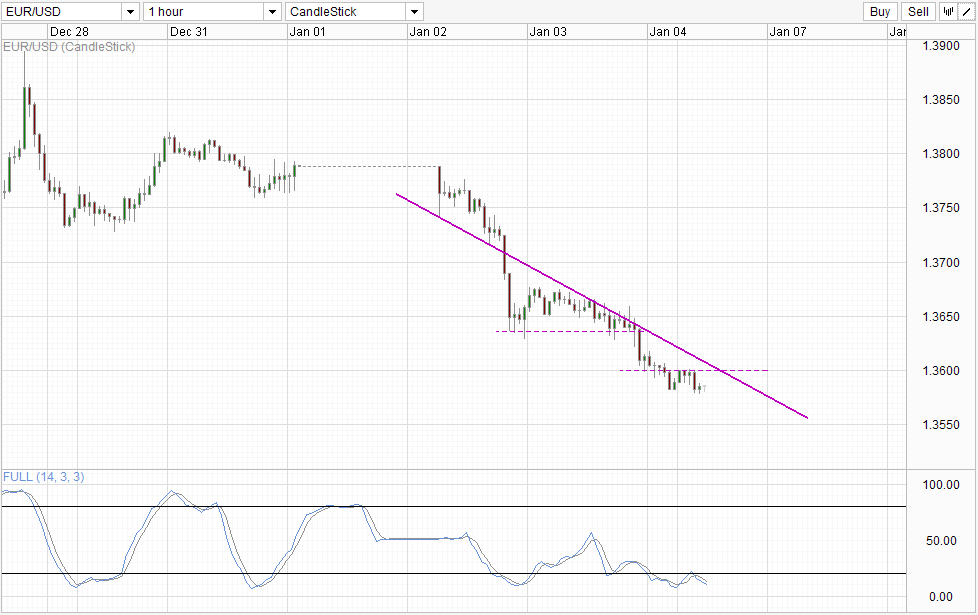

And the continuing slide

prices have been bearish since 2014 and we have not seen any significant bullish response seen. The last episode of bearishness took place during the session of the United States on Friday that broke the previous consolidation zone and sent prices below 1.36. Despite a slight decline up during the last hour of trade, prices remained below 1.36.

Time Table

saw trading this morning slight continuation of Friday's decline, but held firm 1.36. There were some other attempts within hours that followed, but 1.36 remained stubborn, allowing downward pressure to build the descending channel will be active in the game, even if prices remain flat for the next few hours. However, we do not need to wait a few more hours for the next step downward price fell below the already low last Friday earlier. Therefore, do not be surprised if we see prices push lower here especially as vast Asian market at the moment is very risk averse with China HSBC / Service PMI market coming lower than the previous month. Given the current bearish sentiment, bears may hang excuse they can find to sell on.

Stochastic indicator dampens bearish cheers if, with readings currently in the oversold region. In addition, since the volume of transactions remains low, there is a chance that current bearishness may not reflect the rest of the market. Therefore, even if S / T trend is bearish, traders may still want to limit their risk (eg, stricter stop losses) in the light of potential bullish sudden peaks.

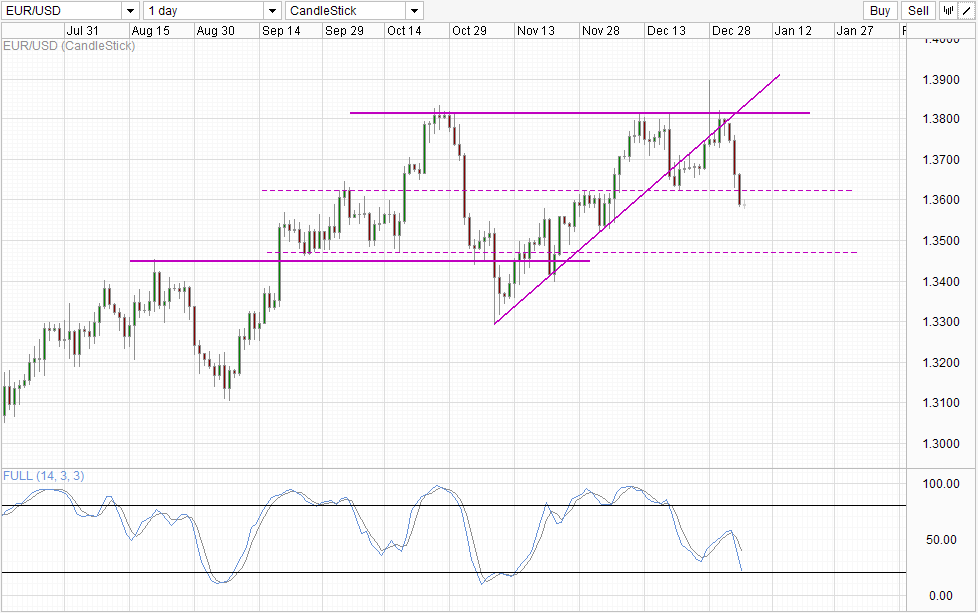

Table Daily

daily chart remains bearish however, and a Triple Top was formed which opens a long-term movement 1.31. With such potential for bears track, merchants can afford to lose a bit of tarmac to ensure that this downward flight is actually taking off before committing. This can be in the form of waiting the confirmation of the 1363 rupture. Stochastic readings are now approaching oversold territory and a bullish reversal potential to 1363 can not be excluded - in line with the short-term analysis that keeps open the possibility of bullish downturn. If an S / T decline takes place, but the price remains below 1,363, a push interim support 1344 -. 1345 becomes more assured

Fundamentals support a long-term downward push as well, with USD should strengthen on QE Tapers and EUR weakening when the financial problems of the EU periphery appear once more. There is also the continuing problem of unemployment in the EU, and Draghi of the ECB could be forced to implement the negative deposit rate possibly stimulate spending

Links :.

Gold Technicals - Internal Trade S / T uptrend channel

GBP / USD - Pound drops to start 2014

USD / JPY - Yen Fights Back As US Unemployment Claims Misses Estimate

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : EUR/USD Technicals – Triple Top Formed, Awaiting Confirmation

Tidak ada komentar:

Posting Komentar