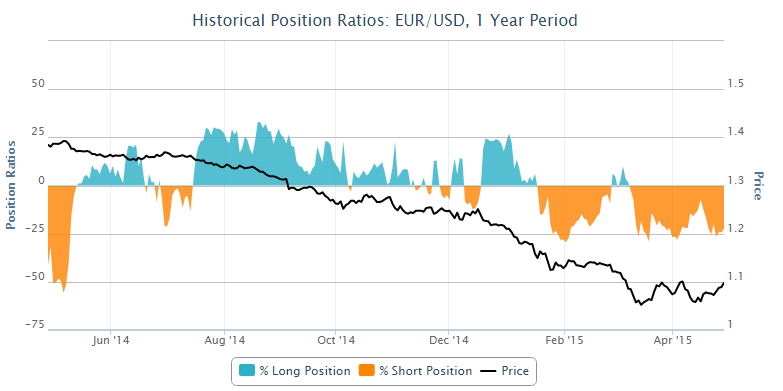

The rally in EURUSD has continued today, forcing his way through the 50 day SMA for the first time in almost a year, while the 50-period SMA on the 4-hour chart has crossed the 0-period SMA. While there is still a major barrier to break before I declare myself bullish, this is certainly a strong signal of dynamic change, at least in the short to medium term.

the pair is likely to face strong resistance between 1.1025 and 1.1055 where the trend lines and past resistance levels - one of them being the top of the range, it was negotiated in since the beginning of March - combine to offer a potentially ending rally barrier.

There are some things on the 4 hour chart that tells me - on the first attempt at least - the pair will fail to break this important resistance level. The first and most obvious is that recently, every time the pair has made a new high, it was quickly followed by a correction. This is not a sign of market conditions strong trends.

Support is the stochastic and MACD. Stochastic was overbought since last Thursday, which is unusual in a trending market. However, the last two rallies in the price action were achieved with lower on stochastic peaks, creating a bearish divergence.

This is a red flag and suggests a reversal is near. When so close to a major resistance level, I find it hard to ignore. Especially when the MACD histogram is showing similar divergence with the price action. Of course, these are secondary indicators price action and should therefore simply be treated as a warning.

If 1.1050 does not prove to be too much resistance, the 50 day SMA can provide logical support that we can see increased pressure to buy. It would act as a confirmation of the initial break and would be very bullish.

i

[ad_2]

Read More : EURUSD – 50 DMA Broken for First Time Since May

Tidak ada komentar:

Posting Komentar