Indian Rupee weakened today in line with other emerging market currencies, appetite for the risk of Asian market has deteriorated following the same yesterday during the US session. This overall decline is not really surprising that the market was too optimistic in the last days before the first witness Yellen monetary policy in the House of Representatives. While the new Fed chairman is not really optimistic about the market recovery and actually said more than tapered cuts will come, US equities and risk correlated assets remained optimistic. This irrational behavior established a strong possibility of an eventual withdrawal, which brings us to the mild bearishness today which could well be the beginning of a long-term downtrend.

Time Table

Recent economic data also favor a weaker Rupee. rate of consumer price index growth slowed more than analysts expected, reducing the need for RBI to further hike rates. On the other hand, the factory fell and the call for more relaxed monetary policy to promote growth becomes stronger.

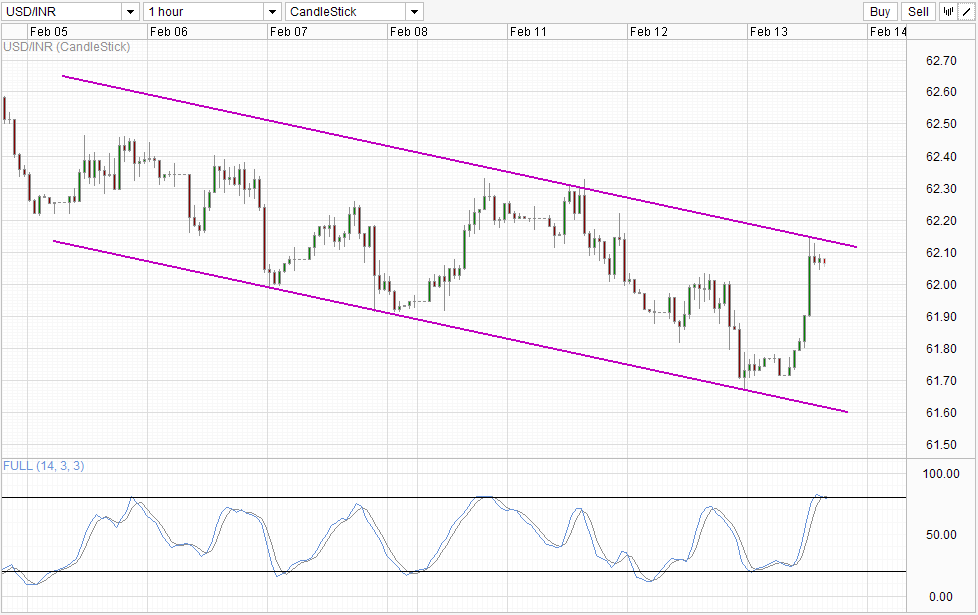

However, despite all this, the downward trend in the short term USD / INR remains intact. Prices are not rallied quite sharply from 61.7 to 62.1 above, but we still have to break down the Top Channel or above violate the soft resistance of 62.2. stochastic indicator also shows the first signs of a bear market signal, which promotes movement Bottom Channel and the continuation of the downtrend that has been in the game since February 4 This is a good testimony to the resilience of Rupee , and we could actually see more short-term Rupee buyers that carry traders are more confident now about money previously beaten.

Weekly Chart

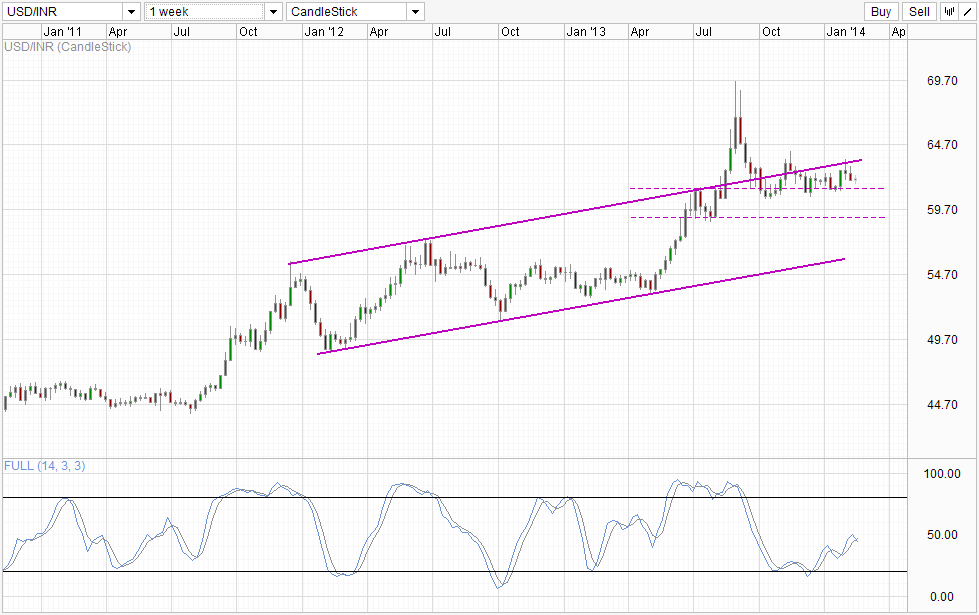

This notion is not far - in February, India has experienced outflows of only 316 $ million versus $ 493 million in Thailand, South Korea $ 1.2 billion and Taiwan $ 2.4 billion USD, showing the attractiveness for assets denominated Rupee. Therefore, the short-term direction to Rupee to remain in place (bearish for USD / INR), but a long-term orientation can be a little trickier. Given this relatively strong international demand, RBI will definitely cutting speeds more comfortable in the future is certainly necessary that the potential for growth in India continues to remain low. Therefore, the long-term downside risk for Rupee is high, and that is even before we consider the expected gain of force by USD due to the US in capital inflows coupled with the narrowing of QE purchases .

Techniques suitable as well, with the uptrend that has been in play since August 2011 remaining intact. Although the price bounced off the Top Channel, Channel Bottom does not seem to be a bearish viable option at this time because there is strong support seen at 61.3. Although 61.3 59.0 is broken will be expected to be able to finish the job with stochastic readings most likely to be deeply oversold even before the support level is tested. However, a shift to 61.3 is possible, and traders will have to determine whether the short-term earnings potential short circuit is now sufficient to outweigh the long-term risk of potential weakness in INR.

More Links:

AUD / USD - Reduces Back Down Below 0.0

EUR / USD - Rolls Over Resistance 1.37

GBP / USD - Surges above the resistance Level 1.66

This article is only for general information purposes. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or its subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

[ad_2]

Read More : USD/INR Technicals – Rupee Holding On But Risk Long-Term Weakness

Tidak ada komentar:

Posting Komentar