USD / JPY breached 103.0 yesterday following rumors that the BOJ will be looking to increase current stimulus . Governor Kuroda was seen yesterday, saying that the central bank will maintain its commitment to achieve the inflation target of 2% in 2 years, fueling speculation that BOJ may even go beyond the purchase of Japanese government bonds (JGBs) and buy riskier products such as marketing actions related funds to achieve its objective. How this will benefit Japanese economy is a huge question mark, like the purchase of products linked to the stock market will drive prices higher assets - BOJ may give the 2% inflation, he really wants. However, how this will then inspire highest production / consumption that is necessary to drive the Japanese economy is sketchy.

Share price inflation (besides Nikkei 225 is currently higher at 6 months) does not mean anything, and Japan should have already learned this lesson from the US, where the term "QE" was born. US stock prices are at record levels, but unemployment rates remain high, with the economy still about 1.1 million jobs lower than pre crisis days. Similarly, additional QE (nicknamed JQE2) BOJ will shave off some unemployment problems and the current level of consumption slowdown of Japan. Yen has indeed weakened because of the artificial liquidity in the market, but there is some evidence that consumers consume less because of inflated prices in the F & B industry - the opposite of what BOJ wants :. Full recovery of the Japanese economy

Therefore, Japanese equities are in a very precarious scenario, and we could see prices fall like a house of cards if BOJ does not address the underlying problems of economy directly. Currently prices remain buoyant and in fact largely bullish due to the fact that the Bank of Japan injected liquidity with the promise to buy more stocks indirectly (through funds related to trading). Take that away, and we are back to levels that the Japanese economy and profitability of global pre-intervetion business (without additional revenues from exports due to weaker yen) has not increased much.

Yen What then?

This is a more delicate matter in the long run. the current weak yen can be attributed to the additional liquidity BOJ, but one can not ignore the fact that the need for a safe haven currency in 2013 has been on the decline with the global stock market is going strong. The "Fear Index" Vix is also close lower pre 07, lending strength to this claim. In addition, USD has strengthened significantly and is expected to further strengthen the Fed should gradually reduce QE purchases in 2014. As a result, USD / JPY uptrend will remain without BOJ action.

However, it should also be noted that the market has given huge bonuses in USD / JPY in anticipation of the BOJ Yen weaken. Therefore, if the effect of the BOJ stimulus is in question, there will be at least a few quarters of traders who may think that Yen should return to its previous strength or at least recover some of it. But if you look fundamentals - if BOJ stimulus fail to revive the economy, Japan will be sentenced to perhaps another long period of deflation / recession, and that would have a weakening impact on the Yen

Certainly it. Yen management become less obvious and therefore traders will certainly be to assess what is the market-oriented - the fundamentals of the Japanese economy, or the failure of the BOJ to weaken Yen further. long-term wise, it is likely that the price direction means going back to basics, but there is no saying how market sentiment can influence prices in the next 2 years BOJ stimulus era.

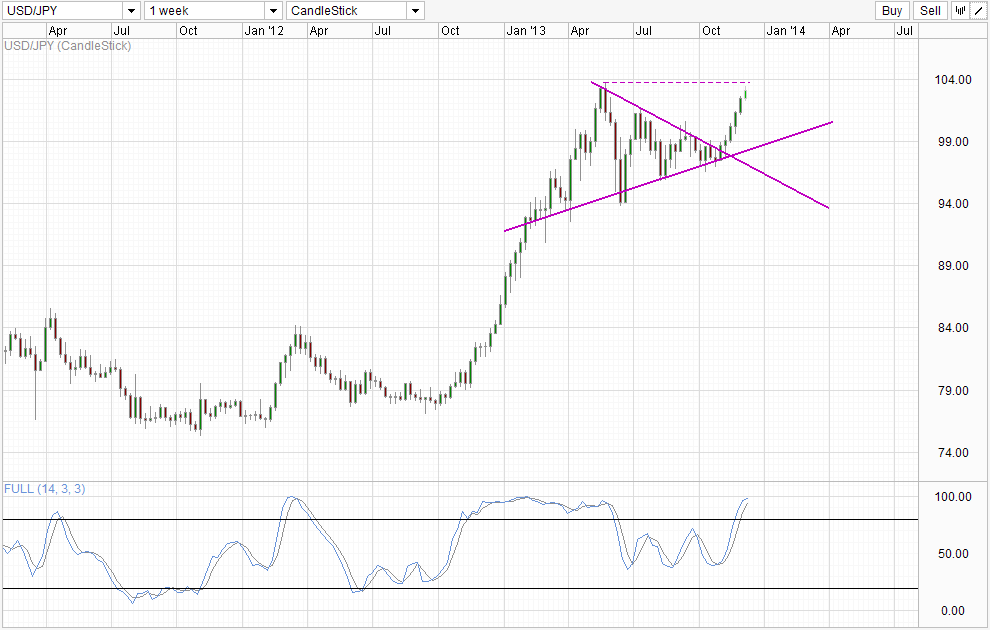

Weekly Chart

from a purely technical point of view, however, USD / JPY will face resistance in the form of 2013 beats around 103.75. Stochasic readings are also towards the mathematical limit of 100.0, which favors a bearish decline in the immediate future. For now, it appears that the bullish trend is intact, and although the price rebound of 103.75, it is possible that the price could find support from 100.5 (which may be the confluence with the rising trend line assuming a slight decline rates in the coming weeks). This fits well with the scenario where additional stimulus BOJ fail to excite the market, but instead of desperate market ends speculation that BOJ will do even more stimulus in 2014 -. One possible scenario happened in 2012 before QE3 was announced

Links:

GBP / USD - Relieves Far from two-year high at 1.6350

AUD / USD - turns and looks towards 0.0 again

EUR / USD - dropped to the key level at 1.3550

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : USD/JPY – Onward Towards 2013 Highs But Japan Economic Woes Remain

Tidak ada komentar:

Posting Komentar