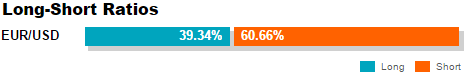

EUR / USD was one of the biggest winners during the hours of Asia yesterday, but all the nothingness to turn bullish bravado as prices traded lower later in the European session and US, staying in a narrow band between 1.3695 and 1.3710. To be fair, EUR / USD was not the only currency pair where the bulls have failed; other conventional risk currency pairs GBP / USD, AUD / USD and NZD / USD traded all down as well, and the extent of their losses were much larger - 3 currency pairs traded below the opening levels. Moreover, even if EUR / USD gains sleek, prices are not able to stay in the black, suggesting that EUR / USD bulls may just be that much stronger than the rest of short-term currency .

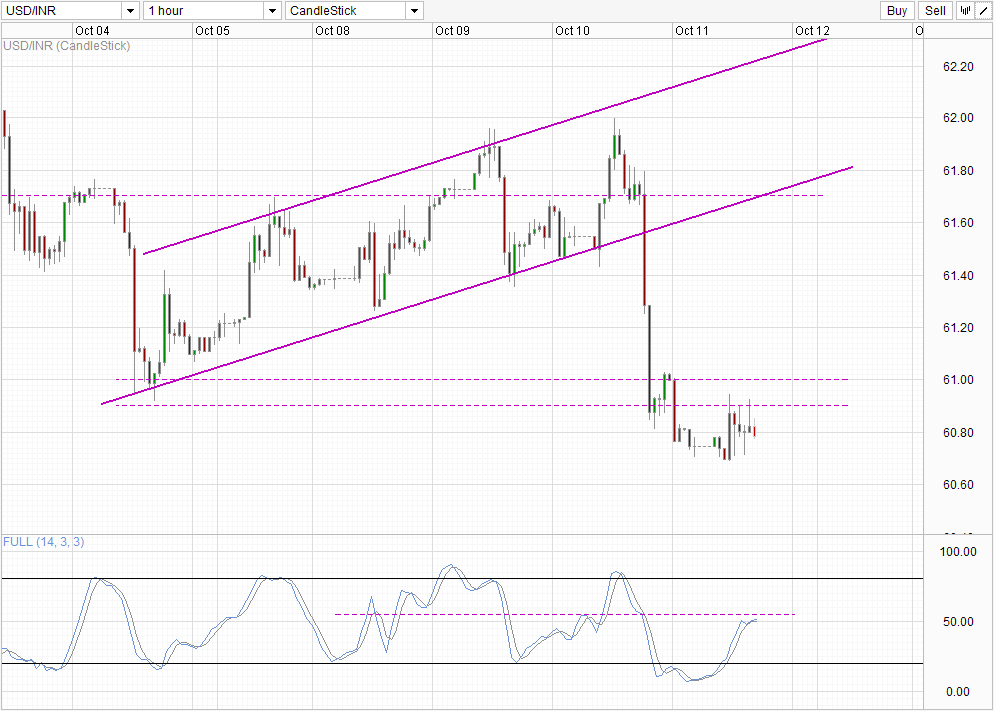

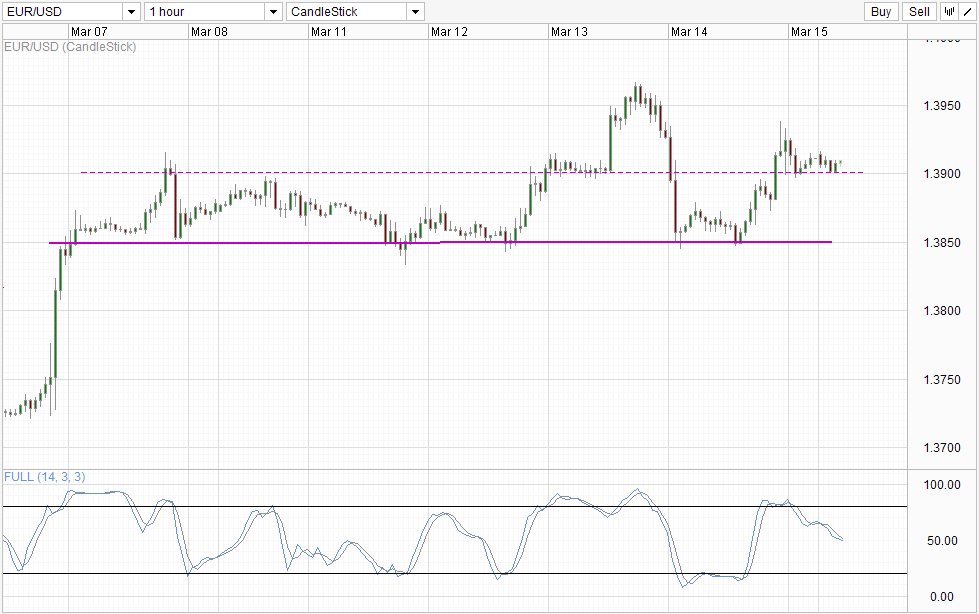

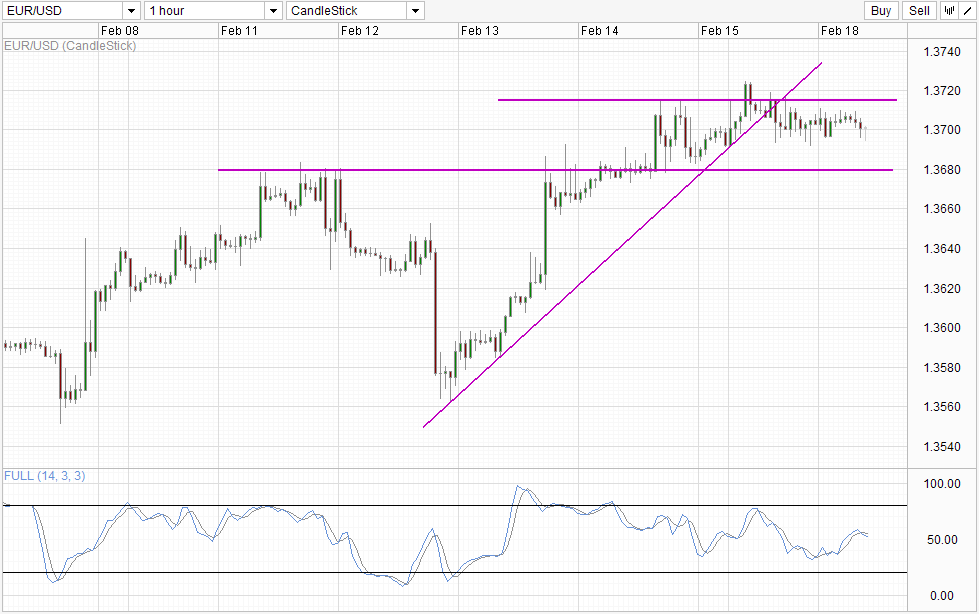

timetable

Another good bullish factor goes for EUR / USD for now is that prices have stayed most time above 1.37. Today we have seen prices pushed below 1.37, but prices have since recovered. As such, even though technicals suggest that a push towards 1,368 is possible after the failure to break 1.3715 and bearish break of the trend line rising prices have a good chance of staying afloat around 1 , 37 mark, opening the possibility of a push 1.3715 once more.

