EUR/USD – Yellen Nominated, Euro Halts Sharp Slide EUR / USD shows little movement on Thursday as the pair trades slightly above line 1 35. The pair has stabilized after sharp losses the euro Tuesday. There were many developments around the Federal Reserve Wednesday. As expected, President Obama nominated Janet Yellen to lead the Federal Reserve. In addition, the minutes of the FOMC meeting indicated that most policy makers favor tapering QE before the end of the year. In economics, French and Italian industrial production news came well below their estimates. Wednesday's highlight is the US Unemployment Claims.

The dollar was broadly higher in Wednesday trading as President Obama appointed Susan Yellen to head the Federal Reserve. Yellen take over from Bernard Bernanke, who is due to retire next year. Yellen, who is currently vice president of the Fed, became the main candidate after former Treasury Secretary Lawrence Summers withdrew his candidacy. Yellen is considered favorable to the status quo in position and supported Bernanke in three rounds of QE increases. His appointment must be confirmed by the Senate, but it should be broadly supported.

The minutes of the policy meeting in September Federal Reserve were released Wednesday. At the meeting, the Fed surprised markets by opting to stay on course with its bond purchase program, which is taking place at 85 billion $ / month. The minutes said that the decision not to start narrowing was a "close call". This has increased speculation that we could see narrowing before the end of the year. However, the monkey wrench in all this is the financial uncertainty of the judgment and the threat of the debt crisis. In addition, the Fed relies heavily on key releases such as non-farm payrolls, which were hanging off. It is unlikely that we will see any attempt to reduce QE before December at the earliest.

The American case has now entered its second week, and neither side seems to show some flexibility. Polls show that the majority of the public blame Republicans for the impasse, which is likely to increase pressure on Republicans to agree to pass the budget so that the government can resume operations. The economic damage of the judgment should not be important if the crisis is resolved soon, but the political fallout is likely to be important.

As if Congress does not have its plate full with the budget deficit and to stop a crisis in the debt ceiling could trigger a devastating financial crisis. The US has a debt of $ 16700000000000, and the country will run out of funds to pay off debt on October 17 unless Congress authorizes the raising of the debt ceiling. Otherwise, the US could potentially default on its obligations, which could cause chaos in national and international markets. There are a lot of bad blood between Republicans and Democrats on the closure, and this will undoubtedly complicate negotiations on the debt ceiling. There are signs of some progress, the talks between the parties on the possibility of a short-term increase in the debt limit, avoiding a default for now.

