Latest employment data from Australia showed more and more used by 1.1k in October compared with an expected 10.0K. This would be reason enough to send bearish AUD / USD lower to rush, but the data in the overall figure is even more bearish. the number of full-time jobs fell by 27.9K, one of the largest monthly decline we've seen in the last five years. The only reason that headline figure still appears positive is due to a number of part-time employment grew 28.9K. One saving grace was the turnout that was maintained at 64.8%, suggesting that the unemployed are still looking for work. But given that expectations for the participation rate to increase to 64.9% and 64.8% of the previous month was the result of a lower revision number this month is still considered as slightly bearish.

Time Table

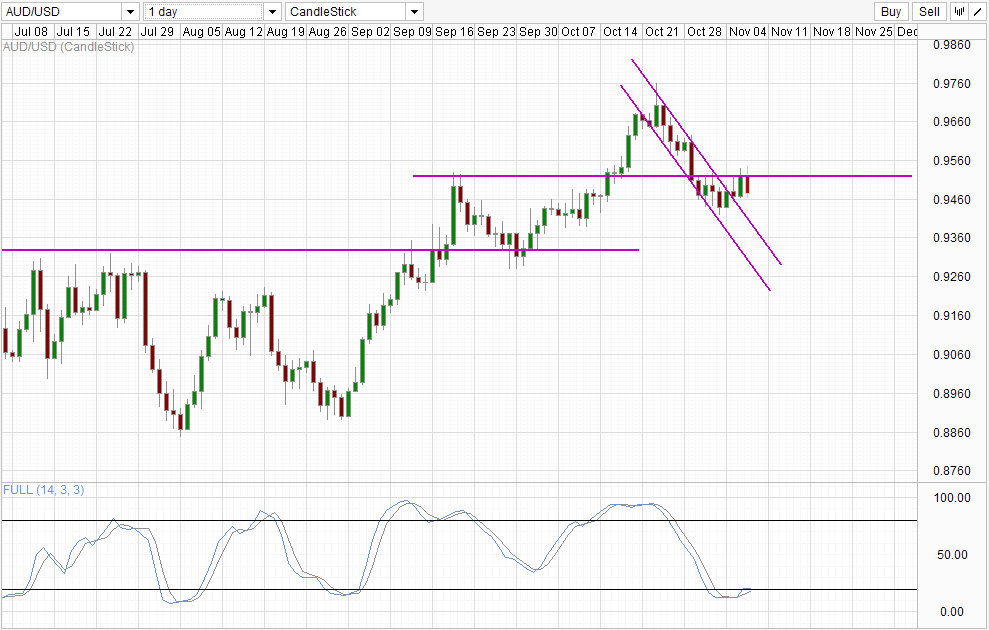

Therefore, it is not surprising to see AUD / USD down almost 50 pips after 'ad. It is likely that there were additional downward pressure following technical traders break 0,952 support and increase the bottom of the channel. However, at present a technical point of view, the possibility of a bullish downturn is high with prices that can not match the lowest of November 5, with stochastic readings suggesting that the bearish momentum may be more for now as readings longer point in the oversold region.

table Daily

Daily Chart is less optimistic, however, with prices towards the Top channel following the 0.952 rebound. Stochastic readings are oversold, but it seems that we have avoided a bull cycle signal, highlighting the strong bearish bias as the price is right now.

put together short-term and long-term chart, the most bearish scenario would be the price break the 0,942 that will trigger further bearish acceleration in the short term. On the daily chart of the push will result in a downtrend reversal Tweezers Top, while stochastic readings will be able to move below 20.0 more resolutely, increasing bearish conviction in both the S / T L / T delay.

Links:

GBP / USD - consolidates around 1.61

EUR / USD - Get above the 1 key 35 Level

Dow 30 - New record Close but downside risk remains

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : AUD/USD – Bearish Floodgates Waiting To Open After Dismal Job Numbers

Tidak ada komentar:

Posting Komentar