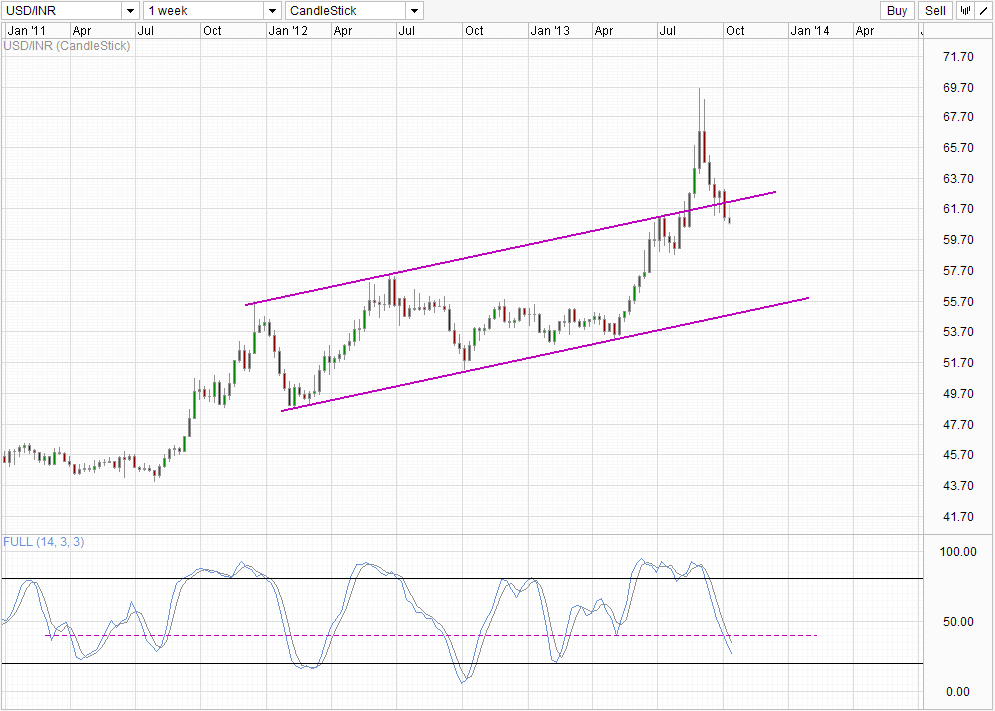

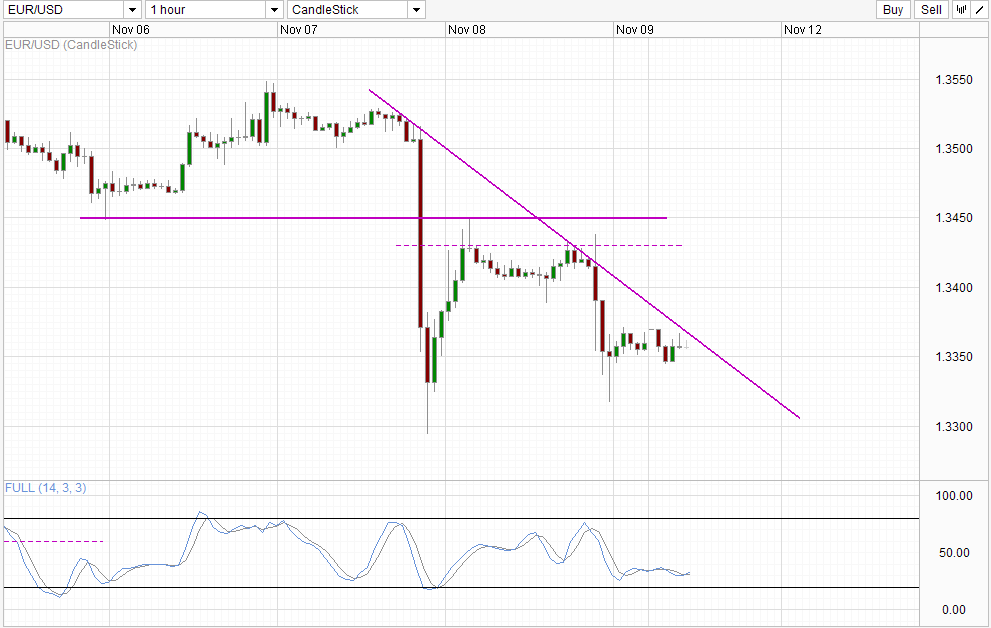

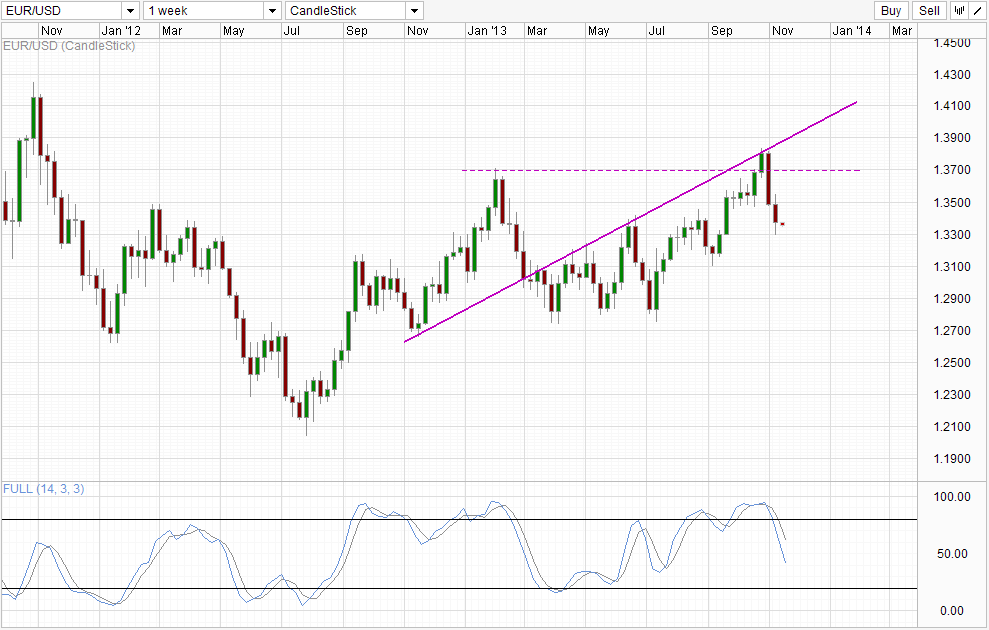

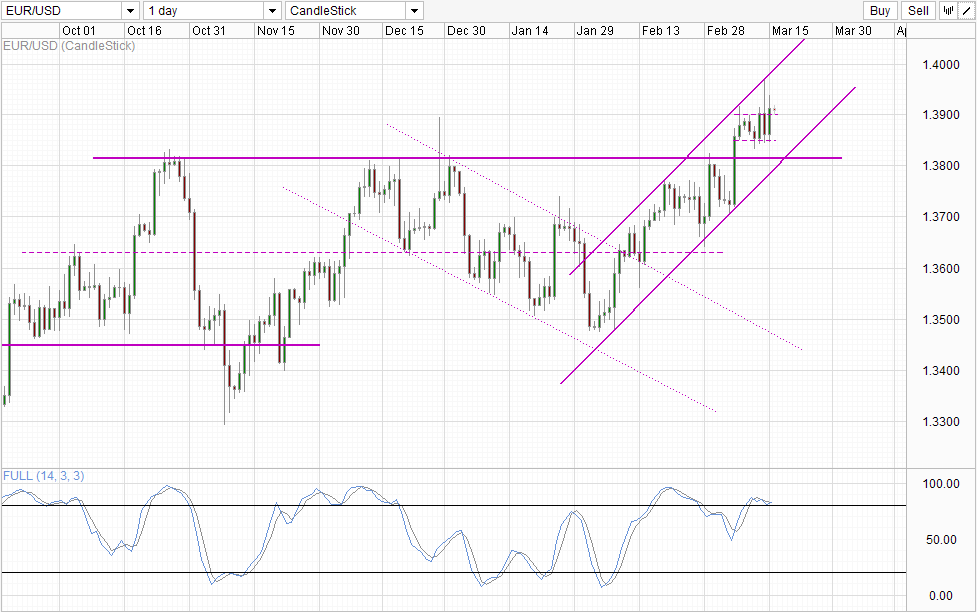

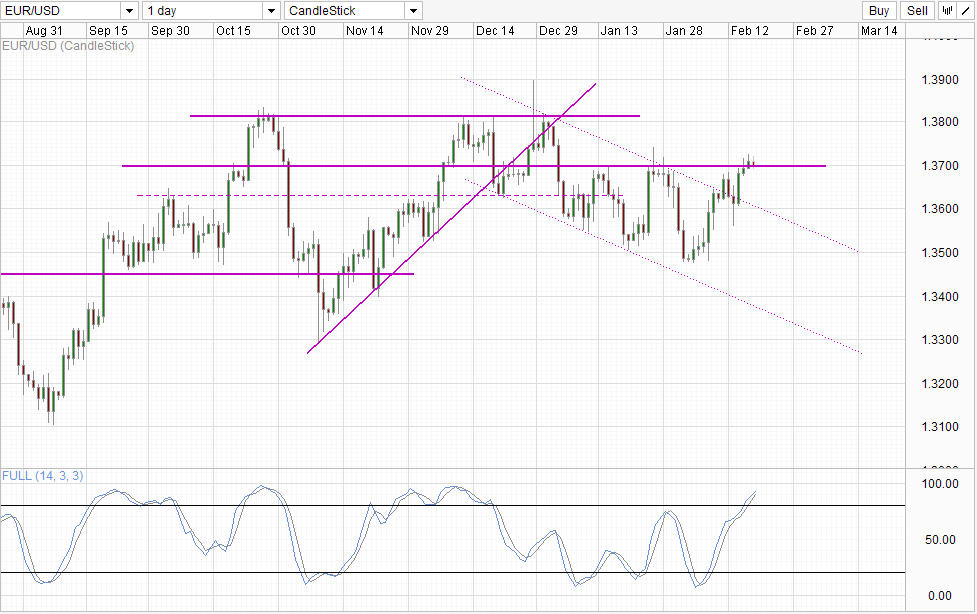

Daily chart

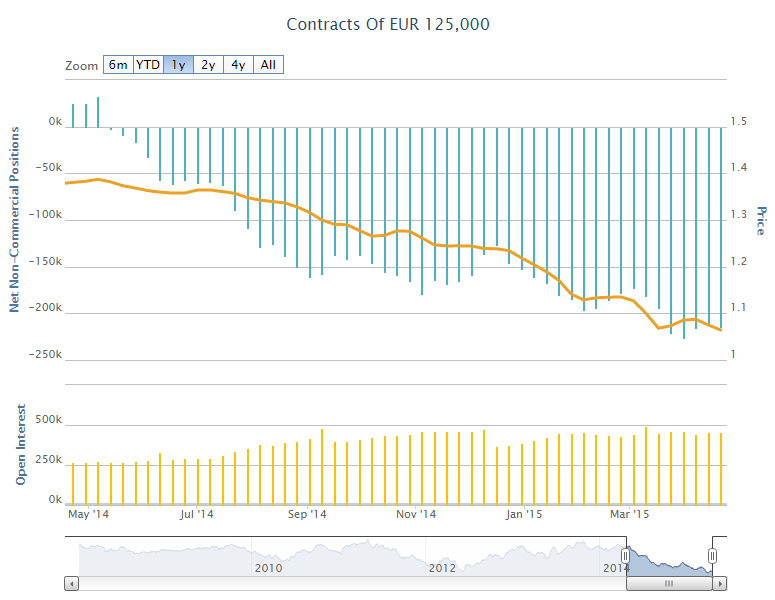

Daily Chart is less optimistic, as the inability to move beyond 1.37 suggests conclusively that a top may be in place, which opens a lower back movement with an ultimate downside target below 1348 that the downward trend that began in late December 2013 will be back in the game. stochastic readings agree with Stoch curve already deeply overbought. In addition, it should be noted that there is a divergence between prices and Stoch peaks, suggesting that the current bullish recovery from early February may be too aggressive, increasing the likelihood of a downturn.

Looking at the calendar of economic news, there is no major European economic news that could fuel further gains in EUR / USD. As such, the only reason why EUR / USD may possibly go higher going forward would be inherent bullishness and technical pressures. While EUR / USD has done better than other currencies, it should be noted that yesterday was a "risk on" day globally which saw global equity indices from Asia and Europe climbing any higher (Bank holiday in the US). Therefore, failure to see gains in risk currencies as a block is disconcerting, and we can conclude that there is a bearish sentiment most important work (possibly related to the strength of the dollar), which can still drag EUR / USD lower.

