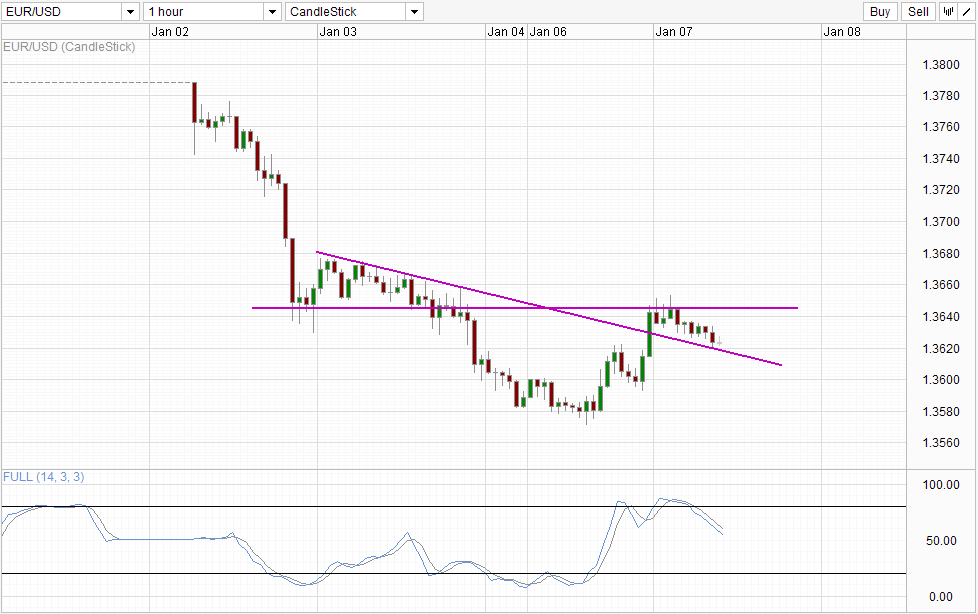

EUR / USD managed to rally yesterday despite weaker than expected German Service PMI and the consumer price index. Prices were down slightly decline in early US session, but it has nothing to do with the 2 economic data mentioned above, and appears to be a mild bearish decline after 1.36 was broken. The following affirmation 1.36 resistance turned support sent prices higher again, allowing the price to reach the next resistance level of 1.3645. This thrust is further fueled by weaker than expected ISM manufacturing composite number not that weakened USD on light speculative game that the new Fed President Janet Yellen (which incidentally would be passed by the Senate later) can easily go the lark tapering QE. However, 1.3645 held despite several attempts to break it, keeping intact bearish overall bias and EUR / USD has been trading lower since US session ended.

Time Table

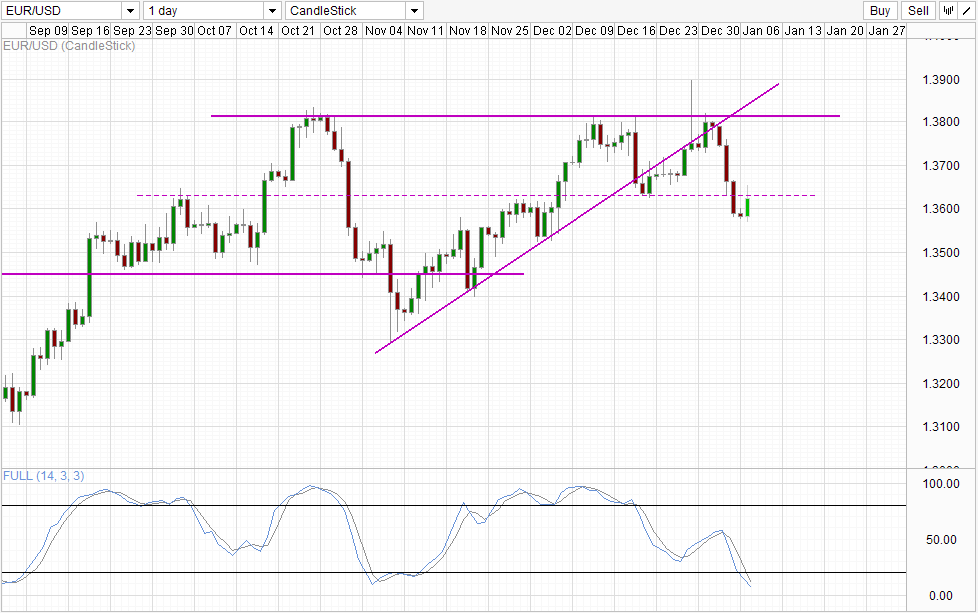

With all things considered, it is difficult to see the rally yesterday as anything a / T correction movement S. first, prices rose below and hit a low near 1,357 before the sudden withdrawal happened. This has already been planned from a technical point of view the price was bearish but a decline was still on the books Whereas the prices have not had a significant bullish response since the beginning of the new year. In addition, with a potential Triple Top pattern formation on the daily chart, a new test of 1363 support turned resistance (seen in the daily chart) is actually welcomed by the bear because it would bear to size up the extent of bulls and help confirm the Triple Top.

Moving forward in the short term, the stochastic indicator says the overall S / T with the Stochastic bearish bias curve in the middle of a down cycle with Stoch levels already below the recent trough intermediate seen during the fall pullback. This suggests that the bearish conviction is stronger than ever and promotes continuous thrust downward along the descending trend line.

Table Daily

Speaking of Triple Top model, should we close the candle today below 1363 accompanied by a bearish candle, the next day the Triple Top pattern is confirmed. However, stochastic readings are firmly in the oversold region and there is a chance that prices may remain between 1.353 and 1.363 (consolidation between late November and early December) for a long period of time before the next bearish step begins expansion . This will allow the bears to rest after the steep slide down from 1.38 and stochastic readings will most likely push up and primed for the next down cycle

Links :.

GBP / USD - active Pound as the UK, US services PMIs Dip

central bankers Kick Start an important week

AUD / USD - Little Movement to start the week

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : EUR/USD Technicals – Bears Maintain Pressure Despite Bullish Pullback Yesterday

Tidak ada komentar:

Posting Komentar