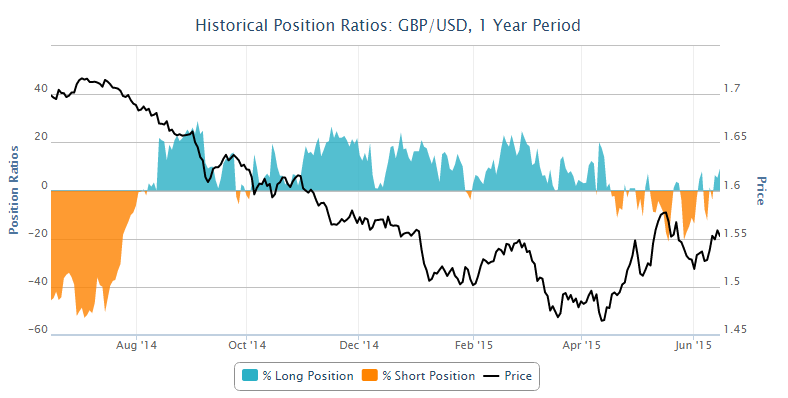

While the cable continued upward trend following the break above the descending channel (flag formation) he faces resistance around this has been a key area of support and resistance for the pair.

in the state, the daily chart is showing indecision only around current levels. We are yet to see a convincing reversal pattern that suggests the rally is over and the trend of continuous decline.

Today, OSA currently candle looks like a hanging man and failed to break above Friday, OSA peaks. That said, it is incomplete and alone strongest inversion configurations.

support the bearish argument is that we are seeing a bearish divergence between price action and the stochastic oscillator on the 4 hour chart, while the daily chart, it is now to cross in overbought territory. This doesn, AOT only means we, Äôll see a reversal, it highlights just a slowing momentum that can happen in the race until a reversal.

A reversal pattern on the daily chart or previous lows being broken on the 4 hour chart can provide such support for the divergence. I would see the pair break below 1.5420 to 1.5450 broken before I become more bearish as it looks like a reliable area of support and resistance on the 4 hour chart.

We may have to wait a little longer for it though as the pair appears once again likely to rally, with the last 4 hours candle, a green hammer, being quite optimistic. What will be the key now is whether it will be followed by a break of Friday, high OSA. Otherwise, it could be considered a bearish signal.

All things considered, I'd like to see confirmation that the trend is either continuous or reverse before becoming bullish or bearish on the pair. The former could come Friday, AOS ups and divergence being broken and it being broken 1.5420 to 1.5450, preferably combined with a reversal pattern on the daily chart.

It should be noted that the previous candle on the weekly chart is very optimistic and another strong trend signal could come from marabuzo line or detention or be broken this week.

NB the FOMC meeting held on Tuesday and Wednesday (16 and 17 June) and will be followed on Wednesday with the latest monetary policy decision, a declaration of new economic projections and a press conference.

* The tools above and many others can be found in OANDA Forex Labs.

[ad_2]

Read More : GBPUSD – Divergence Appears at Resistance Level

Tidak ada komentar:

Posting Komentar