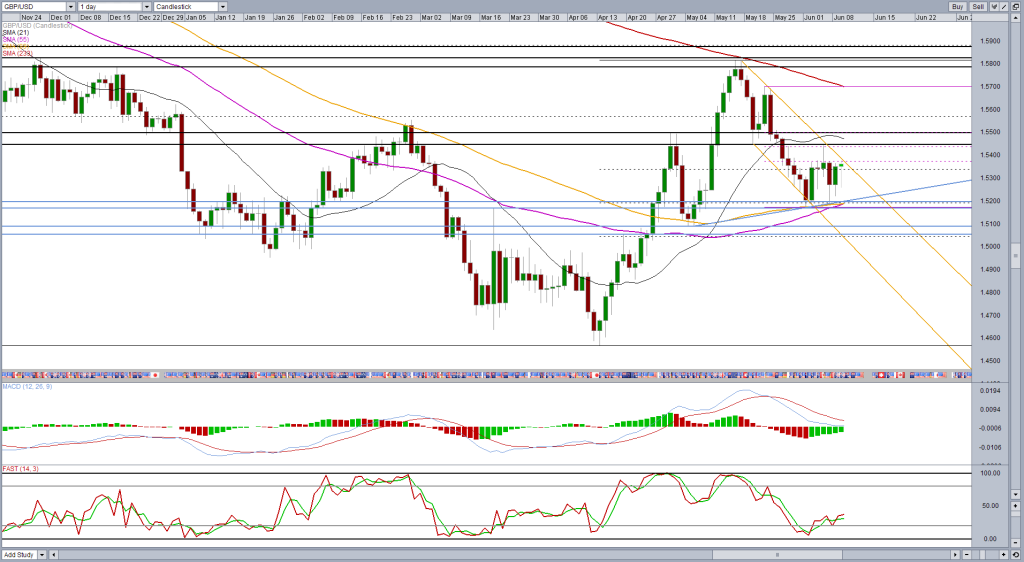

June was a month of consolidation for cable so far. The pair found resistance from the top of the descending channel and simple moving average 89-period on the 4 hour chart, while a number of support levels combine to create a significant barrier to the downside.

These include the level 55 and 89 day SMA, 50 fib - low 13 April to 14 May high -. and the fact that it is a front area of support and resistance

We can see a consolidation in the couple of days coming, but we are on track for an escape . From a technical perspective, a break higher seems more likely that the downstream channel effectively combines April 13 to May 14 rally to form a flag formation -. A bullish continuation pattern

A break of this could bring the 233-DMA at stake, currently around 1.57, which proves to be too strong resistance level in May.

a break below 1.5170 on the other hand could prompt a rather aggressive move lower because of the number of support levels are taken in the process.

It could also be considered as breaking the neckline of the head and shoulders, formed since April 24, which would be very bearish. Based on the size of the training (neck head), this could cause a movement back towards 1.45, while the previous low around 1.4566 could prove to be an important support level.

* The tools above and many others can be found in OANDA Forex Labs.

[ad_2]

Read More : GBPUSD – Breakout Near After Consolidation

Tidak ada komentar:

Posting Komentar