Today is the first day of the largest election in the world where over 814 million Indian citizens will hold a vote of vote that will determine the next government for the next 5 years. This election was hyped up as that would change the fortunes of India, high inflation and lowering production hit the developing countries for the past 5 years, and rightly or wrongly voters are hoping to see a change in the administration believing that their economic fortunes are changing.

This hope for a better future Rupee stimulated and main stock index Sensex higher in recent months, as traders and investors are optimistic following the preliminary polls favor opposition party BJP. Some polls even suggest that the party can even get an absolute majority, without the need for a coalition. If this is to happen, it is likely that the new government will be able to get laws passed so much easier and allowing the economy to recover in a much faster and more efficient (assuming the BJP does indeed turn out to be as pro business as touted).

timetable

However, the reaction of the market certainly does not reflect the optimism / hope that we can expected with the beginning of the 6 weeks long elections. Sensex is currently trading 0.62% lower in Indian Rupee has also weakened against the dollar. the great global trend can be attributed to risk-off this fall, but it is not true that the Asian indices are generally stable, with most indices paring opening losses for the rest of the day. Price action on the Sensex was the opposite - prices actually started higher but pushed lower thereafter, suggesting that the decline is due to own loss of India rather than large risk trends. The same charge can be imposed on the rupee when other major currencies are actually trading stronger against the dollar, instead of weaker.

What does this mean?

It is possible that this is just a blip and a small case market to buy the rumor and sell the news. However, if the weak Rupee Sensex and continues for the next days, we could see a deeper correction of the gains that have been won in recent months as the market sentiment about the election may have changed.

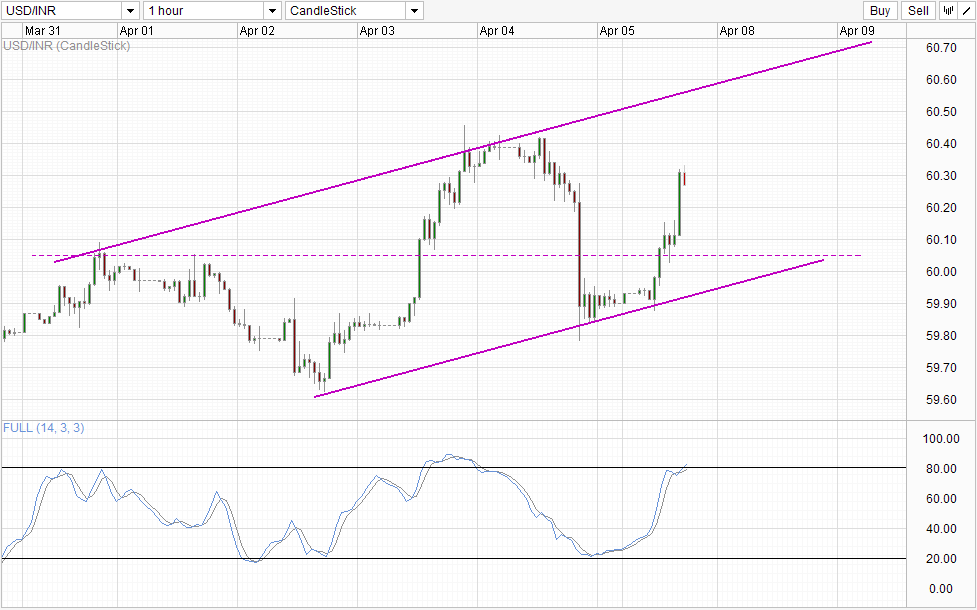

Short-term technicals favor a weak rupee and continued. Prices appear to be trading within a rising channel and we could see a push towards Canal Top. Recent high oscillation around the ceiling 60.4 consolidation seen last Friday can still offer resistance. Since the stochastic readings are currently in the overbought region, the probability of USD / INR lower bounce becomes higher. However, if prices continue to pull in the short term and grow above 60.4 without breaking a sweat, the probability of a change in sentiment on the elections increases, and further gains in USD / INR can be expected.

Links:

WTI Crude - 100.5 Critical To S / T Direction

Nikkei 225 - Remain Bullish Ahead Of BOJ Despite Friday Slide

Gold Technicals - stay above 1300

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : USD/INR – No Cheers As India Election Begins

Tidak ada komentar:

Posting Komentar