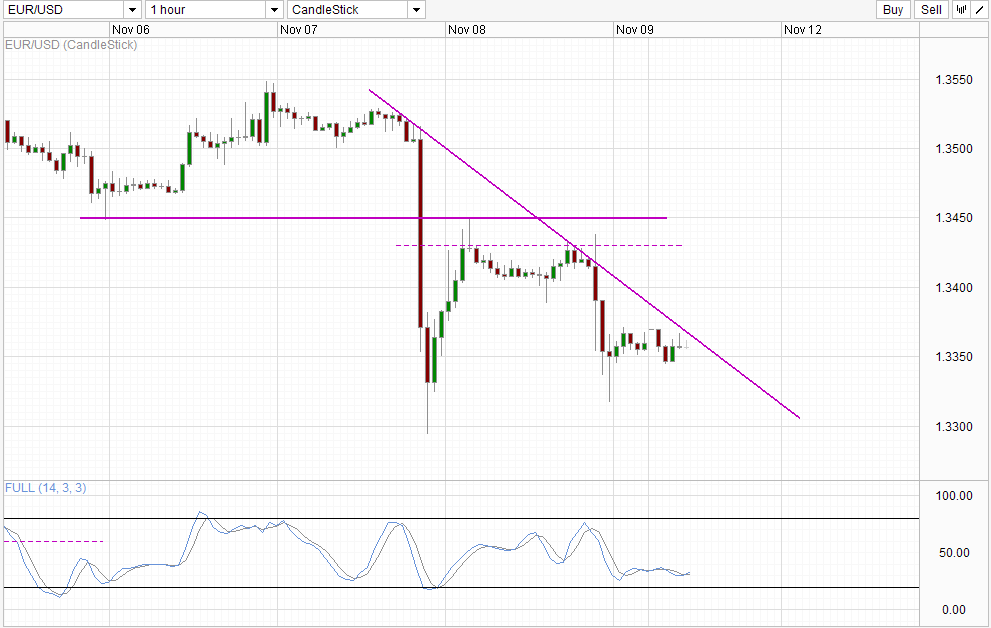

The stronger than expected US non-farm jobs last Friday increased speculation that the Fed Thinning current QE stimulus program. This led stronger USD and pulled EUR / USD lower, pulling prices down to 1.3318 Friday.

Time Table

However, the decline on Friday is a dwarf compared to the large market Thursday after the rate cut by the ECB, where prices have fallen from above 1.35 to under 1.33. However, prices have recovered significantly, suggesting that support for EUR / USD is strong, and even implies that prices can be displayed if a sideways trend for lower rates. The same could be said about the post NFP reaction where prices are negotiated mainly between 1335 -. 1337

Nevertheless, the overall pressure remains bearish, and as long as prices remain below the descending trend line that is still in play, we can expect a slight technical pressure that may be able to push the price towards 1,330. bearish target below 1330 may be more difficult considering that stochastic readings will definitely be in the oversold region when this happens, which promotes a rebound scenario that can open more upside target should the downward trend line being broken. Whereas the decline in the ECB's surprise rate failed to breach 1.33, it becomes even less likely than 1.33 based on the current dynamic fracture will be able to do the job.

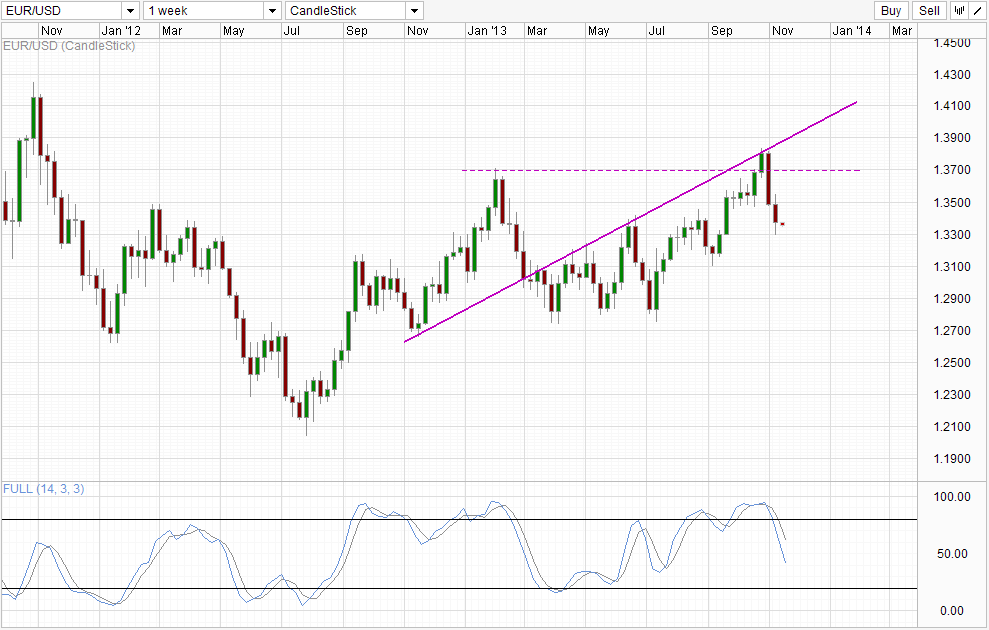

Weekly Chart

long-term chart is currently in favor of a bearish move, with operations 1.37 resistance level coupled with the bearish rejection off the trend line and the downward cycle of signal strength Stochastic adding to the bearish momentum. However, it should be noted that prices remain higher than the January opening levels, hence the overall bias should remain bullish that would make current bearish sell-off as a mere correction. Nevertheless, there are no signs that the current bearish momentum is reversing or even slowing down. Therefore, if prices manage to break 1.33, a move towards 1.31 is still possible, even if it is simply "corrective", as would be the next important support level. Beyond that will probably be based on this singular movement only as stochastic readings will likely be in the oversold region

Links :.

Week FX Americas - Jobs Here, Jobs There, Jobs Everywhere

week FX Europe - ECB pulled the trigger and kept the Ajar Door

FX week Asia - Commodities focus on Chinese reforms expected Plenum

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : EUR/USD Technicals – Slight Bearish Potential But Mostly Supported Post NFP

Tidak ada komentar:

Posting Komentar