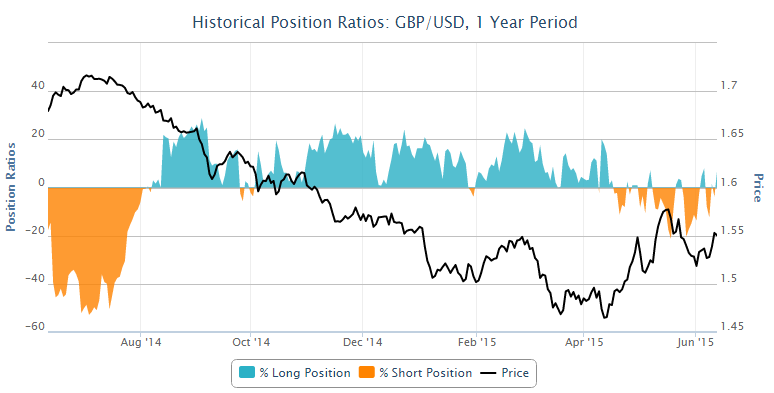

Having rallied strongly on Wednesday, the cable is paring gains today, but we are still seeing signs the pair remains bullish

.The most obvious of these came after the US release of retail sales, which together with the basic reading was better than high expectations. The previous reading for April was also revised higher.

This suggests that the consumer starts to spend some of that extra disposable income higher wages and oil prices. This should start to filter through into higher inflation readings could prompt the Federal Reserve to raise interest rates this year -. An event that would typically be bullish for the dollar

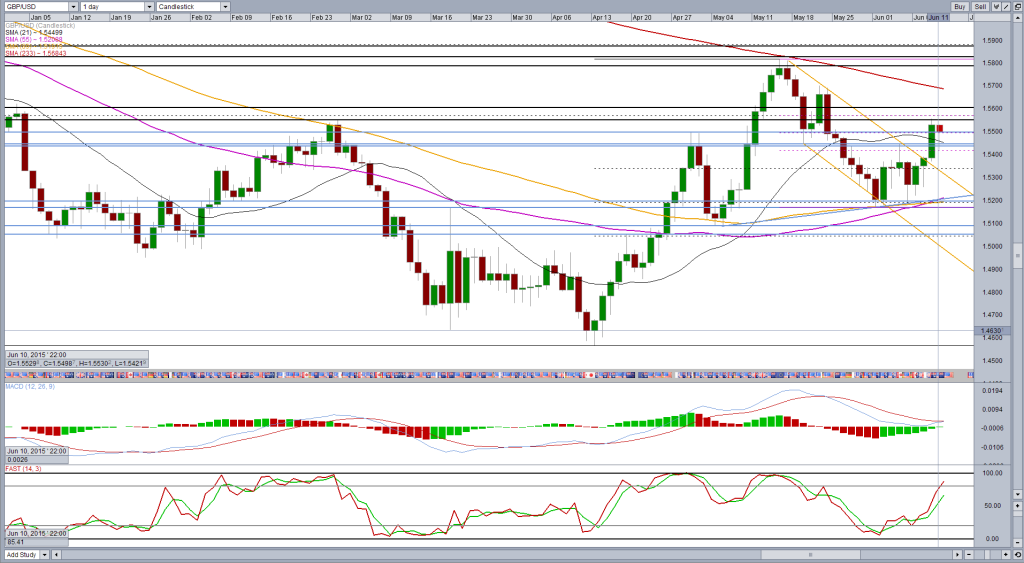

The first reaction to this reading was just that, a dollar rally, but when it faces its first key area of technical support - the recent strength on some occasions and the previous support between 1.54 and 1.5450 - it bounced higher

what we were left with the four-hour chart is something that looks like a tweezer bottom, a bullish trend reversal.

this suggests to me that there are more benefits to come in this pair and if the peaks of yesterday can be broken 1.56 level looks bright next to the resistance.

I still think the pair could go beyond here and the first major test will be the 233-day simple moving average just below 1.57, but I will keep an eye on the table for any signs that this does not happen.

for example, this might be a discrepancy between a discrepancy between an action of the oscillator and the price associated with a reversal on the 4 hour chart.

If we do not manage to break above the highs of yesterday, it could be a warning sign of a bearish reversal, especially if accompanied by a hanging man candle. This would make tomorrow very interesting and important.

* The tools above and many others can be found in OANDA Forex Labs.

[ad_2]

Read More : GBPUSD – Still Bullish Despite Retail Sales Data

Tidak ada komentar:

Posting Komentar