Time Table

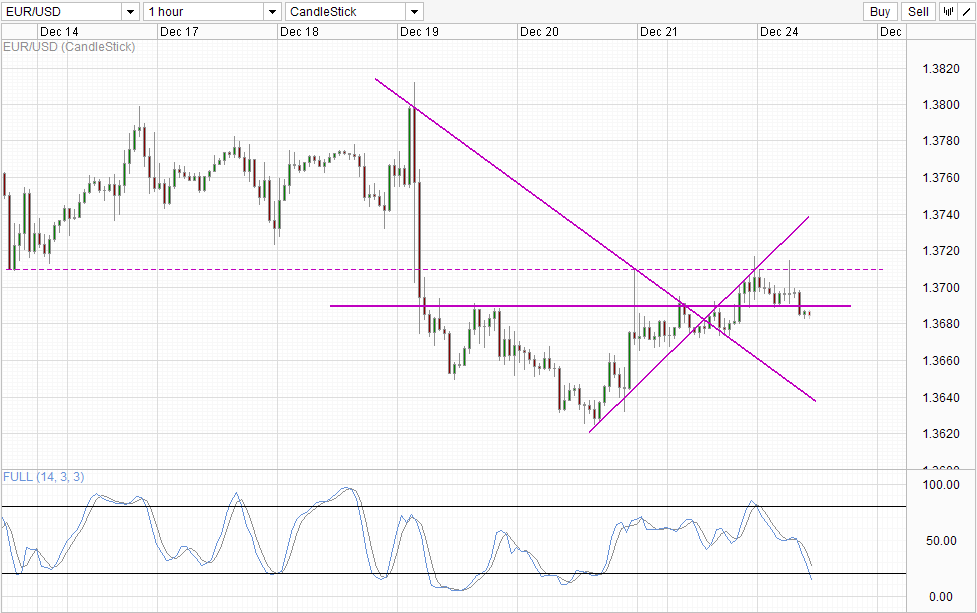

Our analysis yesterday, which stated that the EUR / USD remains well supported turned after all, but we must say that the push above 1.37 was still quite unexpected. Prices have since dropped below the 1369 resistance and back into the consolidation area of the breakout before Monday, but prices should remain strong with stochastic readings suggesting that sell-off is already oversold. This increases the likelihood 1.367 retention bracket and open the possibility to retest 1.369.

Table Daily

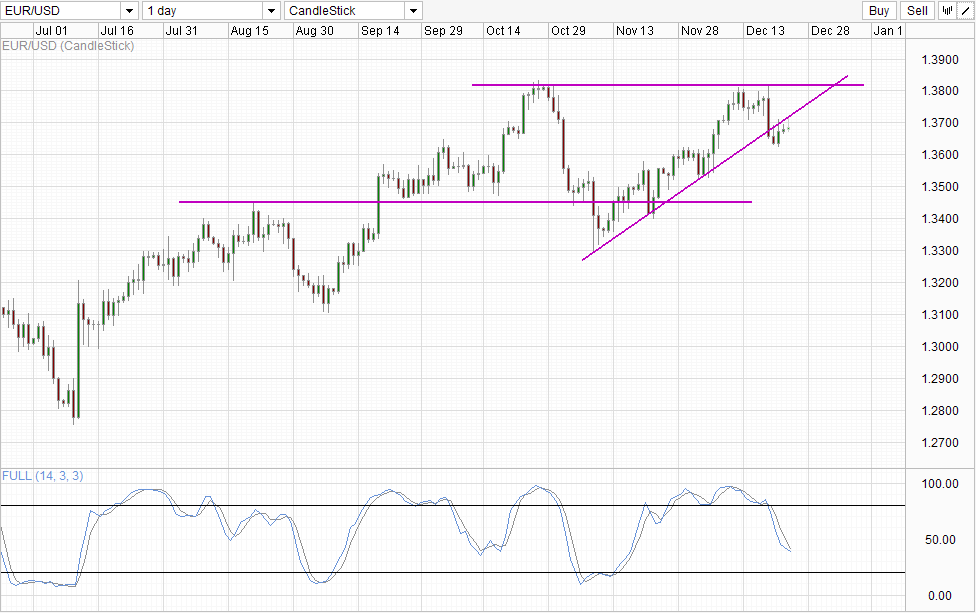

However, long-term prospect for EUR / USD remains bearish according to the Daily chart. The rally yesterday failed to rise above the rising trend line, suggesting that the post FOMC QE Tapering breakout remain in play, and push downward from here will be promoted. However, stochastic readings also allow the possibility of a short-term rebound, with the curve Stoch potentially bounces on the "support level" of 40.0, which may even trigger a full bullish reversal from there should successfully Price to rise above the rising trend line.

on the root, USD should strengthen in the long term while EUR should weaken as highlighted in the analysis of yesterday. That being said, traders should note that we may see the hot money flowing back into euro as traders / speculators who have enjoyed big gains in uS equities can be more confident and start investing in European equities, which will lead to EUR in the short term. But that hot money flows may end up as a double edged sword, because the output will be equally if not stronger market should begin to lose confidence in the euro area once more

links :.

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : EUR/USD Technicals – Surprise Push Above 1.37 But Bulls Unable To Hold Gains

Tidak ada komentar:

Posting Komentar