Time Table

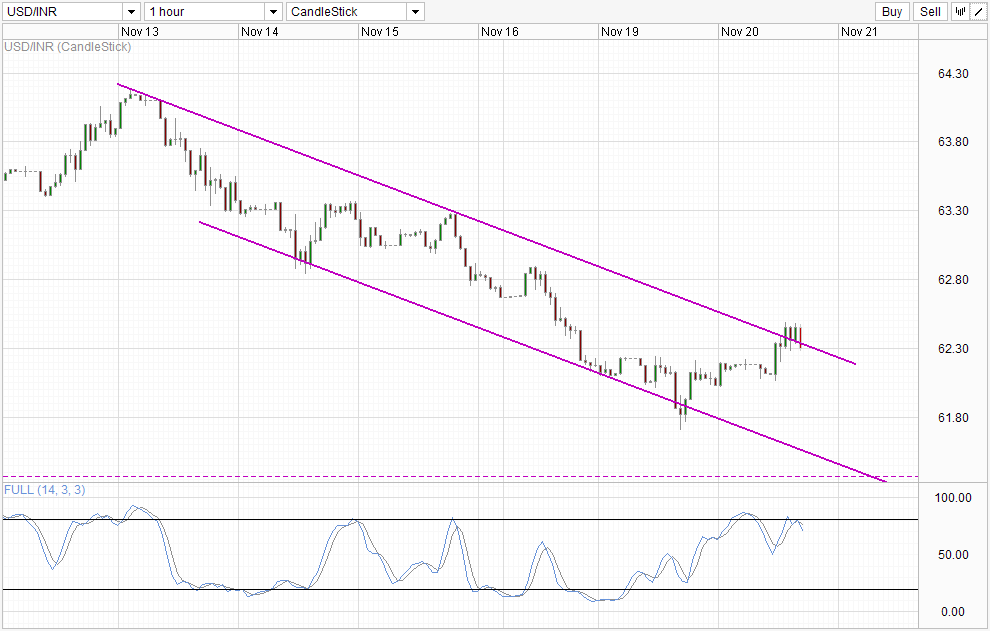

downtrend in USD / INR continues despite the rebound seen during the European session yesterday. Prices remain capped below by Top Channel, with Stochastic indicator showing a bear market signal. Bottom Channel becomes an obvious target on the downside, and there may be a strong downward price acceleration should violation 62.2 in conjunction with stochastic pushing below 60.0.

If prices push above 62.45, further upward pressure can not be ignored, with 62.8 immediate becoming bullish objective. However, the overall bearish bias is still disabled, increasing the likelihood of a retreat to Top Channel again. Price should preferably grow above 63.3 before the downward pressure can be facilitated.

It is also important to note that USD / INR decreased in recent days due to the weak USD. If USD strength to return to the game, this short-term bearish bias will be reassessed. As it is currently there are first signs that the strong dollar may return. pacifist speech yesterday by Bernanke, Yellen and Evans failed to impress the market with stocks, gold prices fall and Bond. This suggests that speculators who were betting on a non-cone results in December FOMC may be fully saturated, and we could see long-term fundamental drivers playing a greater impact going forward.

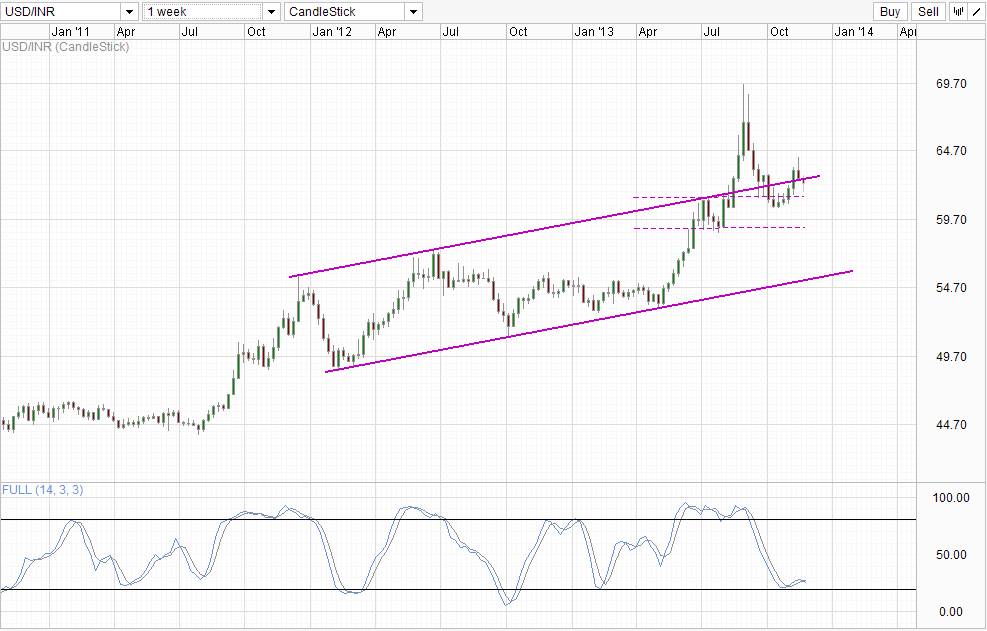

Weekly Chart

This means that prices may be on track to return to 70.0. Currently prices are trading below the channel top, but we are still far from a bearish confirmation. Hence the probability of a false break is high. Likewise, stochastic readings link below and cross the signal line, but we are located very close to oversold territory with the previous bullish signal barely take off. Without pushing below the recent low of 20.0 above, the upward cycle can technically stay in the game, once more the chances of a false break

is not catastrophic for Rupee however, International Finance Corp -. The financial arm of the World Bank, published Rupee denominated bonds for the first time in the program related rupee USD $ 1B. The first tranche of the issue of 3Y bonds priced at 7.75%, which is close to the Indian government bonds of the same maturity (7.59 __gVirt_NP_NN_NNPS <__% to 8.07% for 3Y and 4Y). The demand was much higher than expected, with investors who want as much as 20 billion INR against the size of the planned issuance of IFC 3-10000000000 between INR. Strong demand for INR related products is a good sign that foreign investors have not yet given up on the INR and implies that investors do not believe the INR depreciated will not be too much in the coming years.

Therefore, even if the USD / INR is planned to rally outside of here, do not expect the same kind of upward momentum in May and expect along the way a lot more resistance

links :.

AUD / USD - based on the support at 0.94

EUR / USD - Moves to three weeks above 1.3550

GBP / USD - Runs on wall of resistance at 1.6150

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : USD/INR Technicals – S/T Bearish Trend Intact, Long-Term Outlook Mixed

Tidak ada komentar:

Posting Komentar