Time Table

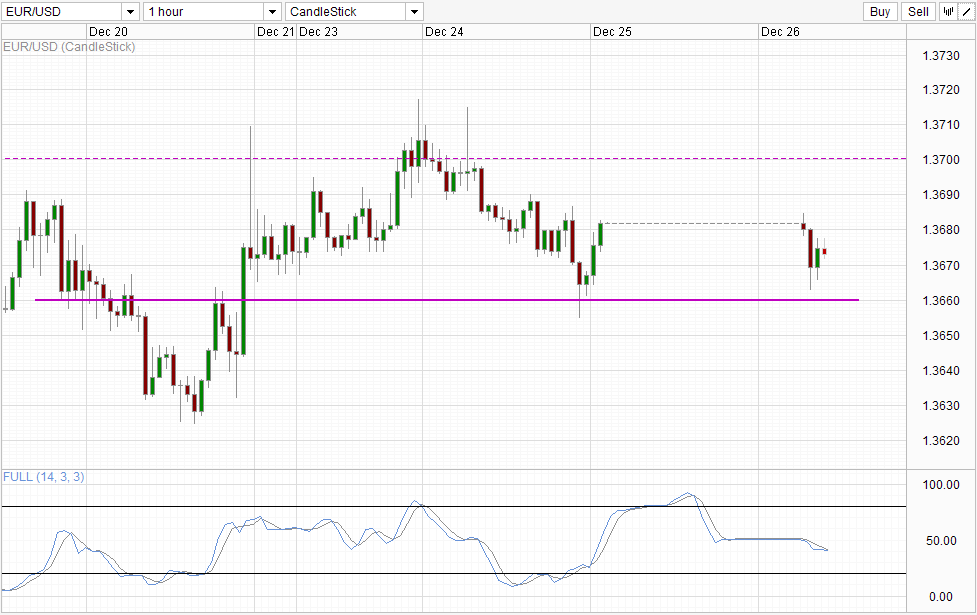

USD is to not let the holiday break affecting his stride. The greenback strengthened during the Boxing Day trading began, pushing against all major currencies, including EUR, which cast a little less than 20 pips in open troughs. If we ignore the empty candle on the chart, the decline this morning appears to be a further decline from the high of December 23 The fact that high swing today has not been able to match the previous swing high December 24th saw during US session suggest that previous bearish momentum remains in play, a notion that is supported by stochastic readings are not affected by the oversold region.

However, traders should also note that prices have failed to knock down swing said US session on December 24, and prices have been spinning over 1,367 flexible support. In addition, the line Stoch / Signal converge and can even reverse soon. Therefore, traders should not automatically assume that prices will grow next lower especially since the volume of transactions in the coming days will be low. A stronger bearish signal is breaking 1366 which will open a possible move towards 1.3625 but even then, traders should be aware that any directional follow through this week will be low during this period.

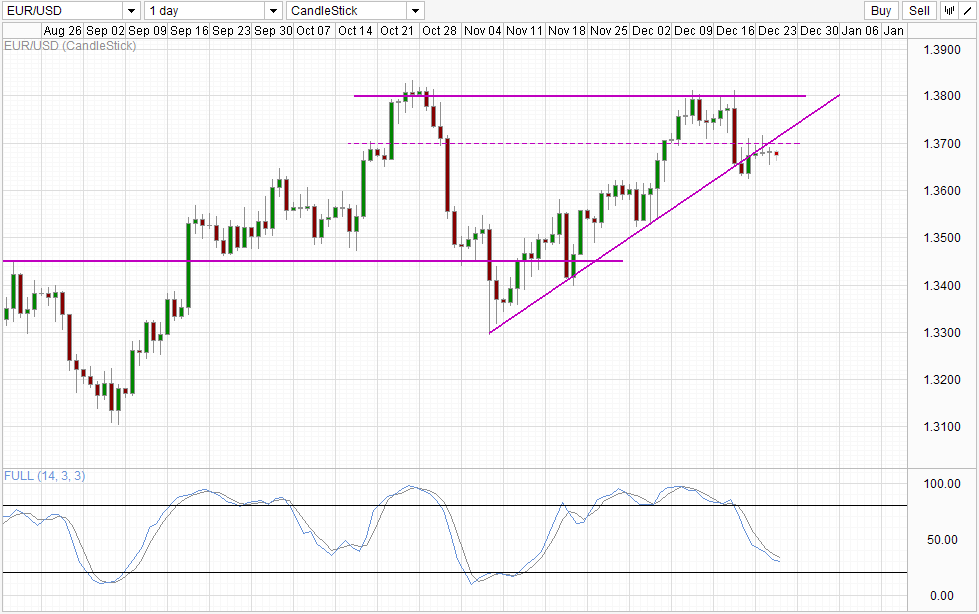

Daily Graphic

price action on the daily chart remains bearish as long as it remains below 1.37 and light can even keep bearish bias above 1.37 if the rising trend line remains intact. However, the current bearish momentum may find support from 1.36 to 1.3625 as stochastic readings are close to the oversold region, corresponding to the table in the short term is to show us.

Nevertheless, do not expect short-term rebound to last given the USD is expected to strengthen in 2014, while EUR may weaken the ECB remains very accommodative and explicitly stated that the rate of negative interest are possible and a viable option if necessary. All this can be just bravado of the ECB which can not be called, but given that the EUR / USD has been rallying over the past month, it is clear that the market has not really priced in a scenario ECB accommodating, giving us a lot of potential downside ECB should ease again in 2014 (ie liquidity injection style ala LTRO or via interest rate cuts). Moreover, from the point of view of pure economic power, the United States are head and shoulders better than the euro area, which in itself should promote a lower EUR / USD move forward before considering even actions of the Central Bank.

Links:

GBP / USD - Pound disdain Sharp US data

USD / CAD - Loonie Holds Firm Despite Sharp numbers US

AUD / USD - rangebound As Markets Eye Key US release

This article is only for general information purposes . It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : EUR/USD Technicals – Bearish Pressure Intact But Don’t Expect Sudden Slide

Tidak ada komentar:

Posting Komentar