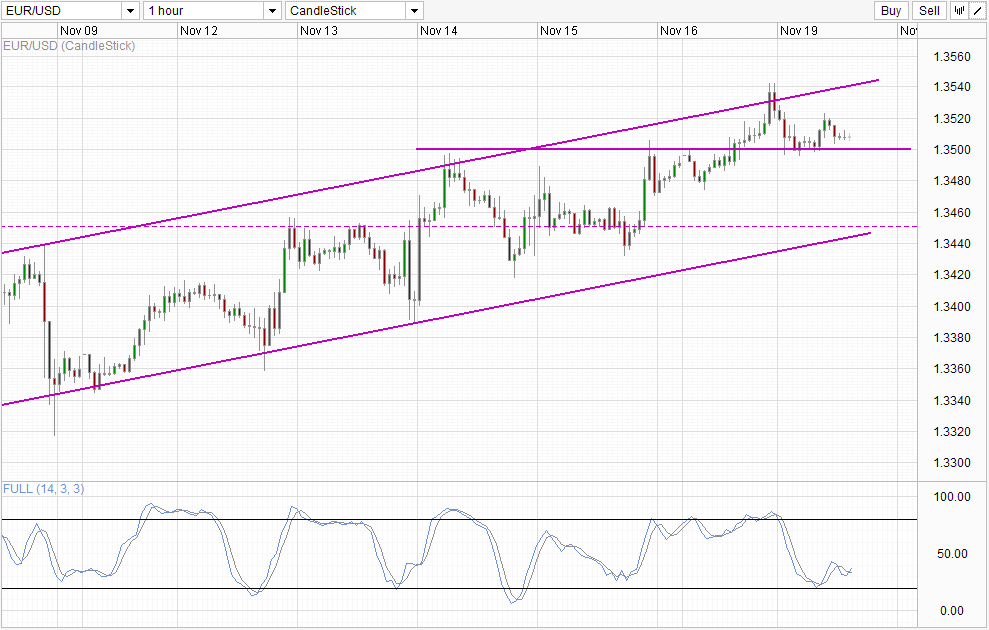

Time Table

Despite accusations (made by me, unfortunately) that EUR / USD underlying sentiment may turn bearish, prices have managed to break the resistance 1.35, knock over in 1354 beginning of the US session. bullish momentum fizzled as the US session continued, but prices remained above 1.35, suggesting that the bullish momentum certainly not over, and earlier assertions that the bears can be caught earlier are unfounded.

The reason for the rally in EUR / USD can not be fundamentally based, as there was no announcement of news that could have inspired a stronger EUR. The mere announcement of significant new (euro area trade balance and current account was not exactly bullish). In addition, the break of 1.35 is reached during the Asian session, suggesting that the strong subsequent recovery during the European session can simply be inspired by upward pressure escape.

On the other hand, there were good fundamental reasons for USD strengthening in the US hours. Net cash long-term TIC increased $ 25.5 in September, showing that foreigners make long-term confidence in economic growth in the United States / health. A net inflow of funds in US is bullish for USD in itself, but in this case, the support of economic growth in the long run by foreign investors is yet one more reason for the Fed to consider narrowing QE, resulting in EUR / USD pushing lower.

Currently, from a technical point of view, the price should head lower towards Bottom Channel, but looking Stochastic curve highest peak, a case that we are in the middle of a cycle bull can be done as we have seen the same Stoch Trough Thursday. Therefore, a movement towards Channel Top can not be excluded.

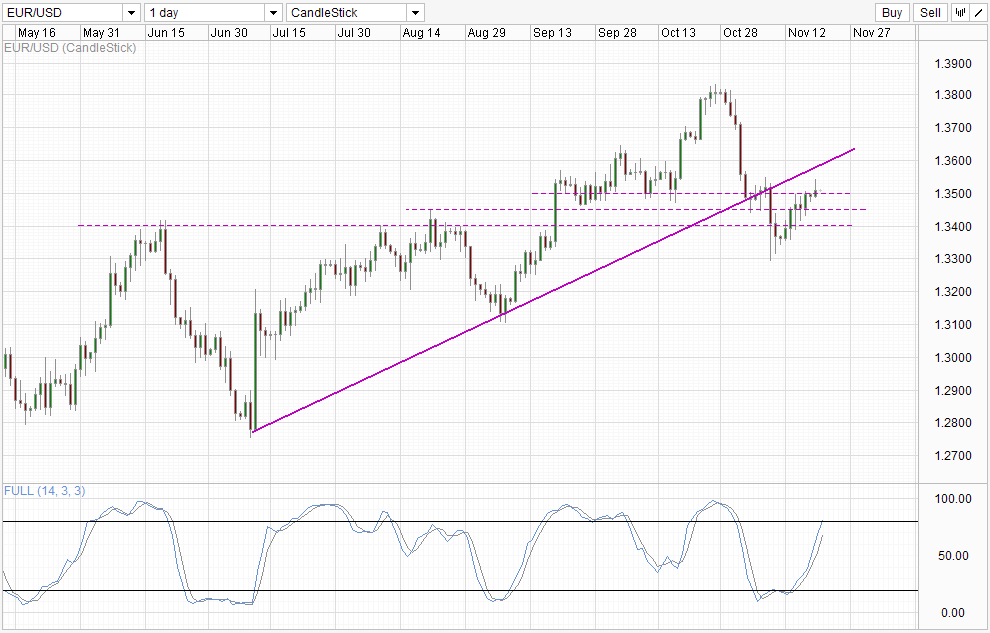

Table Daily

Daily Chart is bullish with the release of 1.35, opening a potential movement the lower face of the rising trend line. However, stochastics tells us that the bullish momentum is already hitting overbought region, suggesting that the current bullish momentum might not be able to last too far.

However, the fundamentals do not look on this increase EUR / USD kindly. Growth in the euro area remains weak, and a large part of the recovery effort in the euro area was awarded to Germany alone. Structural problems in Italy, Spain, Portugal and the rest, while other peripheral EU nations are much worse. Therefore, a bullish convincing sound worth EUR narrative. On the other hand, we have USD that grows from strength to strength due to speculation that the Fed will shrink in early 2014, except December. Even if the Fed does not shrink, US stocks are on track for strong growth in 2014 (does not matter, even if speculative). Therefore, we will continue to see the flow of foreign funds into US (as evidenced by the figures ICT) will lead USD higher and therefore EUR / USD over the long term.

Therefore, even word of caution remains - participate in the EUR / USD bull run if you run, but be aware that things can dramatically reverse once Eurozone woes back in focus

links:

. AUD / USD - Bearish Bias Remains Despite RBA Minutes Reflecting non-commitment to cut rates

GBP / USD - Pound As little change remains above 1.61

USD / CAD - Loonie Edges higher as Purchases of foreign securities jumps

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : EUR/USD Technicals – Bullish Above 1.35 With 1.354 In Sight

Tidak ada komentar:

Posting Komentar