EUR / USD for Thursday, October 10, 2013

EUR / 10 USD October at 10:20 GMT

EUR / 10 USD October at 10:20 GMT

EUR / USD 1.3521 H: L 1.3533: 1.3488

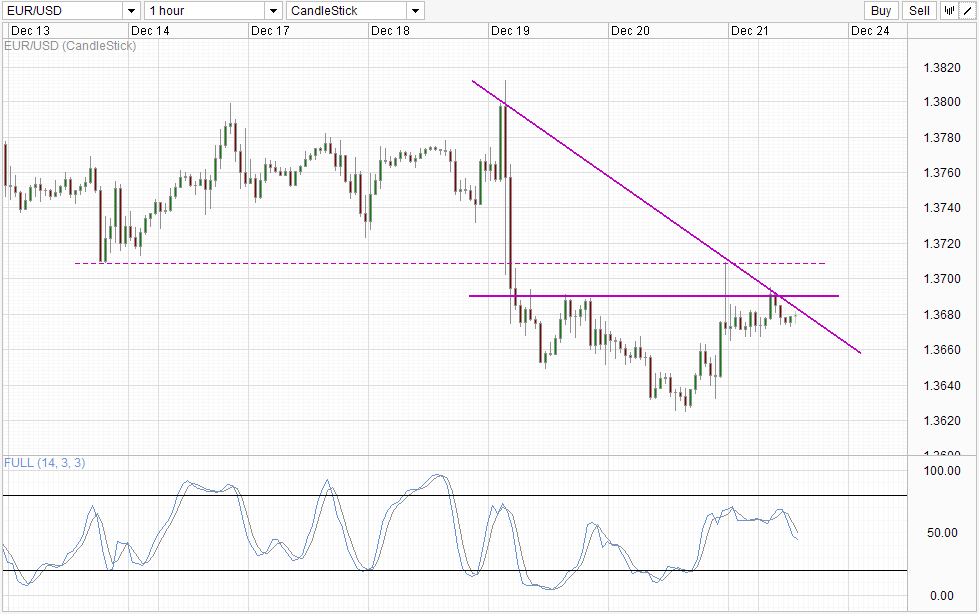

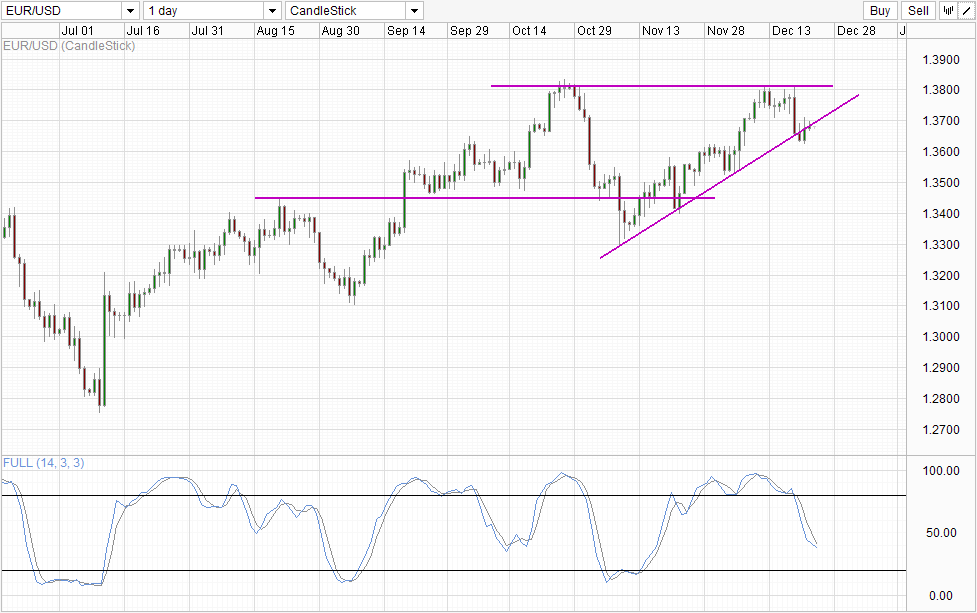

EUR / USD technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3335 | 1.3410 | 1.3500 | 1.3585 | 1.3649 | 1.3786 |

- EUR / USD stable trading Thursday. The pair tested the 1.35 line during the Asian session, but increased slightly.

- The pair continues resistance 1.3585. It is followed by resistance at 1.3649, which held good since the beginning of February.

- The pair is putting strong pressure on the round number of 1.35. Is this key support line hold? This is followed by support at 1.3410

- Current range :. 1.3500 to 1.3585

Other levels in both directions

- Below: 1.3500, 1.3410 , 1.3335, 1.3162 and 1.3100

- above: 1.3585, 1.3649, 1.3786, 1.3893 and 1.4000

Open positions ratio [deOANDA

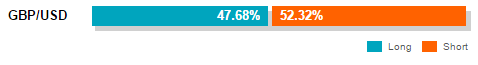

report EUR / USD is unchanged in Thursday trading. This is reflected in the current movement of the pair, which trades in a narrow range. The ratio continues to have a solid majority of short positions, indicative of a strong trader through to the US dollar gained ground against the euro.

After suffering losses Wednesday, EUR / USD is struggling to stay above the 1.35 line. With the US disseminate key employment data later in the day, we could see some movement in the pair if the output does not match market expectations.

EUR / USD Fundamentals

- 6:45 French industrial production. 0.7% estimate. Actual 0.7%.

- 8:00 Monthly Bulletin of the ECB.

- 8:00 Italian industrial production. Estimate 0.6%, -0.3% real.

- 12:00 US Secretary of the Treasury Jack Lew Speaks. Lew will testify on the debt limit before the Senate Finance Committee.

- 24:30 US unemployment claims. 307K estimate.

- 1:45 p.m. US FOMC Member Bullard Speaks James.

- 2:30 p.m. US natural gas storage. 96B estimate.

- 4:20 p.m. ECB President Draghi Speaks.

- 5:01 p.m. US 30-year Bond Auction.

- 4:45 p.m. US FOMC member Daniel Tarullo Speaks.

* Key releases are highlighted in bold

* All GMT release time

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : EUR/USD – Yellen Nominated, Euro Halts Sharp Slide

EUR / 10 USD October at 10:20 GMT

EUR / 10 USD October at 10:20 GMT