Consolidation of the pair since Friday morning, may suggest that the bulls are fighting to gain any momentum and once again, the strength of dollar prevail. While this may be the case in the longer term, I think we might see some other movements in the short-term rise.

The big test facing the pair at the moment is the 50 day simple moving average (SMA), which capped any upward movement for almost a year, most recently last week. While on the previous couple of occasions, which was met with strong selling pressure, on this occasion, it seems to hold its own, suggesting that it might not be so easy this time

The 4 hour chart potentially support this view. The consolidation over the past 48 hours led to the formation of a pennant, which is typically a continuation pattern. A break through the top of the flame suggests that a break of the 50 day SMA will follow as one of the advantages of these configurations is that it offers potential target prices.

In this case, taking the size of the movement to the flame and approach to project above the escape, which would take good price au above the 50 day SMA. It would actually take us just past 1.11, which may suggest that a break above the recent trading range of 1.05 -. 1.1050, although I would be very careful around 1.1050 that these projections are not always perfect

It should also be noted that the 50-period SMA crossing above the 0-period SMA on the 4-hour chart, which is a sign of bullish momentum change. A break above the flame and 50-day SMA could complement it and make the graphics seem more optimistic. Of course, the ultimate test of bias would come around 1.1050.

Helping to drive this movement is reporting today that the Greek Prime Minister Alexis Tsipras has decided to overhaul its negotiating team to work on the reform package with lenders in the country. Indeed, he demoted Yanis Varoufakis who disagreed with the finance ministers of the euro area for months, culminating Friday with seemingly completely lose their patience with him.

This is considered a positive step for the negotiations and already talking about Greece revise its reform list and the suspension of minimum wage plans. An agreement on the reforms, which would provide € 7.2 billion in bailout funds that Greece needs to avoid default, should support the euro, which has been overwhelmed by all the uncertainty in recent months.

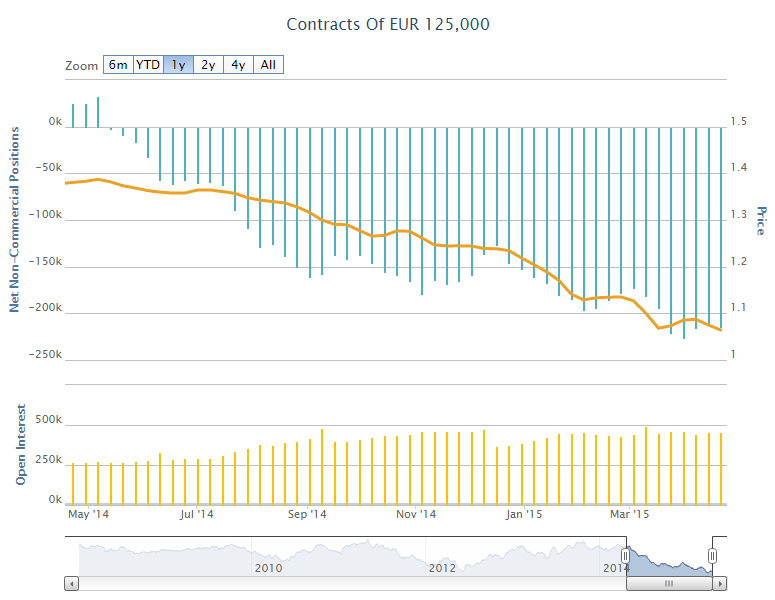

I want to emphasize that an escape is required for this to look more optimistic, which is obviously not guaranteed. Last week, the net position of noncommercial euro has become increasingly short, suggesting the single currency is still under a lot of pressure.

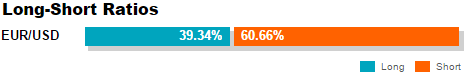

At the same time, the OANDA clients have become somewhat less net short EURUSD today, the book is now 60.66% Short, down 62.13% Friday.

[ad_2]

Read More : EURUSD – Pennant Points to Further Gains

Tidak ada komentar:

Posting Komentar