]

The RBA central bank of Australia published minutes of its February meeting which revealed that the central bank will probably keep interest rates unchanged at record low, to facilitate growth. RBA also noted that there are inflationary pressures, but denied saying the likely figures "contained some noise," and he is "something of a puzzle" that economic activity is low but prices have risen. this is not really new, as President Glenn Stevens already said something to the same effect during the last rate decision. Nonetheless, AUD / USD has reacted bullishly, climbing a summit of 0.08 after the publication of minutes.

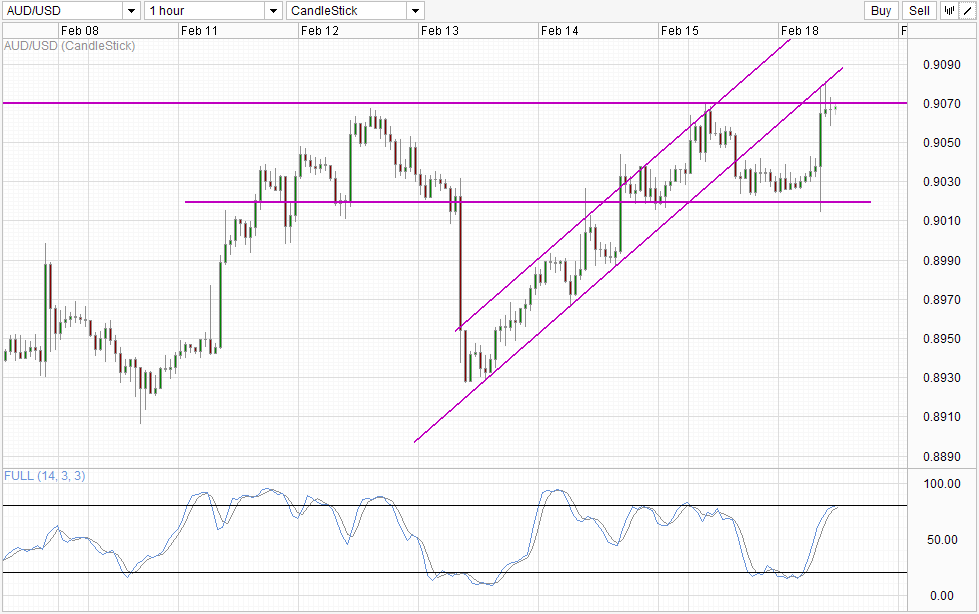

time Table

what is even more interesting is that price actually traded lower initially, falling from 0.04 to 0.015 before rebounding above. This is a clear sign that the report itself does not really provide a clear directional marker, and the strong upward reaction that sent prices up perhaps an overreaction / over-eagerness to buy AUD / USD by the underlying bulls. This assertion is not far that the upward trend since February 13 is still in play. However, this also implies that the probability of a break by 0.07 may be unlikely, and a move towards 0.015 is possible. stochastic indicator is in agreement that the curve Stoch seem to lead soon, suggesting that the bearish cycle can be set in the near future.

Price action also favors a bearish movement. The rally has not only failed to erase 0.07, but perhaps more critically failed to breach in the riser Channel that was previously in. As such, there is a risk that the bullish momentum may have been struck down, and we could possibly see prices pushing below 0.015 towards 0.0 and other support levels below.

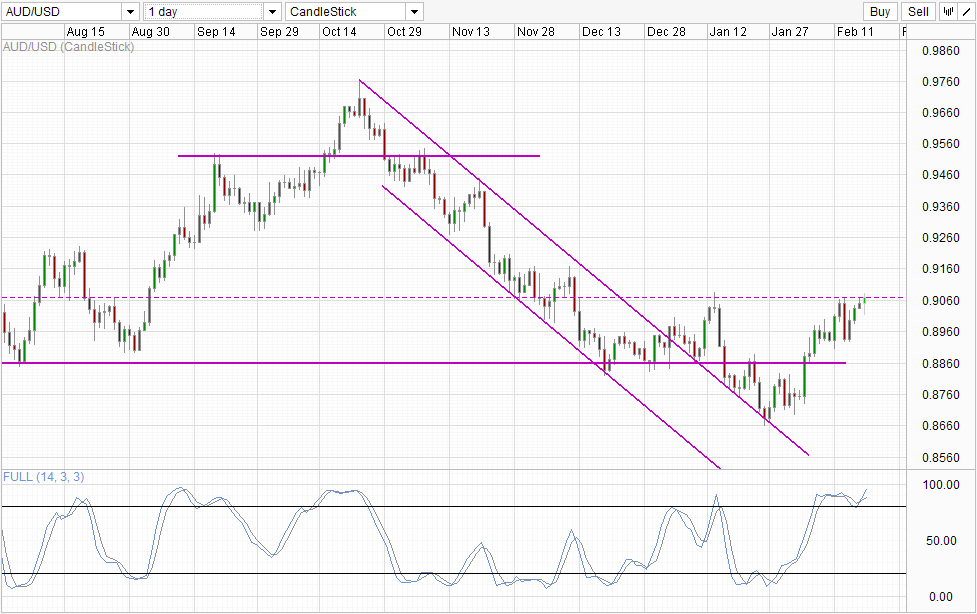

Table Daily

Price action on the daily chart is a mixed bag though. First, the bias is bearish price that we still, even to test the previous swing high seen on January 14 the other hand, prices have traded above the peaks of February 12th / 13, suggesting that 'bullish momentum from the end of January is still in play. stochastic readings are not really helpful either as Stoch curve is extremely overbought but both Stoch and signal lines are always pointed above, so although we believe that the bear market is come, we can not deny that the strong bullish momentum is still in play. in addition, as against the trend oscillators signals tend to be unreliable during strong trends, the possibility of a rupture and a 0.07 evolution to 0.916 can not be deliberately ignored. As such, conservative traders may want to wait for further confirmation before engaging in medium / long term positions.

Aggressive traders on the other hand may see this as an ideal opportunity to short AUD / USD at the moment with a target of 0,866 or less. But in this case, they should note that prices can still go as high as 0.93 before broad downward pressure may be invalidated. Whereas the postponement of the interests of AUD / USD is still the most expensive among all major currency pairs, aggressive traders will have to weigh the potential risk / reward if they decide to short now, when there is a lack of directional clarity.

Links:

EUR / USD Technicals - stay above 1.37 Bearish Despite Setback

GBP / USD - slight losses inflation indicators Markets Eye UK

USD / JPY - Japanese GDP Dips dollar gains

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : AUD/USD Technicals – No New Revelations From RBA Minutes

Tidak ada komentar:

Posting Komentar