EUR / USD lost down this morning but was mostly stable above 1.39 round number. By keeping above the key level, last Friday's rally remained intact and the upward pressure continues to favor a push up Thursday. However, before we all excited at the prospect of bullish EUR / USD, it is important to understand why prices still gathered to begin.

Looking at the economic calendar Friday, we can see that the economic figures for euro area exceeded the expectations or the least satisfied. Germany consumer price index came in as expected, while the number of jobs in the eurozone have improved on a Q / Q basis. Y / Y wise we continue to see a slight decline, but the -0.5% is certainly slower than the figure of -0.8% seen in the previous quarter. Across the economy of British English Channel seems to be a little better as well with growth of output construction 5.4% Y / Y after seasonal adjustments, stronger than expected 5.2% and higher than the previous month of 4.9%. All these figures echoed the larger narrative of the eurozone recovery, pushing EUR / USD higher.

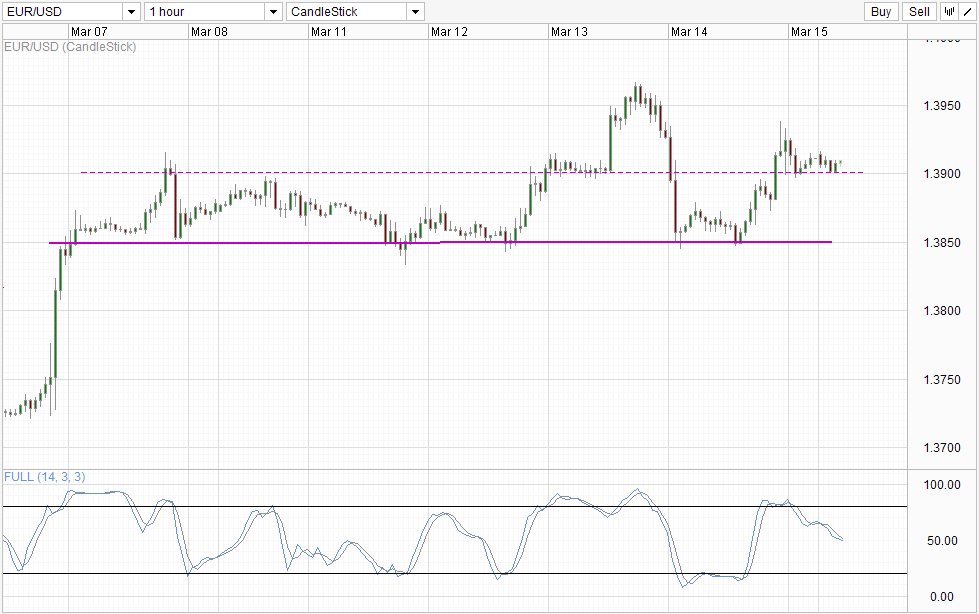

Time Table

However, astute readers will notice that the price action really does not align with the new economic announcements. EUR / USD is already recovering before European markets opened, and actually traded slightly lower when the employment figures of the euro zone were released. Prices climbed again in early US session as US stocks were bearish, a move that is especially when considering that USD is expected to strengthen during the same period because of the refuge flow. This statement seemed to be precise when we see that gold prices actually climbed higher during the period mentioned above, while the USD / JPY traded lower as well, suggesting that traditional flows off of risk were alive and well, and therefore should also be broadly USD strengthened too.

therefore, that the EUR / USD managed to climb higher is a sign that underlying feeling of EUR / USD is bullish. This is again confirmed by the holding of 1.39 support when the Asian market is less than the increase. stochastic indicator suggests that price is in a down cycle right now, but we could also see curve Stochastic rebounded on the "support" level 50.0, lending strength to 1.39 maintenance support.

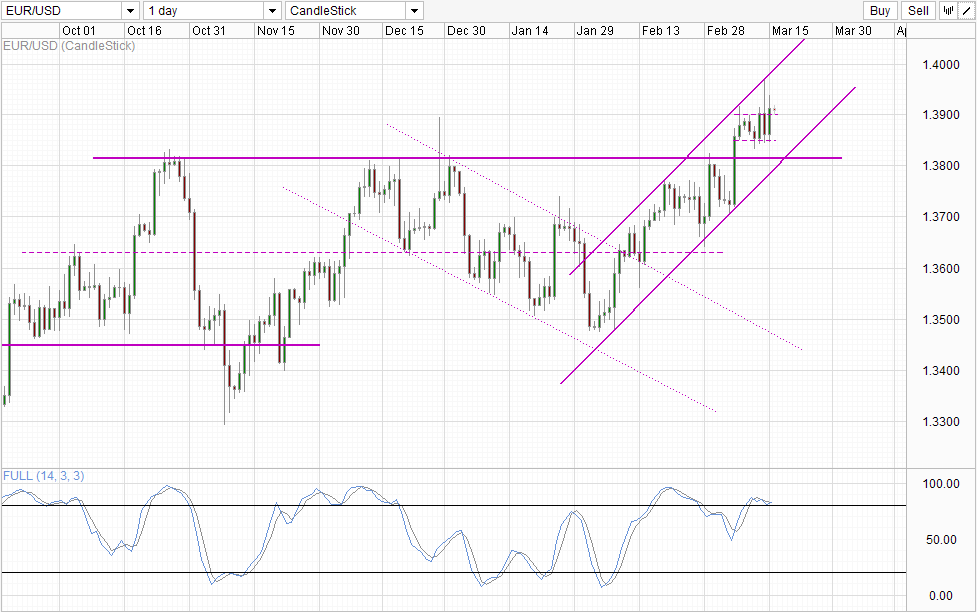

Table Daily

Daily Chart is less optimistic that prices may be in the midst of a bearish rejection Top Channel, which would open a return to the bottom of the English Channel. stochastic indicator on the daily chart is also looking towards a down cycle, but Stoch curve should preferably grow below 65.0 signal the strongest conviction decline. This is important because a breakout may be involved with holding support 1.39, which opens the possibility of a more foolproof Top channel. As such, more confirmation is needed to invalidate the escape and at the same time to establish a strong bearish momentum / long term

Links :.

USD / JPY - Yen Rally continues as Markets Fret Over Ukraine

week FX Europe - Euro Shrugs Off Ukraine and comments from Draghi

Gold Technicals - paring early gains as quiet market after Crimea Vote

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : EUR/USD Technicals – Stable above 1.39

Tidak ada komentar:

Posting Komentar