices have pushed from Friday's close of 1.36922 above 1.37 almost immediately after market opening. This uptrend is strong sign also contributed by large "risk on" sentiment during Asian hours because of a global funding figure dossier published by the People's Bank of China, which amounted to 2.58 billion yuan ($ 425 billion) - suggesting that Chinese banks continue to be risk-taking and the threat of a liquidity crisis in China is a little lower

timetable .

Certainly EUR / USD was not the most optimistic of all (GBP / USD won the title), but this pair remains one of the biggest winners this morning, highlighting the bullish sentiment strong around the currency pair at the moment. this put the bulls in a good position to retest the 1.3715 soft resistance that had kept Friday's gains. with additional support may come from the upward trend line, the probability of a 1.3715 retest and possible break becomes higher. Stochastic gradient on the curve can be reduced, but the readings continue to point higher. With some space left before hitting overbought, we should be able to see more optimistic earnings before an S / T bearish pullback occurs.

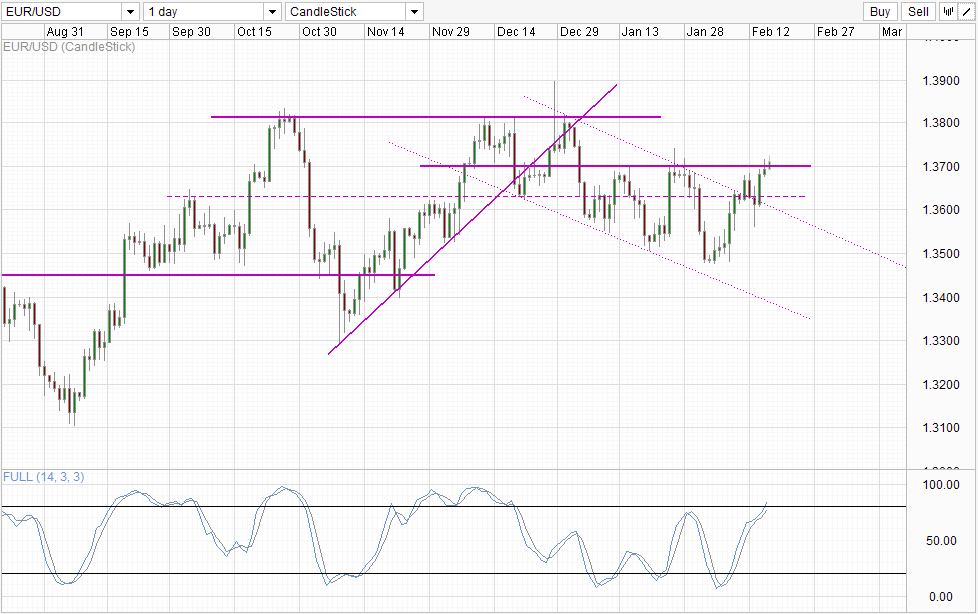

Table Daily

Daily Chart is less optimistic. Although prices have reached the round number of 1.37, we still are trading below the previous swing high of 1,374. In addition, stochastic readings are already in the overbought region, suggesting that the current bullish momentum may begin to decline. As such, the potential for a "fakeout" above 1.37 can not be ignored, and traders will further confirmation before a push towards 1.3815 is considered likely.

Nevertheless, there is a good bullish support. current rally of 13 February (12 February the US session) took place after the break of 1.3625 to 1.363 resistance. This break also coincides with a Top Channel descent rebound, confirming the break of the channel seen on February 11 As such, we are already riding on a bullish wave escape and so do not take too much effort to break 1.37 since the whole market is bullish on the forehead right now.

Fundamentals are mixed well. Market sentiment is certainly optimistic, but we wonder how long it would last. Although Chinese banks continue to lend more money, the risk of bad debts continued to rise. As it is currently, bad loans ratios in China has already reached a high of 3 years, and pumping more money into the system trying to save all these companies in trouble can lead to throw over the money after bad good, especially if the Chinese economy does pick up t. Therefore, it is able to say that the risk of immediate fall in China is lower for now, but the long-term risks have simply increased.

On the European front, things are looking great for the euro area. The Italian government successfully auctioned 3-year debt at lower Friday despite all the political turmoil, suggesting that investors are beginning to gain the trust and confidence in the currency EUR once more after 5 years of crisis. The same trend is also observed in the Spanish and Portuguese sovereign debt, showing that trust is not isolated only in Italy but also in other European peripherals. This can help cushion losses should risk appetite to plunge suddenly because of the crisis of China's credit, but only time will tell if that reason alone be able to go against risk-off trends in the long term, if it occurs.

Links:

In FX Week Asia - Chinese Fortunes elusive

week in FX Americas - Look beyond the storm clouds

In FX Week Europe - European Recovery Remains in Progress

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : EUR/USD Technicals – Trading Above 1.37 On S/T Bullish Pressure

Tidak ada komentar:

Posting Komentar