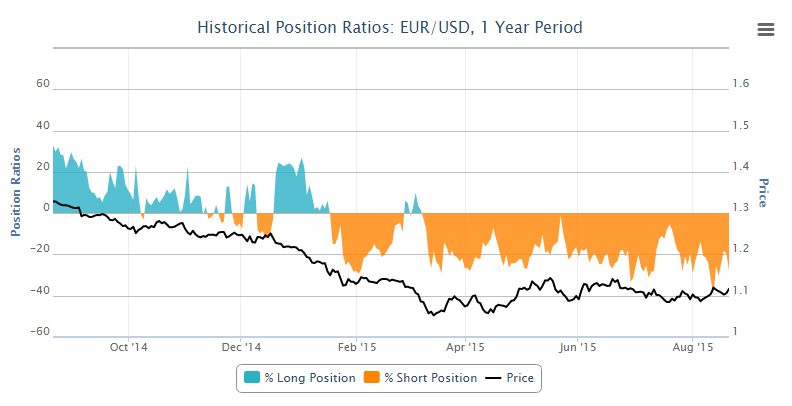

The euro rallies against the dollar again on Thursday after a strong move up in Wednesday on the back of what was. perceived as FOMC minutes standstill

The move came as the pair retested the descending trend line - 1 July peaks - that erupted over the past week. Although it has temporarily breached this level and close slightly below the daily chart, the highest rebound was both immediate and strong resulting in a bullish engulfing.

He also came off the 50 fib level - hollow 5 August to 12 senior Aug -. simple moving average and 233-period on the 4 hour chart

The next major test for the pair will be 1.1214 - last week the highest - around the upper end of the trading range that it has traded in since the beginning of July.

pair has found initial resistance at the moment around 1.1185, which provided similar resistance on 13 and 14 August, but I'm not convinced at this stage that it will take.

If we see a break above the highs of last week, it would be a bullish signal and could cause a move back towards a key area of resistance between 1.1385 and 1.1525.

has been a key area of strength on many occasions this year. On this occasion, the descending trend line from May 8, 2014 highs could also provide additional resistance and the 233 days SMA.

It will be interesting to see how the pair responds if the peaks of last week and are not broken down to 1.1017 this week will be crucial for this. If the pair is higher low would be a bullish signal while a break and daily close below would be bearish because it means the neckline of a double top has been broken.

The tools above and others can be found in OANDA Forex Labs.

[ad_2]

Read More : EURUSD – Seven Week High Eyed on Dollar Weakness

Tidak ada komentar:

Posting Komentar