Links:

GBP / USD - slight losses inflation indicators Markets Eye UK

USD / CAD - Holidays rangebound trade

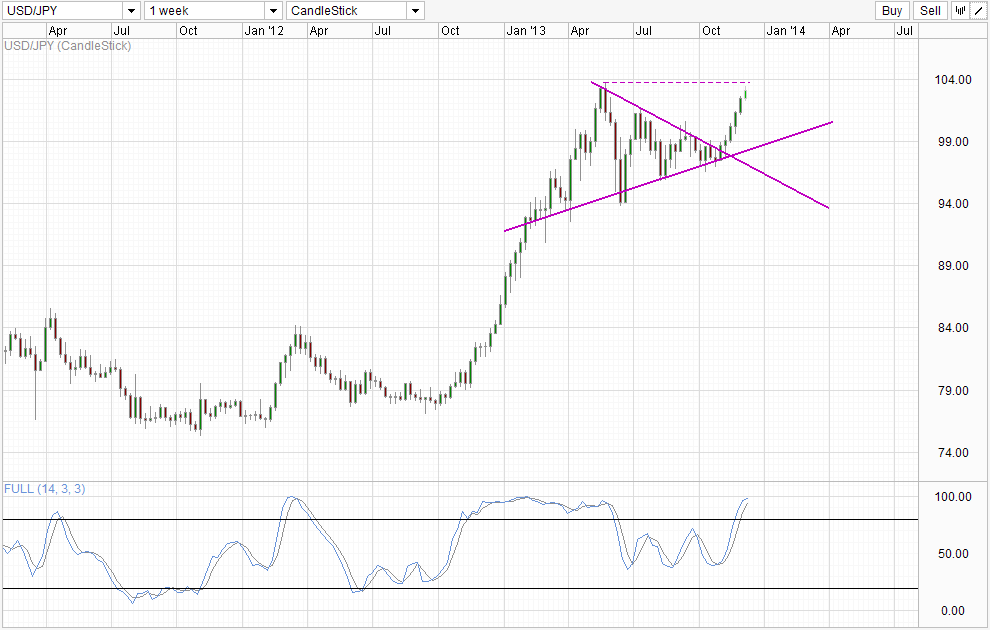

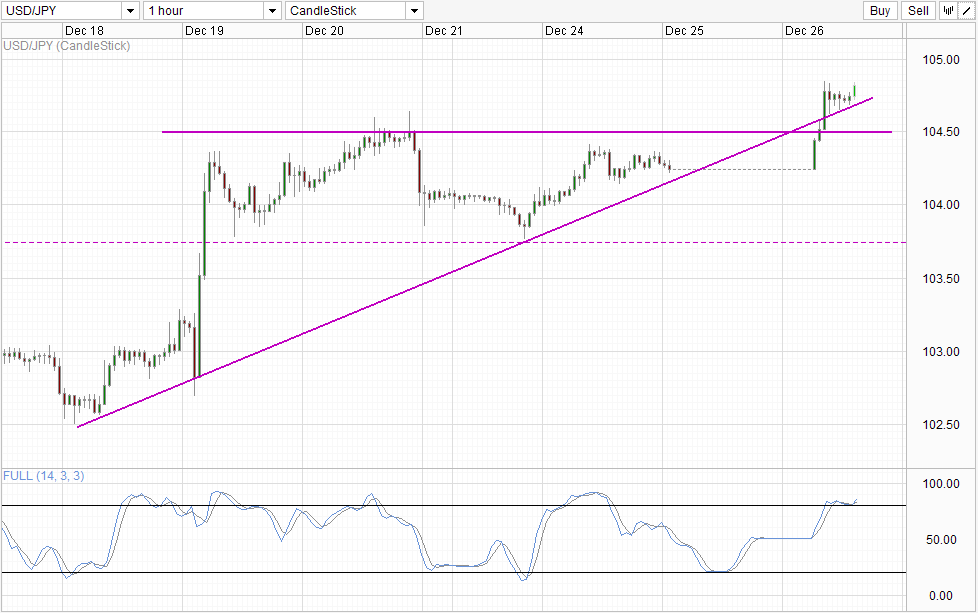

USD / JPY - gains Japanese GDP dollar Dips

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : EUR/USD Technicals – Staying Above 1.37 Despite Bearish Setback