There is clearly some indecision in AUDUSD now, with speculation that the Reserve Bank of Australia could reduce the interest rate that the addition of? uncertainty that already exists, through a Federal Reserve hesitant.

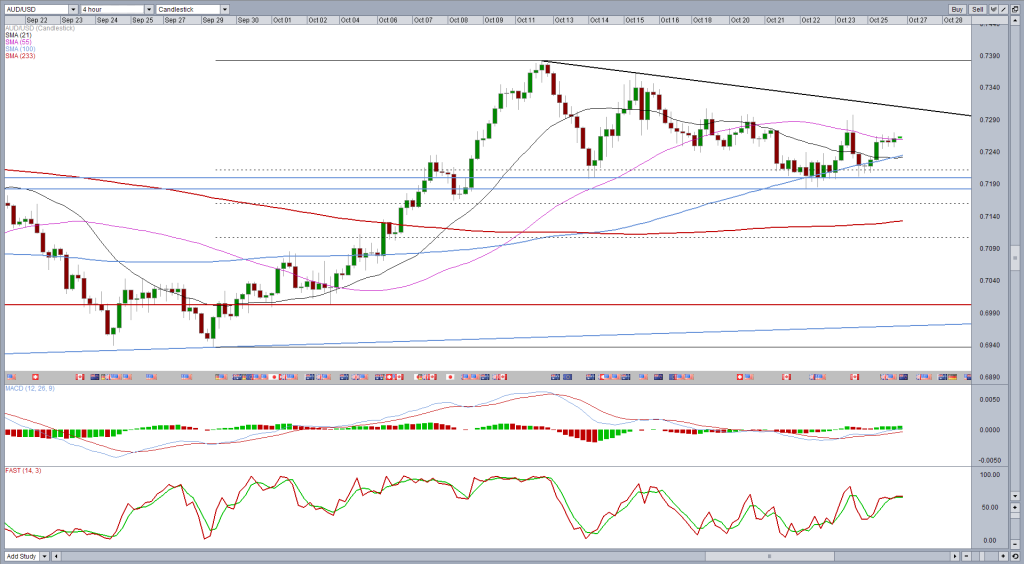

from a technical perspective, the pair looks like it could be on the verge of a major break over the long channel resistance long term. The recent correction after a decent rally in early October does not currently appear to be something more than that. What we have is something that looks like a flag or the corner of a fall, a bullish continuation pattern.

Moreover, 0.72 appears to be well supported for now. The pair has been trading briefly below here sometimes, but every time the passage below was purchased in which established a pretty solid base between 0.7180 and 0.72.

with rate decisions to come from the federal and RBA reserves in the next eight days, the pair is likely to emerge from this period of consolidation rather early, at the least we should get a little more clarity on the outlook for monetary policy.

If we see a break in the downward trend line - September 5, 2014 summits - and 100-day simple moving average, it would be very optimistic and suggest the long period of decline has ended, at least for some time.

next significant resistance area around 0.7530 could come at 0.76, where the 233 days SMA crosses an area before support and resistance.

[ad_2]

Read More : AUDUSD – Have We Seen the Bottom?

Tidak ada komentar:

Posting Komentar