The euro was paring gains against the dollar recently and is currently underway to extend its losing streak to four days

However, there are reasons to believe that recent selling pressure may facilitate the opening of a further evolution towards the summits in may and June.

First, the pair break above the downward trend line - 1 July peaks -. Wednesday indicating a more optimistic sentiment in the pair

the recent decline saw price action retest the trend line and then he temporarily violation, it is trading above there. If we see a daily close above here, it could be considered a confirmation of the break, a bullish signal.

The most recent support around 1.1020 to 1.1030, coincides with the 50% retracement of the move down from 5 August to 12 senior August and the 233-period moving average easy on the 4 hour chart, which was significant support and resistance level, and the sentiment indicator in the past.

all this suggests that we may see a reversal of that level, but we are yet to see any confirmation of this at this stage. We even saw any signs of trend exhaustion, which can instead simply indicate a consolidation phase and continuation of the move lower.

The last full 4 hour candle is certainly bearish, being an almost perfect marabuzo. In addition, the current candle has so far failed to break above the line marabuzo, which is considered another bearish signal.

With all this in mind, as the current level is technically score a logical inversion point for the pair, there is still nothing to suggest this is the case. In addition, a break below would indicate a strong bearish bias as the pair closes in 1.10.

A good candle reversal pattern on the 4 hour chart, as a pattern formation of bullish engulfing or star morning, suggesting the downward trend has been exhausted.

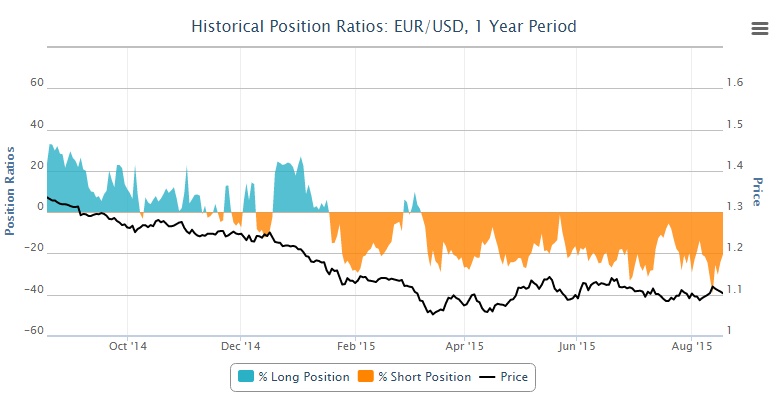

Although OANDA customer data suggests the net short position is reduced, which could be regarded as a bullish indicator, a comparison of data historic against the price below would actually indicate the opposite and support to new lows.  The tools above and others can be found in OANDA Forex Labs.

The tools above and others can be found in OANDA Forex Labs.

[ad_2]

Read More : EURUSD – Key Support Put to the Test

Tidak ada komentar:

Posting Komentar