Time Table

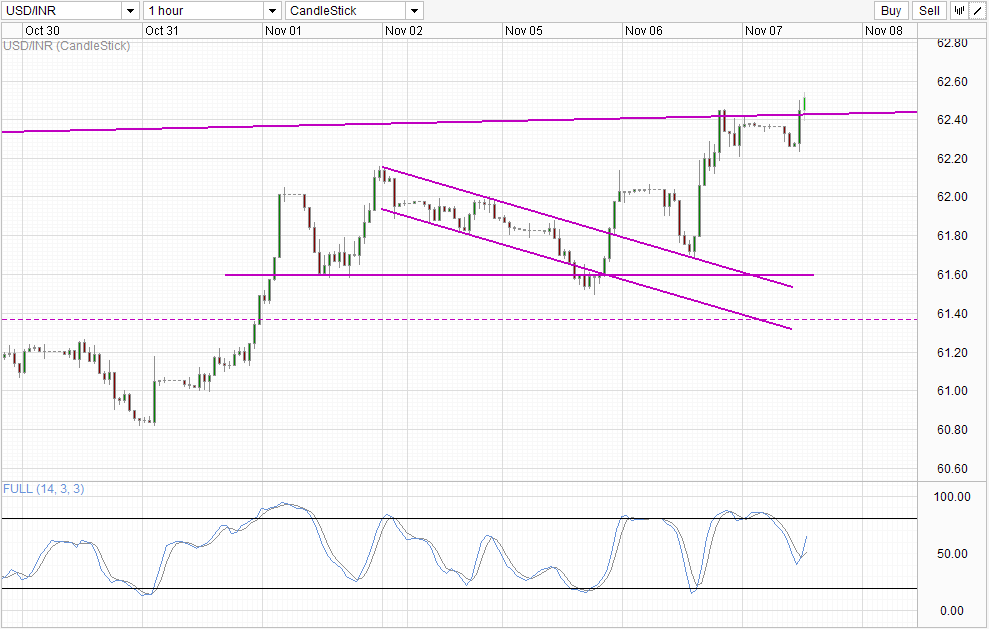

USD / INR marked the level of 62.4 yesterday as expected, but the subsequent downward thrust was much lower than expected. the flexible support of 62.2 held firm, with prices rebounding higher and then break the resistance of the Top channel (see weekly chart below), suggesting that a breakout is at stake now.

Looking back, there are signs of a strong upward surge in manufacturing - initial bearish reaction after the rising trend line was identified was mostly muted which avoided a signal Down cycle of the stochastic indicator. The bear market signal will then appear, but now the momentum has shifted in favor of the bulls, with Stoch readings making a top score turn. The fact that the curve Stoch pushed above the 60.0 level (where previous Stoch peaks were seen) is a good sign that the belief is strong. This increases the likelihood of an upward thrust supported above the rising trend line from the S / T and, with an estimated 62.6 upside target based on the space given before Stoch curve between the regions overbought.

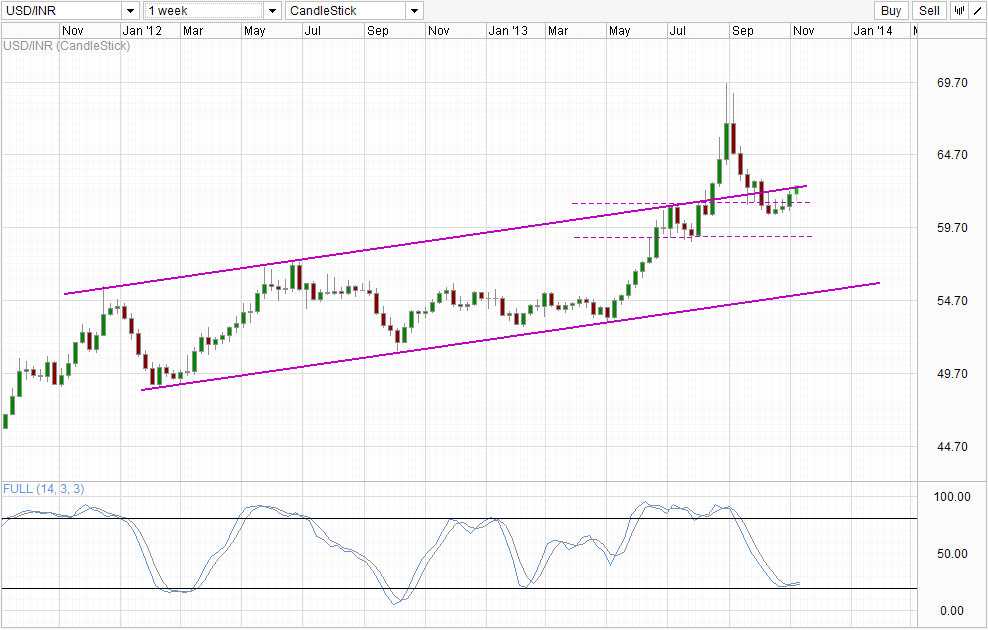

Weekly Chart

long-term perspective, the prospect of a breakdown of the Top channel is a welcome return the long-term trend. Stochastic indicator is also in favor of a bullish cycle movement with stoch curve finally distance themselves away from the signal line and affirming the Stoch hollow that was formed two weeks ago. In addition, the fundamentals continue to favor a USD / INR bullish. For all the doubts about the political kerfuffle surrounding the issue of the debt ceiling and the downward impact of potential narrowing QE, the US economy is undoubtedly in a much healthier state than India. At the very least, it moves in the direction of recovery. A narrowing potential scenario QE USD strengthen as well, favoring an upward thrust in USD / INR.

Therefore, short-term technicals with high score and get online with technicals bullish long-term coupled with the bullish fundamentals, potentially pushing all the way to 70.0 is in the cards . Warning for acceleration toward the head when the break is confirmed on both short and long term charts

Links:

AUD / USD - bearish. Floodgates waiting to open after the employment numbers Dismal

EUR / USD - Get above the key 1.35 Level

GBP / USD - Consolidates around 1.61

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : USD/INR Technicals – Bullish Breakout on Short and Long Term Charts

Tidak ada komentar:

Posting Komentar