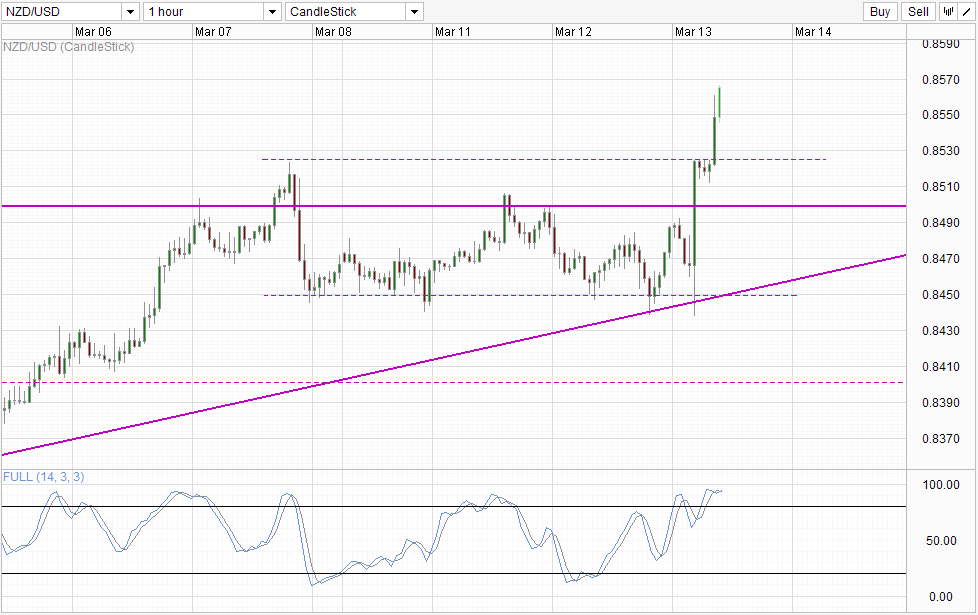

RBNZ Central Bank delivered rising rates that all operators were looking bullish, increasing its cash rate Official by 25 basis points to 2.75%. This pushed NZD / USD above the resistance of the 0.85 round face and above the previous high seen on March 7, which shows a bullish breakout.

Time Table

this may seem silly because obviously NZD / USD rally will should RBNZ rate hike of interest, but it should be noted that the rate hike was widely expected and it is reasonable to think that traders may have a prize of such a scenario to advance. Looking at the recent history where the price of AUD and EUR are not really move when their respective central banks rate changes performed as expected, the fear NZD can rally more or perhaps even start to decline is not unfounded.

Fears that the bullish reaction will be muted became even more true when we realized that NZD / USD actually traded lower during European hours beginning and end of the US session when bears are be afraid to do anything with enormous event risk only a few hours a way. This suggests that the bears can still hiding around, even if the rate hike expectations are high. In fact, when the new RBNZ rising interest rates was announced, the price actually started to decline sharply, pushing below 0.845 immediately before boarding. Therefore, that is inevitable breakout is certainly incorrect.

That said, the bullish sentiment / momentum is certainly strong, and that the price has authorized the resistance 0.8525 4 hours after the rate hike announcement is a strong testimony of the current bullish momentum . However, bullish traders should be aware of bears lurking go ahead and significant pullbacks back towards 0.8525 or even 0.85 can not be ignored.

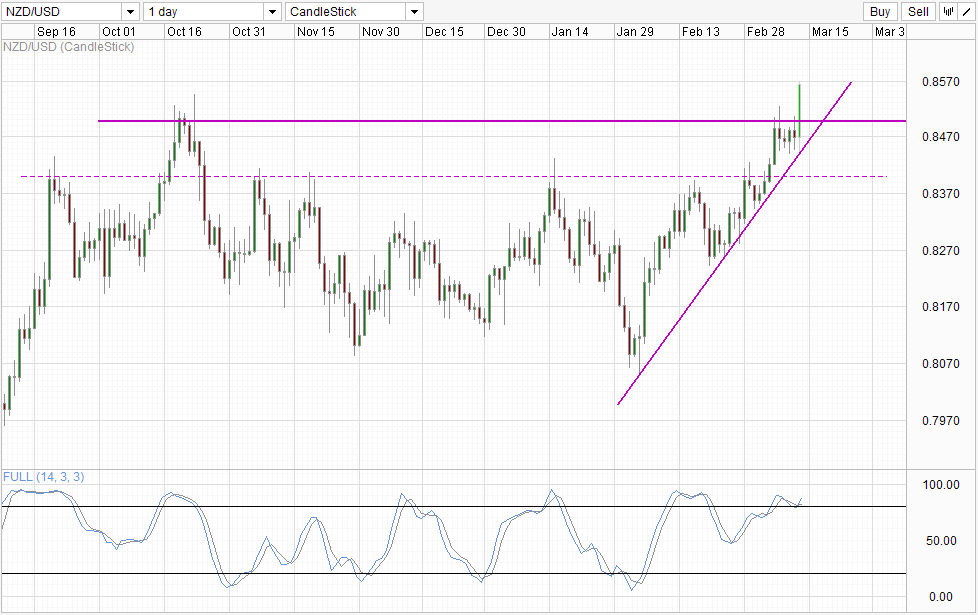

Table Daily

The same could be said for the daily action of the chart price. Although a clear break is happening at the moment, it is still considered risky for traders to go long now if they have not already. opportunities for input only appear after pullbacks took place, with the post-withdrawal reaction / useful degree of decline to determine whether the escape is indeed authentic and more importantly does it have other legs to run more.

Basically, for all the reasons (and we have good reasons) for NZD to get stronger, rallies in NZD / USD will continue to remain uncertain USD is not an easy breeze. Therefore, traders who want to participate in the increase of the story NZD rates will be much better served looking coins that go in the opposite direction instead

Links :.

GBP / USD - Little Movement Before we keys Press

USD / CAD - US Dollar in Holding Pattern As Markets Await Key figures

USD / JPY - Steady in cautious trade

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : NZD/USD – Bullish Breakout Above 0.8525 Post RBNZ Rate Hike Seen

Tidak ada komentar:

Posting Komentar